Data Point

Cox Automotive Analysis: Nissan Quarterly U.S. Market Performance

Wednesday July 27, 2022

Article Highlights

- Nissan's quarterly sales – combined Nissan and Infiniti brand sales – fell 39% from a year ago for a 5.2% market share.

- Nissan slashed incentives by 58% to an average of $1,465 per vehicle.

- Nissan’s average transaction price rose 13% to $36,370.

Nissan posts financial results for the April-to-June 2022 quarter on Thursday, July 28, the automaker’s first quarter of its fiscal year, and analysts expect a 70% drop in profits on higher revenue.

Much of the blame is on China, where COVID lockdowns shut down production and sales. China accounts for a third of Nissan’s global production and sales.

In May, Nissan projected its global sales would rise 3% to 4 million vehicles, with revenue increasing 19% but profits falling 30% as the automaker closes out the third year of its four-year turnaround plan.

The U.S. is a centerpiece for growth in that plan, which includes less reliance on fleet sales and lower incentives. Indeed, Nissan drastically lowered incentives in the U.S. during the quarter, and its average transaction price rose 13%. However, sales fell 39%, far more than the overall industry’s 21% decline.

Here are some data points from Cox Automotive on Nissan’s quarterly market performance in the U.S.

Sales and market share

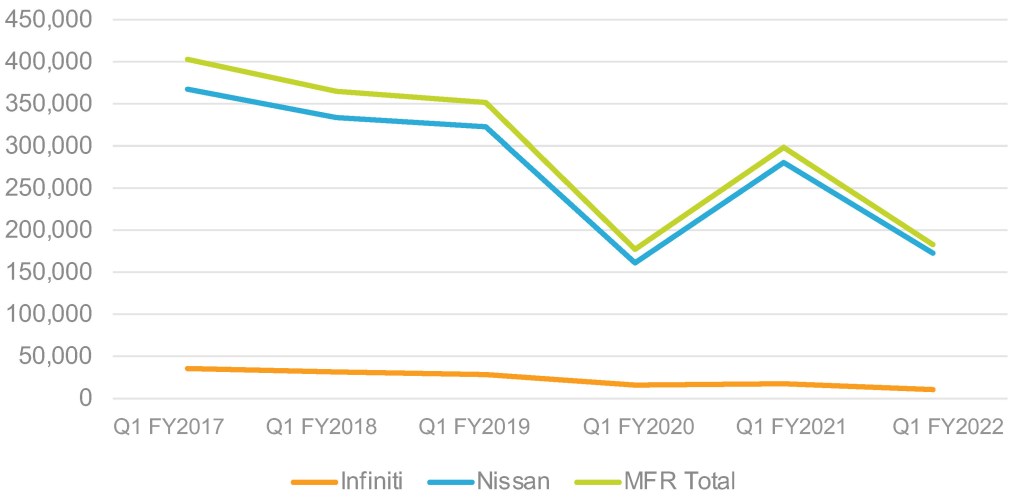

Nissan’s U.S. sales – combined Nissan and Infiniti brand sales – totaled 183,171, down 39% from a year ago and far below the 350,000-plus level of the same quarters of 2017, 2018 and 2019. Nissan vastly underperformed the industry, which had total sales down 21% for the quarter. Nissan’s total market share dropped to 5.2%, down 1.5 percentage points.

Nissan U.S. Sales Performance for Q1 Fiscal Year 2022

Nissan brand sales totaled 172,612 vehicles, down 38%. That pushed its market share down 1.4 percentage points to 4.9%. Nissan had only three models on the plus side of sales. Sales of the redesigned Frontier were up 33% to 20,671 units. Altima sales increased by 35% to 40,315 units. The freshened Pathfinder made massive gains showing a 229% sales increase to 15,303 units, the first time it sold more than 10,000 units since 2019.

Infiniti sales plummeted by 41% to 10,559 units. Its market share fell to .3%. Infiniti had two models that had higher sales year over year – the newer QX55, which saw a 19% increase, and the QX60, with sales rising more than 227%.

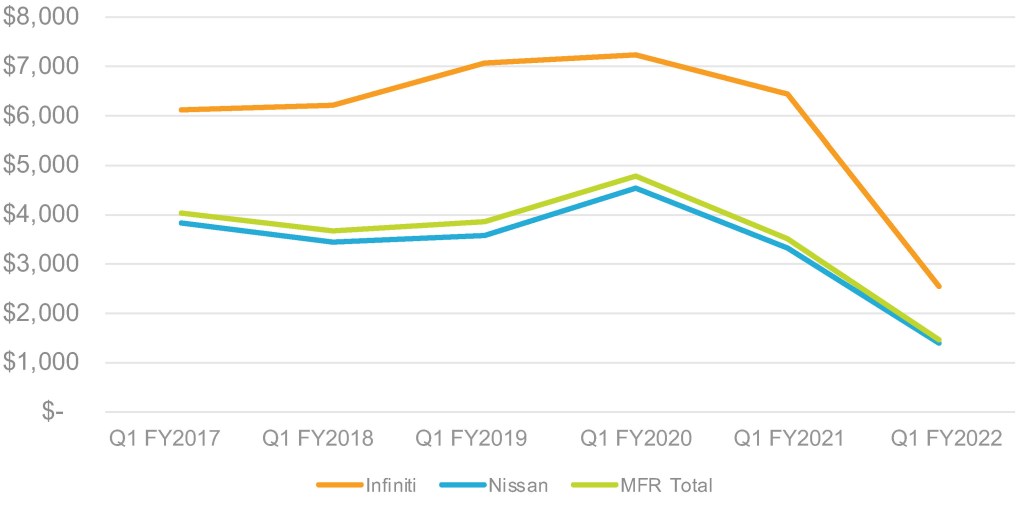

Incentives

Nissan slashed incentives, which are generally high for the industry. In total, Nissan cut incentives by 58% to an average of $1,465 per vehicle, according to Cox Automotive calculations. It was the first time in the past six years for the quarter that incentives averaged below $3,500 per vehicle.

Nissan U.S. Incentive Spending for Q1 Fiscal Year 2022

Nissan brand incentives were slashed by 58% to an average of $1,398 per vehicle, the first time in the quarter it fell below $3,300 per vehicle. Infiniti incentives were reduced by 60% to an average of $2,548 per vehicle. It was the first time ever that incentives were below $6,000 for the brand.

Average Transaction Price

Nissan’s overall average transaction price (ATP) rose 13% to $36,370. Four models had double-digit ATP increases. The Frontier pickup truck and Pathfinder SUV posted significant price gains, up 20% and 27% respectively, according to Cox Automotive calculations. Additionally, the Rogue and Versa both saw increases of more than 11%. The Frontier had an ATP of $40,630. The Pathfinder had an ATP of $45,874, while the Rogue was priced at $34,932, and the Versa was at $21,408.

Infiniti’s ATP climbed 20% to $58,982. It pulled up price gains for all models sold, especially the QX80 at $81,363.

Rebecca Rydsewzski is a research manager of economic and industry insights for Cox Automotive.