Data Point

Cox Automotive Analysis: Toyota Motor Corporation’s Quarterly U.S. Market Performance

Tuesday October 31, 2023

Article Highlights

- Toyota Motor’s quarterly U.S. sales rose 12% from a year ago for a 14.9% market share.

- Toyota’s overall incentives increased by 35% to an average of $1,057 per vehicle.

- Toyota’s average transaction price remained stable at just above $40,500.

Toyota reported improved U.S. sales in the latest quarter, with most models showing gains despite having among the lowest inventory levels in the industry.

In Japan, Toyota Motor Corp. posts financial results Oct. 31 for the July-to-September quarter, the automaker’s second quarter of its 2024 fiscal year.

Toyota’s U.S. sales for the quarter rose 12%, still underperforming the overall industry. Toyota brand sales increased 12%, and Lexus sales rose 11%. Average transaction prices remained stable, while incentives were up 35% to over $1,000 for the first time since 2021.

Here are some data points from Cox Automotive on Toyota’s quarterly market performance in the U.S., one of its most important markets.

Toyota’s U.S. Sales Increased, But Market Share Declined

Toyota Motor’s U.S. sales totaled 590,296, up 12% from a year ago. With overall U.S. sales up 16%, Toyota’s total market share dipped to 14.9%, down 0.5 percentage points. For comparison, Toyota’s share was 16.58% in the equivalent 2021 quarter.

TOYOTA MOTOR CORP. U.S. SALES FOR Q2 FISCAL YEAR 2024

Toyota brand sales totaled 515,400 vehicles, an increase of 12% year over year. The Toyota brand accounted for the majority of the automaker’s market share decline in the U.S.

Out of the 20 Toyota models Cox Automotive tracks, 11 saw sales gains. The popular RAV4 sold 115,814 units in the quarter, a 13% increase. The Corolla and Corolla Cross both had sales up by 34% and 37%. The redesigned Sequoia and the all-electric BZ4x saw sales skyrocket, with the popular truck selling 6,213 units and the new EV selling 2,827 units. Mirai, one of the few fuel cell vehicles currently available, had a sales gain to 882 units, up from 79 units in the year-ago quarter. Other models with sales increases were the Prius, up 91%; Venza, up 102%; Sienna, up 30%; Tundra, up 9%; and 4Runner, up 35%.

Lexus sales rose by 11% to 74,896 units for the quarter. The luxury maker’s share slipped by just 0.1% from the year-earlier quarter. The LX saw sales double for the quarter, selling 1,828 units. The LC was up 216% to 506 units. Additionally, the UX, NX and IS all saw increases, up 34%, 47% and 12%, respectively. Sales for the remainder of the line-up were down.

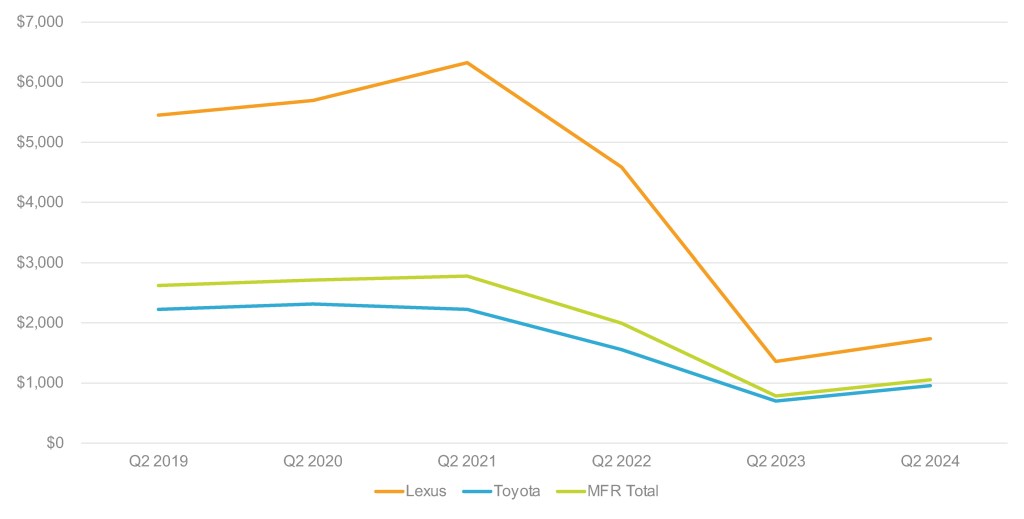

Incentive Spending Increases While Demand Remains High

Toyota Motor bumped up incentives by 35% to an average of $1,057 per vehicle, according to Cox Automotive calculations. This is up from just $785 in the same quarter of 2022.

TOYOTA MOTOR CORP. U.S. INCENTIVE SPENDING FOR Q2 FISCAL YEAR 2024

Toyota brand incentives grew by 37% to an average of $959 per vehicle. Lexus incentives were up by 28% to an average of $1,735 per vehicle, still well below the record of $6,326 during the 2020 quarter. Compared to overall industry numbers, Toyota and Lexus incentive spend continues to be far below average.

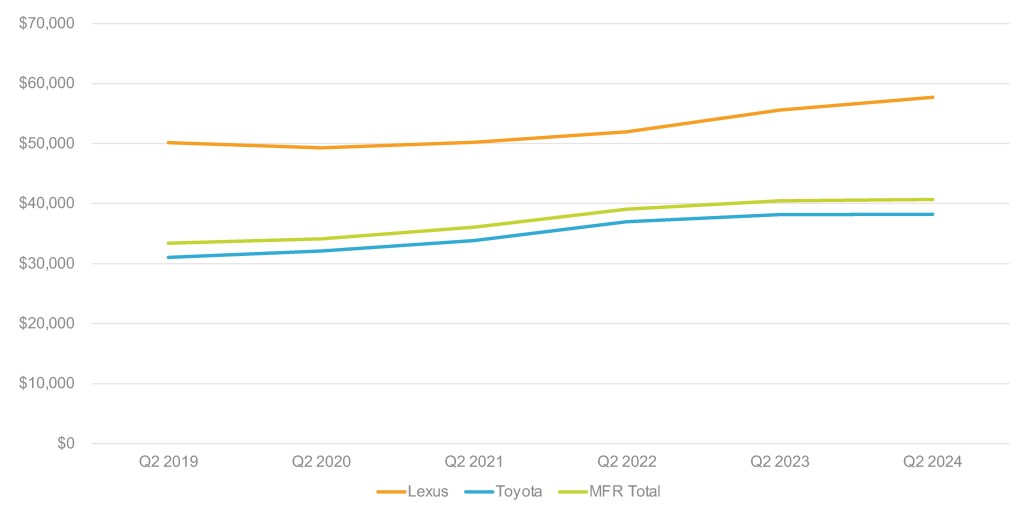

Overall Average Transaction Price Remains Above $40,000

Toyota Motor’s overall average transaction price (ATP) remained stable at $40,674, according to Cox Automotive calculations.

TOYOTA MOTOR CORP. U.S. AVERAGE TRANSACTION PRICE FOR Q2 FISCAL YEAR 2024

The Toyota brand’s ATP was up just 0.1% to $38,198. The Corolla hatchback had an ATP hike of 35%, while the Prius was up 10%. All other offered models saw incremental gains or losses in the single digits.

Lexus brand ATP was up 4% for the quarter. The IS and RX models’ ATP was up 5% for both, and the UX saw the biggest increase of 6%. All other models were up incrementally except for the LS, LC, and GX, which were all down a percentage point or less.

Rebecca Rydzewski

Rebecca Rydzewski is an automotive analyst with over 20 years of experience in the automotive industry. She provides industry and data analysis using consumer and industry data from Cox Automotive and its brands including Autotrader and Kelley Blue Book. Rydzewski joined Cox Automotive in March 2022.