Data Point

Cox Automotive Analysis: Nissan’s Quarterly U.S. Market Performance

Wednesday May 11, 2022

Article Highlights

- Nissan quarterly sales – combined Nissan and Infiniti brand sales – fell 30% from a year ago for a 6.1% market share.

- Nissan slashed incentives by 49% to an average of $1,847 per vehicle.

- Nissan average transaction price rose 12% to $34,681.

Nissan posts financial results for the January-to-March quarter on May 12, the automaker’s final quarter of its fiscal year. Nissan is closing out the second year of its four-year turnaround plan that has the U.S. as a centerpiece for its growth. Part of that plan was to be less reliant on fleet sales and cut incentives.

Indeed, Nissan’s 30% lower sales for the quarter partly represent a decline in fleet sales. Nissan also halved its incentives and boosted its average transaction prices.

Here are some data points from Cox Automotive on Nissan’s quarterly market performance in the U.S., where the company derives the bulk of its profits.

Sales and market share

Nissan’s U.S. sales – combined Nissan and Infiniti brand sales – totaled 201,081, down 30% from a year ago and far below the 400,000-plus level of the same quarters of 2017 and 2018. Nissan vastly underperformed the industry, which had total sales down 16% for the quarter. Nissan’s total market share dropped to 6.1%, down 1.2 percentage points. In 2017 and 2018, Nissan owned 10% of the market.

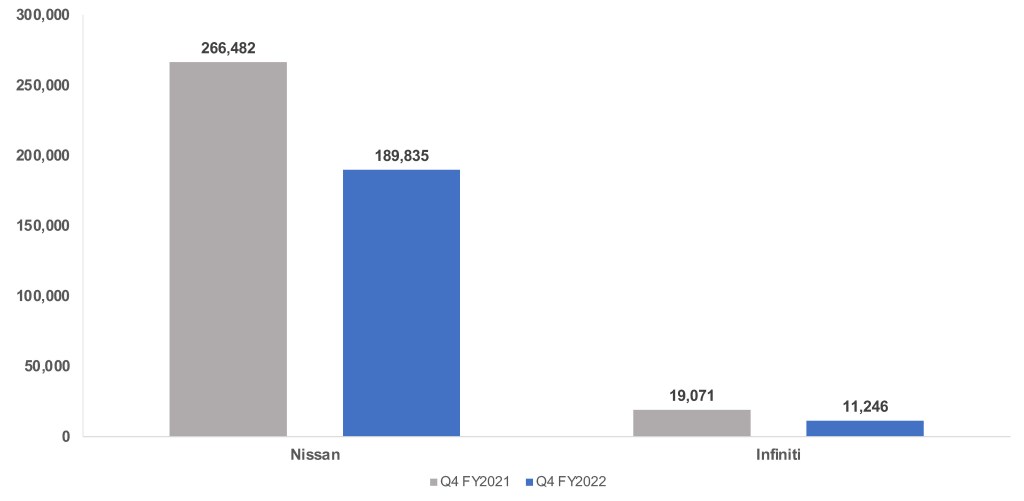

U.S. Sales Volume

Nissan brand sales totaled 189,835 vehicles, down 29%. That pushed its market share down 1.1 percentage points to 5.7%. Nissan had only three models on the plus side of sales. Frontier sales more than doubled to 22,405 units. Likewise, Leaf EV sales doubled to 4,371 units. Altima sales were up 20% to 38,295 cars. The Pathfinder was roughly flat at just under 9,000 units. The volume-leading Rogue SUV had sales nearly halved to 45,235.

Infiniti sales plummeted by 41% to 11,246 units. Its market share fell to .3%. Infiniti had only one model, the Q60, that had higher sales quarter over quarter. It was up 12% to 768 units. Infiniti’s volume leading QX50 was essentially flat quarter over quarter, posting a sales decline of 46 to 3,450 units.

Incentives

Nissan slashed incentives, which are generally high for the industry. In total, Nissan cut incentives by 49% to an average of $1,847 per vehicle, according to Cox Automotive calculations. It was the first time in the past six years for the quarter that incentives averaged below $3,500 per vehicle.

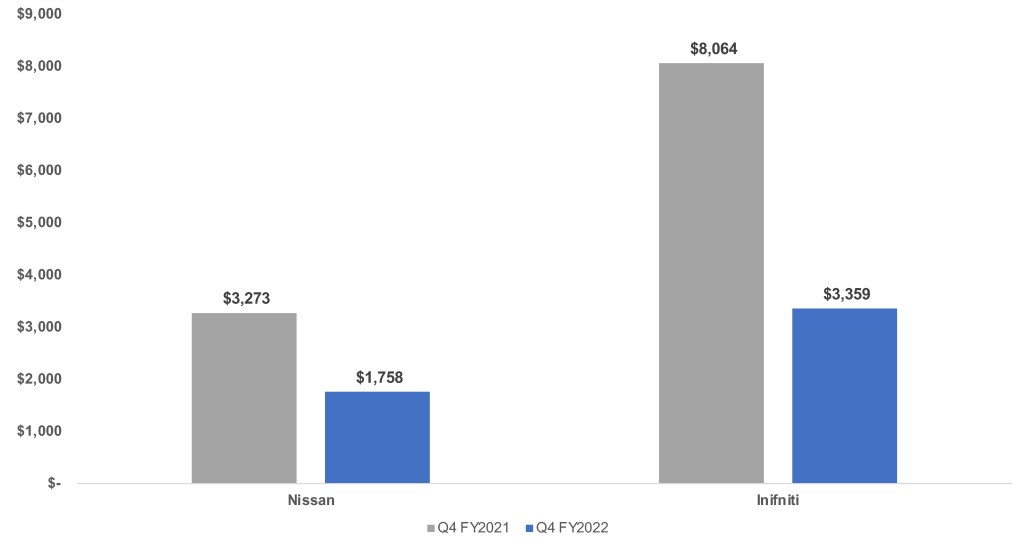

U.S. Sales Incentives

Nissan brand incentives were slashed by 46% to an average of $1,758 per vehicle, the first time in the quarter it fell below $3,200 per vehicle. Infiniti incentives were reduced by 58% to an average of $3,359 per vehicle, though the past two years, Infiniti incentives averaged more than $8,000 per vehicle.

Average Transaction Price

Nissan’s overall average transaction price (ATP) rose 12% to $34,681. Nissan’s recently redesigned models, the Frontier pickup truck and Pathfinder SUV, posted significant price gains, up 20%, according to Cox Automotive calculations. The Frontier had an ATP of $39,607. The Pathfinder had an ATP of $45,085.

Infiniti’s ATP climbed 7% to $56,255. It was pulled up by the Q60, QX60 and its highest-priced model, the QX80 at $80,348.

Rebecca Rydzewski is a research manager for economic and industry insights for Cox Automotive.