Data Point

Cox Automotive Analysis: Stellantis’ Q3 2023 Market Performance

Monday October 30, 2023

Article Highlights

- Stellantis fell back into a sales slump, losing market share.

- Stellantis boosted incentives by 62% to an average of $3,709 per vehicle.

- Stellantis’ average transaction price climbed to $57,771.

Stellantis reports global deliveries and revenues on Oct. 31 and will be grilled by analysts about the impact the UAW strike had on its operating profit, which will take the biggest hit in the fourth quarter.

The UAW went on strike against GM, Ford and Stellantis on Sept. 15, taking down one assembly plant for each automaker in the beginning. For Stellantis, the Toledo, Ohio, plant that manufactures the Jeep Wrangler and Gladiator went on strike. Since then, the UAW added Stellantis’ most profitable plant as a strike target, the Michigan facility making the Ram 1500 pickup truck. The plant employs 6,800 workers, accounting for 28% of Stellantis’ North American sales.

Wall Street analysts say the loss of the plant to the strike could cost Stellantis up to $400 million in revenue and up to $80 million in incremental earnings before interest and taxes. The actual losses will be revealed after the fourth quarter.

On Saturday, the UAW reached a tentative agreement with Stellantis. In addition to terms similar to Ford’s contract, including a 25% wage hike, Stellantis agreed to re-open the Belvidere, Ill., plant, which had been indefinitely idled due to slow sales of the Jeep Cherokee made there, angering the union. Helped by Illinois state funding, the Belvidere plant would build EVs and EV batteries, creating 2,000 to 3,000 jobs. Stellantis committed to $19 billion in new U.S. investments. Employees will go back to work during the ratification process.

In the third quarter, Stellantis fell back into a sales slump after digging its way out in the second quarter. Sales were off 2% when the market was up 16%, prompting continued market share erosion. Worse, Stellantis’ high-volume, money-making brands, Jeep and Ram, have been sliding in sales and market share.

Like most automakers, Stellantis ramped up incentives in the third quarter. Ram had the highest incentives. Jeep had the biggest percentage increase in incentives from a year earlier. And, like other automakers, Stellantis’ growth in average transaction prices slowed.

The U.S. and Europe are Stellantis’ most important markets. Here are some data points from Cox Automotive on Stellantis’ U.S. Q3 market performance.

Stellantis’ Falls Back into a Sales Slump

After breaking its U.S. sales slump in the second quarter, Stellantis returned to negative territory in the third quarter compared with a year ago, which was not a good year for Stellantis either. Meantime, the rest of the U.S. industry saw a 16% increase in sales in the third quarter.

STELLANTIS U.S. SALES PERFORMANCE FOR Q3 2023

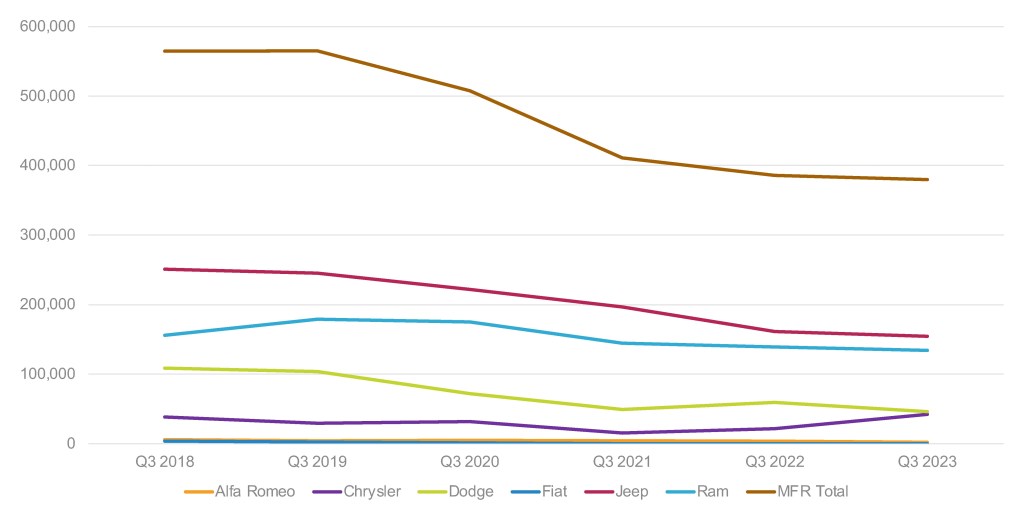

Stellantis sales slipped by 2% to 379,817 units from the year earlier, its lowest sales level for a third quarter in at least six years and far from the third-quarter high of 565,034 vehicles in 2019, according to Cox Automotive calculations.

The Chrysler brand was the only gainer, with sales nearly doubling to 42,315 units to their highest volume in at least six years of third quarters. The increase came from one of the two models the brand sells. The Pacifica minivan had a 120% sales increase to 38,353 units. Sales of the aged 300 sedan were down 5% to under 4,000 units.

Stellantis’ volume brand, Jeep, fell 4% from the year earlier to 154,619 units, its lowest sales volume for the quarter in at least six years. In fact, Jeep sold nearly 100,000 fewer units in the recent third quarter than it did in the third quarter of 2018.

The Grand Cherokee and the Grand Wagoneer were Jeep’s only gainers. Sales of Jeep’s biggest seller, the Grand Cherokee, were up a hefty 52% to 57,915 units. The Grand Wagoneer saw a 22% sales rise to 7,248 units. The Wagoneer was down 22% to 2,867 units.

The Wrangler was off 12% to 41,090 units in the third quarter. Sales of the Gladiator fell 34% to 14,202 units. The Toledo, Ohio, plant that makes the two models was on strike. However, Jeep had ample inventory of both models in the quarter despite the strike, according to Cox Automotive’s analysis of vAuto inventory data.

Ram sales were also down 4% to 134,378, its lowest volume in at least six years for the quarter. Due to a robust fleet market, the Promaster commercial van had a 34% boost in sales to 22,446 units. But that was not enough to offset the 7% decline in Ram 1500 sales, which totaled 109,391 in the quarter.

Dodge sales fell 23% to 46,217 units, its lowest in at least six years. In the third quarter of 2018, Dodge sold more than 100,000 vehicles. The Charger and Challenger, both in their final year in their current form, were down 30% and 33%, respectively, for the quarter. Durango was off 14%. The new Hornet kicked in 1,753 sales.

Alfa Romeo sales had the biggest drop, down 38% to 2,143 units, its lowest in at least six years and only a third of the number of units sold in the third quarter of 2018.

Fiat sold a scant 145 vehicles in the quarter, down 30% from a year ago. In the third quarter of 2018, Fiat sold nearly 4,000 units per quarter.

Jeep, Ram Share Drops Cause Stellantis Market Share to Decline

With Stellantis’ sales down 2% and the overall market up 16%, Stellantis lost more market share. Its share stood at 9.56% in the third quarter, down from 11.38% a year ago to its lowest in at least six years, and for the first time, it fell below 10% in that time, according to Cox Automotive calculations.

Only the Chrysler brand gained, at 1.06%, up from 0.63% a year ago, for its highest market share in the past six years.

Jeep’s share fell to 3.89%, compared with 4.72% a year ago. It was Jeep’s lowest market share in at least six years and only sub 4% share during that time. By comparison, in the third quarter of 2018, Jeep’s share was at a high 5.82%. Likewise, Ram’s share fell below 4% to 3.38% compared with 4.07% a year ago.

Dodge’s share declined to 1.2%, off from 1.8% a year ago and half what it was in the third quarter of 2019. Fiat didn’t even register a market share. Alfa Romeo was down to a barely perceptible 0.05%.

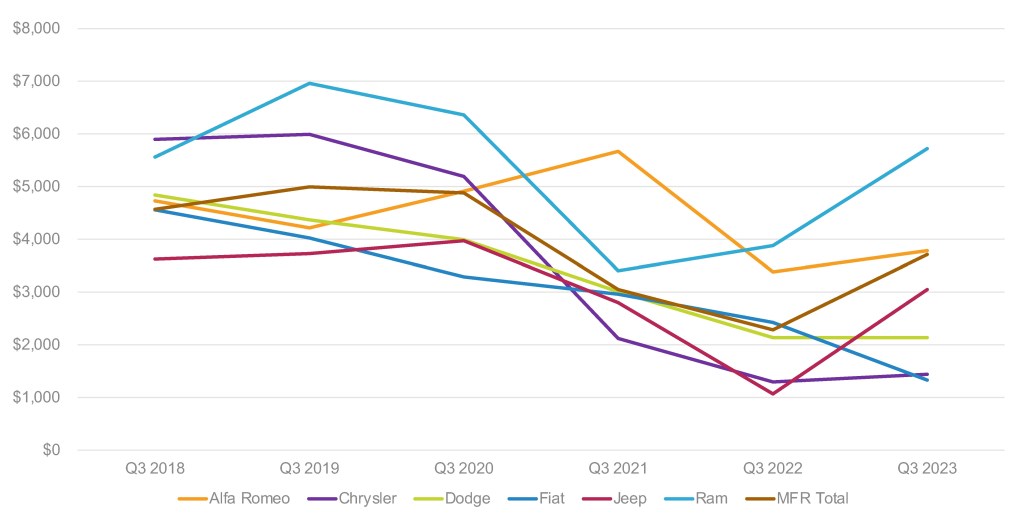

Stellantis Boosted Incentive Spending to an Average of $3,709

After cutting incentives much of the past year, Stellantis, like other automakers, began increasing them in the second quarter and boosted them again in the third. Stellantis bumped up spending by 62% to an average of $3,709 per vehicle, up from $3,134 in the second quarter, according to Cox Automotive calculations. While creeping higher, Stellantis’ incentive spending remains below the third quarters of 2018 to 2020, when it was nearing $5,000 per vehicle on average.

STELLANTIS U.S. INCENTIVES FOR Q3 2023

As was the case in the second quarter, Jeep incentives got the biggest hike, up 185% to an average of $3,048 per vehicle, approaching the amount spent before the pandemic.

Ram had the next biggest increase and the largest incentive. Up 47%, Ram incentives averaged $5,724 per vehicle, even more than Ram spent in the third quarter of 2018 but still off the nearly $7,000 paid in the third quarter of 2019.

Chrysler brand incentives rose 11% to $1,444, well off the pre-pandemic highs of $5,000 to $6,000 per vehicle. Dodge incentives held at $2,138 per vehicle on average.

Fiat was down 45% to $1,331 per vehicle. Alfa Romeo incentives got a 12% bump to $3,785 per vehicle.

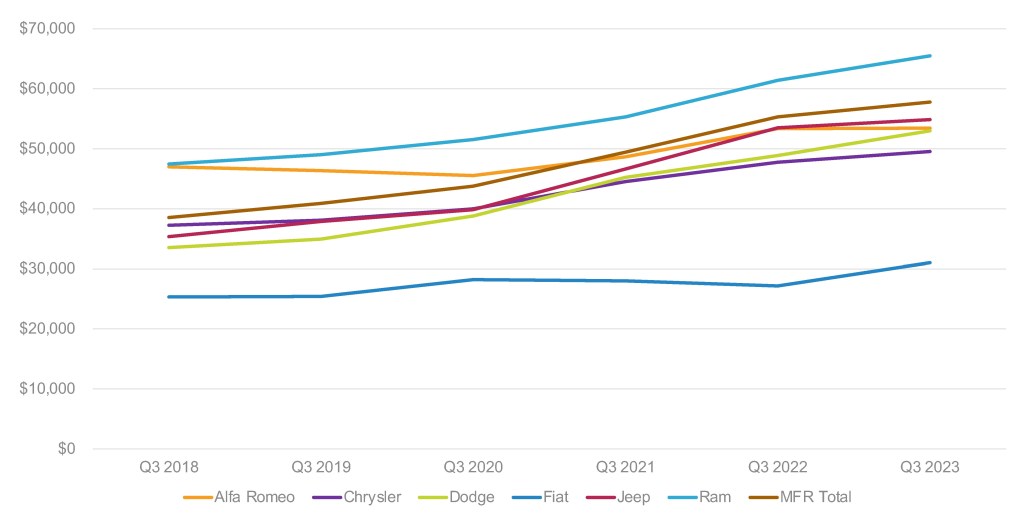

Stellantis Average Transaction Price Climbs 5% to $57,771

Stellantis’ average transaction price (ATP) increased by 5% to $57,771, its highest in any third quarter in at least six years, according to Cox Automotive calculations. All brands saw higher ATPs except Alfa Romeo, which was flat. All Stellantis brands had ATPs that were the highest for the third quarter in at least six years.

STELLANTIS U.S. AVERAGE TRANSACTION PRICES FOR Q3 2023

Chrysler’s ATP edged 4% higher to $49,531. The volume-leading Pacifica had a 2% rise to $49,931.

Jeep eked out a 3% increase to $54,848. The Wrangler had the biggest increase, up 4% to $58,410. The Grand Wagoneer had Jeep’s highest ATP at $104,567, up 3%. The volume-leading Grand Cherokee carried an ATP of $56,447, up 3%.

Ram’s ATP was up 7% to $65,473. The Promaster commercial van accounted for the bulk of the increase, with an ATP that jumped 24% to $60,894. The Ram 1500 had a 5% gain in its ATP to $67,076.

Dodge’s ATP rose 8% to $52,983. The Challenger accounted for most of the increase, with a 13% rise in ATP to $53,653. The Charger had a 6% gain at $48,794. The Durango was up 9% to $58,407. The Hornet, which just went on sale, had an ATP of $38,241.

Alfa Romeo and Fiat had ATPs of $54,372 and $32,124, respectively.