Data Point

Cox Automotive Analysis: Stellantis’ Q1 2023 Market Performance

Tuesday May 2, 2023

Article Highlights

- Stellantis struggled in the first quarter, with U.S. sales down 9% while industry sales increased 8%.

- Stellantis’ market share fell to 10.3% on Jeep and Ram declines.

- Stellantis cut incentives to $2,355 per vehicle on average; transaction prices edged up to $55,577.

Stellantis is struggling in the U.S., one of its most important markets, with bloated inventories and underperforming sales. How that impacts the overall company will be revealed—in part—on Wednesday, May 3, when the automaker reports its shipments and revenues. The automaker will not post full financial results as it only does so every six months.

In the first quarter, despite an overabundance of inventory across most of its many brands, Stellantis’ U.S. sales fell 9% while the industry was up 8%. Its market share declined to 10.3%. Stellantis trimmed only 3% from its incentives, increasing spending on some brands while pulling back on others. Stellantis’ average transaction prices rose by 4%.

The U.S. and Europe are Stellantis’ most important markets. Here are some data points from Cox Automotive on Stellantis’ U.S. Q1 market performance.

Falling Jeep Sales Cause Stellantis to Underperform

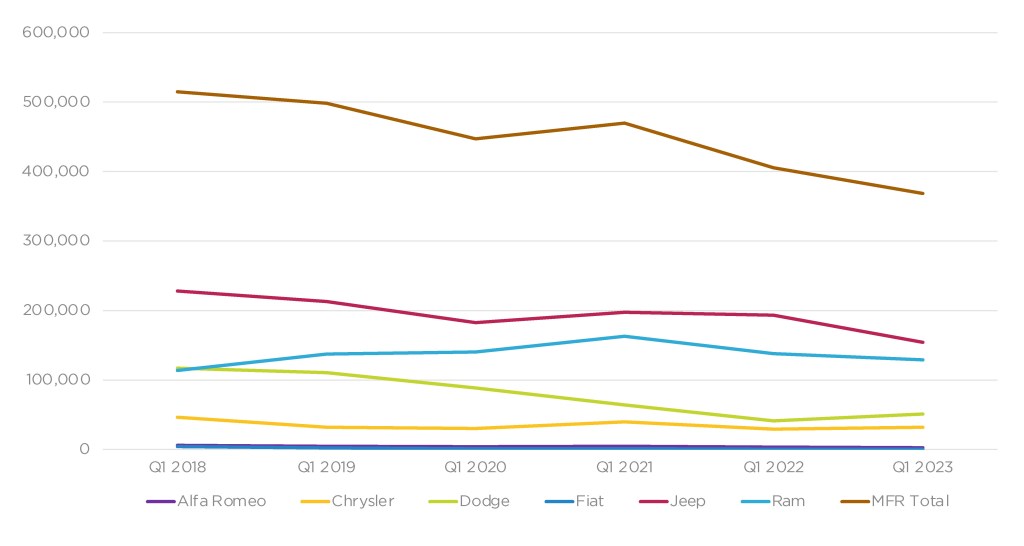

In the first quarter of 2023, Stellantis’ sales in the U.S. fell 9% to 368,327 vehicles. The overall market was up 8%, according to Cox Automotive calculations. The quarter marked the only time in at least the past six years that Stellantis’ first-quarter sales fell below 400,000 units. By comparison, Stellantis posted sales of 514,769 in the first quarter of 2018, its highest for the quarter in the past six years.

STELLANTIS U.S. SALES PERFORMANCE FOR Q1 2023

Much of the damage to Stellantis’ sales came from its volume-leading Jeep brand, despite having plenty of inventory and a hike in incentives. Jeep sales declined 20% from the year-ago quarter to 154,203 units, the lowest first quarter for Jeep in at least six years. Jeep’s high-water mark was the first quarter of 2018 when it sold 228,105 vehicles. Jeep’s high-revenue models had sales down by significant percentages. The volume-leading Grand Cherokee had a sales decline of 27% to 54,502 units. Jeep’s newest and priciest entries – the Grand Wagoneer and Wagoneer – had big sales declines. Jeep sold just over 2,000 Grand Wagoneers and about 5,600 Wagoneers.

At the other end of the spectrum, the so-called cheap Jeeps – Cherokee and Compass – showed some gain, but that was against last year when sales of those models plummeted. In the most recent first quarter, Cherokee had a gain of 31% in sales to just over 13,000, but that is a far cry from the 30,000 to 50,000 plus sales the Cherokee model used to deliver in a quarter.

Only the Chrysler and Dodge brands posted sales increases.

Dodge sales climbed 24% to just under 51,000 units, still well below earlier years. Gas-powered Dodge muscle cars are on their farewell tour with special editions before they are replaced by electric versions. Volume-leading Charger sales soared by 43% to 22,128 units. Sales of the Durango SUV, the brand’s second bestseller, had sales up 22%. Challenger sales edged 2% higher.

With only only two models of the Pacifica and an aging 300 sedan, Chrysler posted a sales increase, up nearly 10% to 31,899 in the quarter. The brand’s strength came from the Pacifica minivan, which had sales rise by nearly 10% to 28,910. Sales of the 300 sedan rose 9% but to less than 3,000 units.

Ram sales slipped by 8% to 128,722 vehicles, the second-lowest first-quarter sales in at least six years. Thanks to a robust commercial vehicle market, Ram was saved by the Promaster van, which posted a 90% sales increase to 17,694 units, and a triple-digit rise in sales for the Promaster City van. The volume-leading Ram 1500 pickup saw sales fall 17% to 105,350 units.

Alfa Romeo sales plummeted by 27% to a mere 2,309 units, the lowest sales in at least six years of first quarters and less than half of the most Alfa Romeo ever sold, which occurred in Q1 2018.

Mostly out of business, Fiat had sales down 59% to a scant 138 units. The Fiat 500L had an ironic 200% sales increase – it had three sales in the quarter. In the first quarter of 2018, Fiat sold more than 4,000 vehicles.

Stellantis’ Market Share Declines Mostly Due to Jeep

Due to underperforming the overall market, Stellantis’ market share fell 1.9 percentage points to 10.3%, its lowest in at least the past six years, according to Cox Automotive calculations. In the first quarter, Stellantis’ share of the U.S. market fell behind Hyundai Motor Company (Hyundai, Kia and Genesis) for the first time ever.

Jeep accounted for 1.5 percentage points of the decline. Its market share slipped to 4.3%, marking the first time in years that Jeep’s share was below 5%. In the year-ago first quarter, Jeep’s share was its highest for the quarter in at least six years at 5.8%.

Ram share dipped by 0.6 of a percentage point to 3.6%, its lowest since the first quarter of 2019.

Only Dodge had an increase in market share, up 0.2 percentage points to 1.4%, still well off the high of 2.8% in 2018 and 2019.

Chrysler’s market share of 0.9% was even with a year ago but down from its highest share of 1.1% in the first quarter of 2018.

Alfa Romeo and Fiat share barely registered.

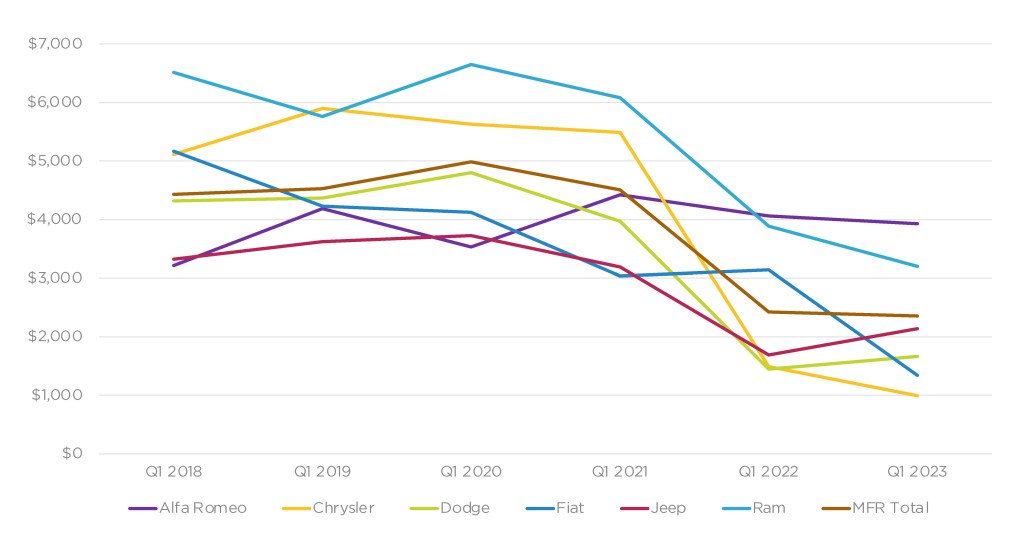

Stellantis Shuffled Incentive Spending, Cutting to an Average of $2,355 per Vehicle

Stellantis shuffled its incentive spending in the quarter. In total, Stellantis cut incentives by nearly 3% to an average of $2,355 per vehicle, according to Cox Automotive calculations. Within that number, Stellantis added spending to some brands and cut incentives for others. In Q1, Stellantis incentive spending was among the largest in the industry.

STELLANTIS U.S. INCENTIVES FOR Q1 2023

Though it does not look like it paid off in sales numbers, Jeep incentives climbed by a hefty 27% to an average of $2,136 per vehicle. However, the per-vehicle average is still far less than Jeep spent in 2021 and earlier when incentives were between $3,200 and $3,700 per vehicle on average.

Dodge incentives got a 15% hike to an average of $1,667 per vehicle, still far lower than in 2021 and earlier when average incentives were around $4,000 per vehicle.

Stellantis cut spending for Ram, Chrysler, Alfa Romeo and Fiat. Ram incentive spending dropped by nearly 18% to an average of $3,200 per vehicle, its lowest in years. Fiat spending was slashed by 57% to $1,341 per vehicle on average. Alfa Romeo spending was trimmed by 3% to an average of $3,928 per vehicle.

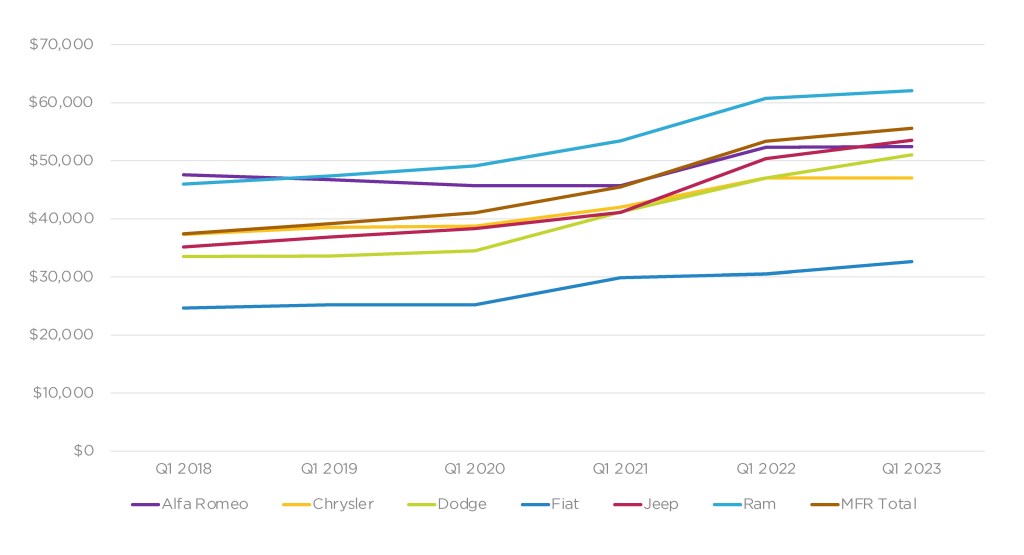

Stellantis Average Transaction Prices Edged Up to $55,577

Stellantis’ average transaction price (ATP) edged up 4% to $55,577, its highest in any first quarter in at least six years, according to Cox Automotive calculations. All brands enjoyed higher ATPs.

STELLANTIS U.S. AVERAGE TRANSACTION PRICES FOR Q1 2023

Due to the final special editions of the Charger and Challenger, Dodge saw the biggest boost in ATP, up 8% to $51,007. The Charger’s ATP soared by 14% to $47,017. The Challenger climbed 13% to $54,751. The Durango eked out a 2% gain to $53,646.

Jeep’s ATP rose by 6% to $53,516. The gains came from 10% increases in ATPs for the Grand Cherokee at $57,279 and Wrangler at $58,579. The Wagoneer’s ATP fell by 10% to $74,048. Jeep’s most expensive model, the Grand Wagoneer, had a 7% gain in ATP to $103,419.

Ram had the highest ATP, up 2% to $62,058. The Ram 1500’s ATP rose 4% to $64,897. The Promaster van got a huge 19% gain to $53,848.

Chrysler’s ATP came in flat at $47,019, as Pacifica’s ATP of $47,516 was flat with a year ago. Alfa Romeo and Fiat had ATPs of $52,425 and $32,615, respectively.