Data Point

Cox Automotive Analysis: Nissan Quarterly U.S. Market Performance

Wednesday February 8, 2023

Article Highlights

- Nissan Motor Corp.’s quarterly sales in the U.S., combined Nissan and Infiniti brand sales, fell 2% from a year ago for a 5.3% market share.

- Overall incentives were slashed by 28% to an average of $1,456 per vehicle.

- Nissan Motor Corp.’s average transaction price rose 9% to $38,185.

While the global chip situation is improving, it has not been quick enough for Nissan’s small, high-volume Sentra and Versa models, which has hampered U.S. sales. Nissan Motor Corporation reports financial results on Thursday, Feb. 9, for the October-December period, Nissan’s third quarter of its fiscal year 2022, which ends March 31, 2023.

Despite inventory shortages and lower sales, Nissan Motor Corp. is earning higher revenue per vehicle sold in the U.S. due to stronger pricing. The higher pricing on Nissan’s new and renewed products has attracted a higher tier customer, Nissan Motor Corp. executives have claimed. In addition, the automaker, which typically spends among the highest levels on incentives, has been able to cut discounting. Here are some data points from Cox Automotive on Nissan Motor Corp.’s quarterly market performance in the U.S., one of its most important regions.

Nissan Motor Corp.’s Sales Performance Improves Over Past Quarters, Down Only 2%

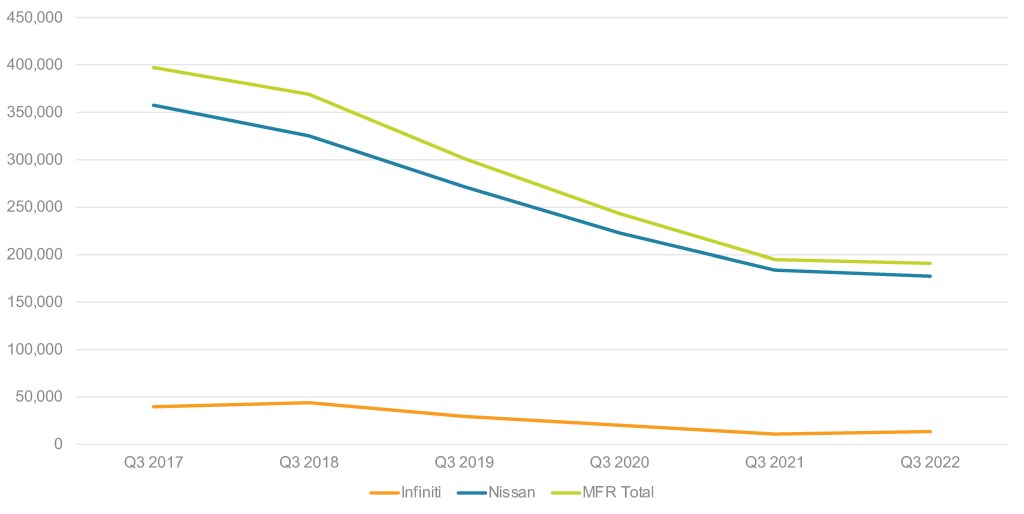

Nissan Motor Corp.’s U.S. sales – combined Nissan and Infiniti brand sales – totaled 191,012 for the quarter, down 2% from a year ago and far below the 300,000-plus level of the same quarters of 2017, 2018 and 2019.

With industry sales up 9% while Nissan Motor Corp.’s sales dipped 2%, its total market share dropped to 5.3%, down 0.6 percentage points from the year before and roughly half of its more than 9% market share in its third quarter of 2017.

Nissan U.S. Sales Performance for Q3 Fiscal Year 2022

Nissan brand sales totaled 177,439 vehicles, down close to 4%. That pushed its market share down 0.7 percentage points to 4.9%. Nissan had only four models on the plus side of sales. Sales of the Altima were up by nearly 20% to 33,833. Murano sales increased by 13% to 7,697 units, while the Pathfinder SUV made significant gains showing a 63% sales increase to 20,280 units. Rogue sales were up almost 11% to 56,345 units. The new Ariya EV sold 201 units for the quarter. All other models were down by double digits, some due to inventory shortages.

Infiniti sales were up a healthy 24% to 13,573 units. Its market share remained unchanged year over year at 0.4%. Infiniti had three models that had higher sales from the year before – the redesigned QX60 SUV with sales of 6,243 units, a 329% increase. The QX50 saw a gain of 16% to 2,557 units, and the QX55 was up 8% to 1,463 units. All of Infiniti’s models showed sales decreases ranging from the QX80 with a 12% decline to the Q50 sedan at -78%.

Typically a Big Spender, Nissan Motor Corp. Slashed Incentives by 28%

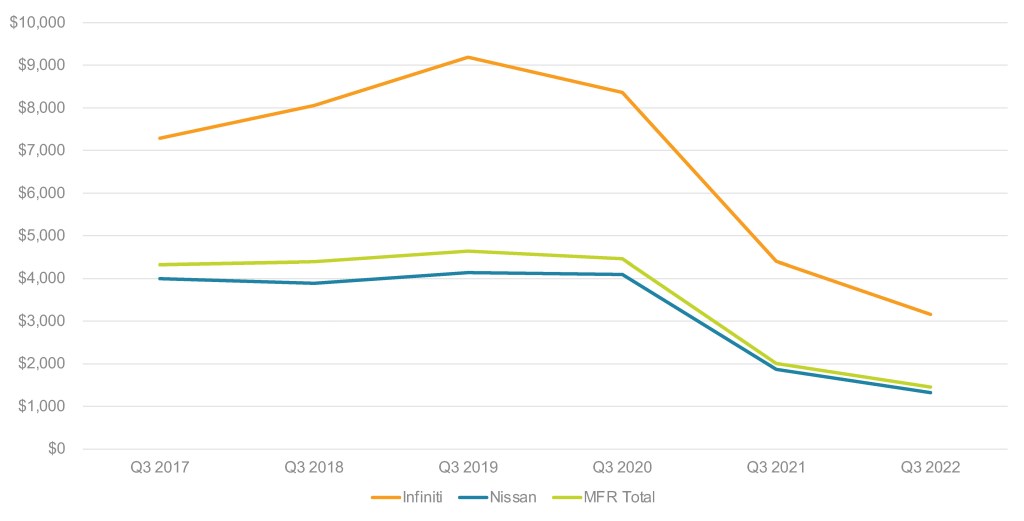

Nissan Motor Corp. slashed incentive spending, which is generally high for the industry. In total, incentives were cut by close to 28% to an average of $1,456 per vehicle, according to Cox Automotive calculations. It was the first time in the past six years for the quarter that incentives averaged below $2,000 per vehicle. The automaker is still above the industry average for incentives. Industry-wide, the average incentive for the October-December quarter was $1,141.

Nissan U.S. Incentive Spending for Q3 Fiscal Year 2022

Nissan brand incentives were drastically reduced by 29% to an average of $1,325 per vehicle, the first time it fell below $2,000 per vehicle in the October-December quarter.

Infiniti incentives were down by 28% to an average of $3,161 per vehicle. It was the first time ever that incentives were below $4,000 for the brand.

Nissan Motor Corp.’s Average Transaction Price Rose Nearly 9% to $38,185

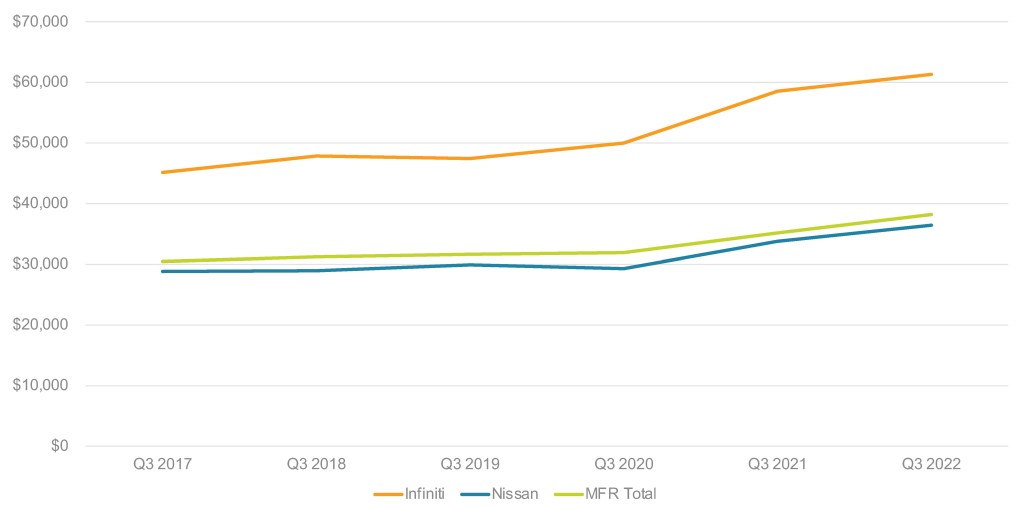

Nissan Motor Corp.’s overall average transaction price (ATP) rose nearly 9% to $38,185.

The Nissan brand’s ATP was up 8% to $36,417. All of Nissan’s models showed ATP increases apart from the Murano, which declined by only 0.1% to $43,943, according to Cox Automotive calculations. The Rogue, Kicks and Pathfinder had the largest ATP increases, between 6% and 8%.

Infiniti’s ATP climbed close to 5% to $61,297. It was pulled up by single-digit price gains of almost all models being sold except for the QX60, which was down 0.4 percentage points.

Nissan U.S. Average Transaction Price for Q3 Fiscal Year 2022

Rebecca Rydsewzski is a research manager of economic and industry insights for Cox Automotive.