Data Point

Cox Automotive Analysis: Nissan Quarterly U.S. Market Performance

Tuesday July 25, 2023

Article Highlights

- Nissan and Infiniti brand sales combined rose 33% in U.S. for a 5.9% market share.

- Incentives grew by 46% year over year to an average of $2,141 per vehicle.

- Nissan Motor Corp.’s average transaction price rose nearly 2% to $37,079.

The most recent quarter was another tumultuous one for Nissan Motor Corp., but in the important U.S. market, sales surged up from recent lows. That could help the Japanese automaker’s bottom line when financial results for the company’s first quarter (May-June) of its fiscal year 2023 are announced this week.

In Japan, the abrupt departure in June of Ashwani Gupta, deputy to CEO Makoto Uchida, was followed by charges that Nissan had carried out surveillance of Gupta, including having cameras around his home. Gupta had questioned Uchida’s strategy for an agreement being negotiated with Renault, details of which are expected to be announced any day.

At the same time, former Nissan-Renault CEO Carlos Ghosn sued Nissan for $1 billion. Ghosn is a fugitive living in Lebanon after being charged with financial crimes in Japan.

In the U.S., however, and despite the corporate distractions, the Nissan and Infiniti brands combined to outpace the industry’s percentage increase for sales, thanks to improved inventory and Nissan’s strength in SUV and small car sales. Nissan boosted incentives but not to the heights they were before the pandemic. Its average transaction prices inched higher.

Here are some data points from Cox Automotive on Nissan Motor Corp.’s quarterly market performance in the U.S., one of its most important regions.

Nissan and Infiniti Sales Improve, up 33%

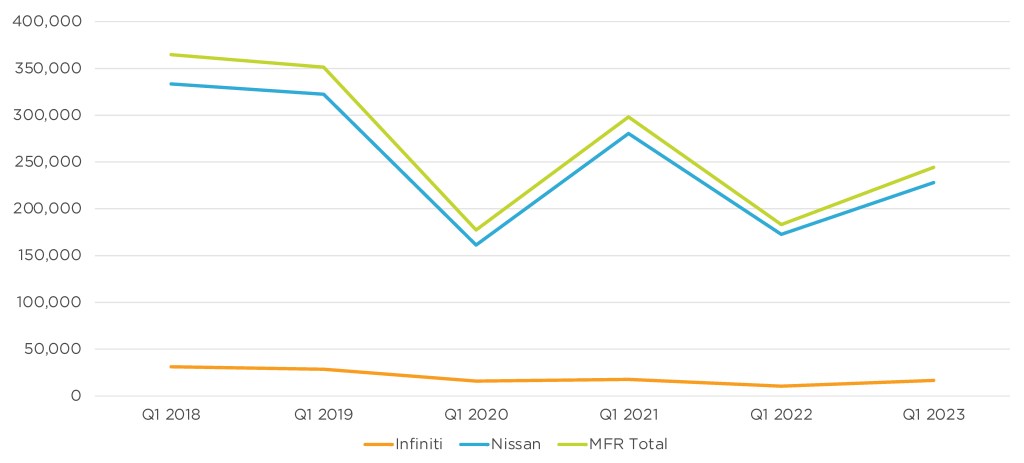

In April, May and June, Nissan Motor Corp.’s U.S. sales – combined Nissan and Infiniti brand sales – totaled 244,353 for the quarter, up a healthy 33% from a year ago and above the industry’s gain of 17%. Still, it was below Nissan’s pre-pandemic sales volumes in 2018 and 2019.

Nissan U.S. Sales Performance for Q1 Fiscal Year 2023

With increased sales, Nissan’s total market share rose to 5.9%, up 0.7 percentage points from the year before. Both brands saw increases in market share for the quarter. Nissan now holds a 5.54% market share, and Infiniti is at 0.40%, up 0.1% from the previous year.

Nissan brand sales totaled 227,824 vehicles, up a robust 32%. Nissan’s quarterly sales bump was mainly driven by strong sales of its SUV and small car lineup. Murano sales increased by 18% to 8,744 units, while the Pathfinder SUV made significant gains, showing a 24% sales increase to 19,003 units. Rogue sales were up 68% to 71,246 units. Armada sales soared by 104% to 5,915 units. The compact Versa increased sales to 7,113 units, an 115% jump, while the Sentra sold 34,938 units, a 103% increase. The new Ariya EV sold 2,335 units in the quarter.

Infiniti sales were up a healthy 57% to 16,529 units. Infiniti had three models with higher sales from the year before – the redesigned QX60 SUV with sales of 7,731 units, a 138% increase, the QX80 with a gain of 63% to 1,463 units, and the Q50 saw a gain of 42% to 1,829 units.

Nissan Raised Incentives to an Average of $2,141 per Vehicle

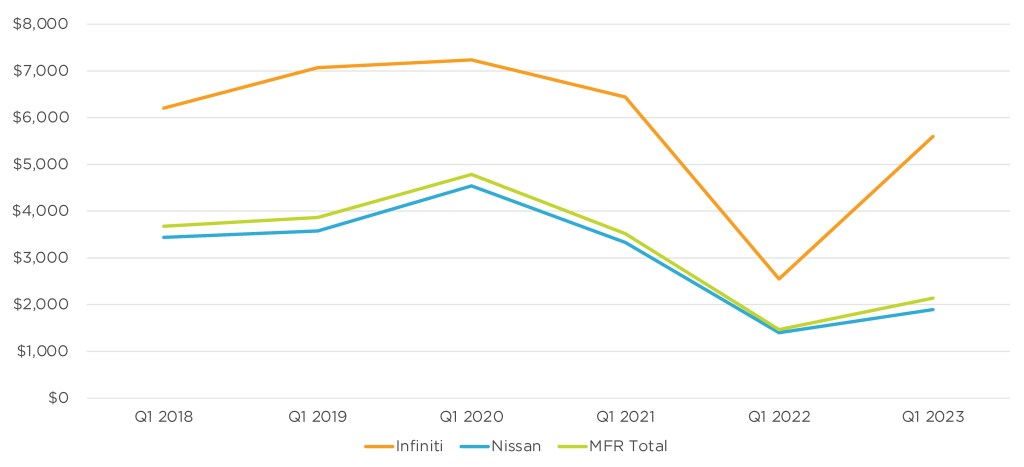

Nissan Motor Corp. raised incentive spending, which is already generally high for the industry. In total, incentive spending year over year was boosted by 46% to an average of $2,141 per vehicle, according to Cox Automotive calculations. Industrywide, automakers spent on average $2,048 per vehicle, the highest amount since October 2021.

Nissan U.S. Incentive Spending for Q1 Fiscal Year 2023

Nissan brand incentives increased by 35% to an average of $1,890 per vehicle, up from last year’s average of $1,399.

Infiniti incentives were up a whopping 120% to an average of $5,596 per vehicle, still far below pandemic-level incentives, which reached as high as $7,000 per vehicle.

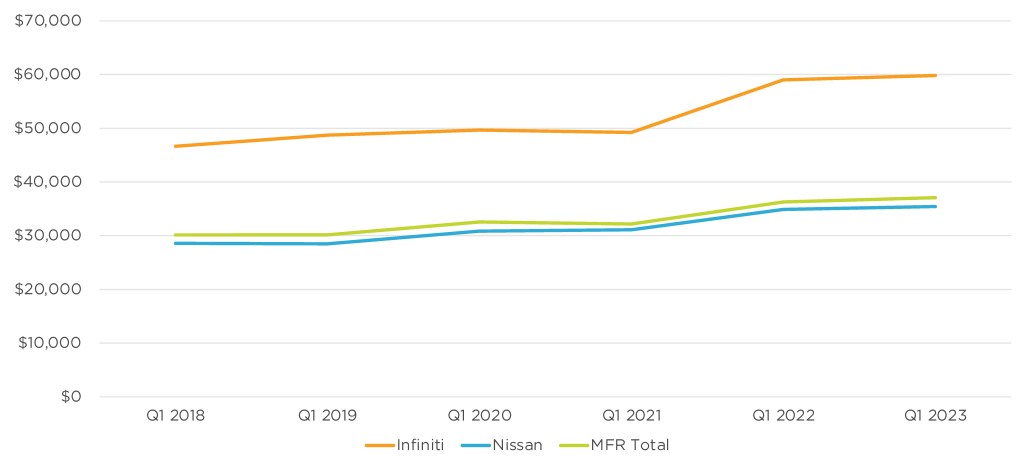

Nissan Motor Corp.’s Average Transaction Price Rose Only 2% to $35,429

The Nissan brand’s average transaction price (ATP) was up 2% year-over-year to $35,429. Most of Nissan’s models showed ATP increases, from the Sentra at 2% to the Altima at 5%. The Leaf was the biggest decliner, with its ATP dropping 6% for the quarter, according to Cox Automotive calculations.

Nissan U.S. Average Transaction Price for Q1 Fiscal Year 2023

Infiniti’s ATP rose by 1% to $59,832. Four models saw ATP drop between 0.3% to 2.7%. Only two models, the Q60 and QX50, were up only 0.1%.