Data Point

Cox Automotive Analysis: Toyota Quarterly U.S. Market Performance

Wednesday May 12, 2021

Article Highlights

- Toyota, Lexus sales far outpaced the industry, boosting market share

- Lexus bumped up incentives, Toyota trimmed incentives.

- Toyota, Lexus Average Transaction Prices hit new highs.

Toyota Motor reports financial results for Q4 FY 2020, the January-to-March 2021 quarter, on Wednesday, May 12, the fourth quarter of its fiscal year that ended March 31, 2021.

In the U.S., one of its most important markets, Toyota far outpaced the overall market in sales for the quarter, pushing market share higher. Lexus outpaced other luxury makers and surpassed BMW, becoming the No. 2 luxury marque.

While Toyota bumped up incentives, they remain among the industry’s lowest and were more than offset by much higher average transaction prices. Toyota’s quarterly performance was all the more remarkable due to the fact that it had among the lowest inventories in the industry for both brands.

Here are some data for the quarter from Cox Automotive on Toyota’s performance in the U.S.

Sales and Market Share

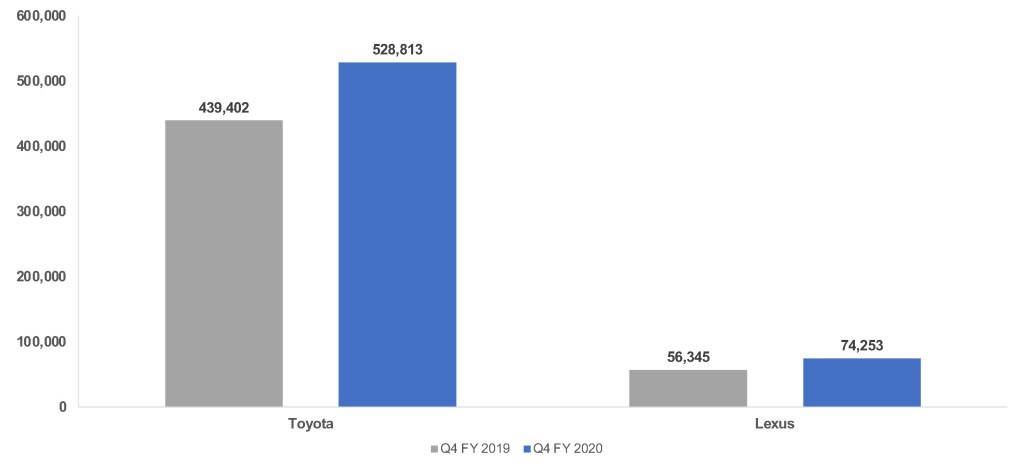

Toyota sold a total of 603,066 vehicles in the quarter, up 20% from a year earlier. Toyota brand sales rose 20% to 528,813 vehicles. Lexus sales soared 32% to 74,253. The increases were despite the automaker and both of its brands reporting the lowest inventories in the industry during the quarter.

Sales Volume

For the automaker in total and the Toyota brand specifically, sales were the highest for the quarter at least since 2015. Lexus sales beat every comparable quarter except the same quarter in 2015 when sales were slightly higher.

Toyota substantially outperformed the market that was up 11% in total for the quarter while luxury vehicle sales were up 17%. That pushed Toyota’s share to new highs. The automaker gained 1.3 percentage points of market share. It earned a 15.4% market share, its highest of any similar quarter and its first time surpassing the 15% mark for the timeframe. Toyota’s market share was exactly 1 percentage point lower than GM’s and 1.9 percentage points higher than Ford’s.

Toyota brand took 13.5% market share, up 1 percentage point from a year ago, and its first time surpassing 13%. Lexus captured 1.9% market share, a .3 percentage point gain from a year ago and its highest since the same quarter in 2015 when it hit 2%.

Aside from the Yaris that is being discontinued, the only Toyota model with sales lower in the quarter than a year ago was the full-size Tundra pickup truck. The Tundra is inventory-constrained due to the global computer chip shortage. Toyota has been purposely using the chips allocated to the Tundra for other models as a new version will be launched later this year. Toyota sold under 20,000 Tundras in the quarter, a first for the timeframe since at least 2015.

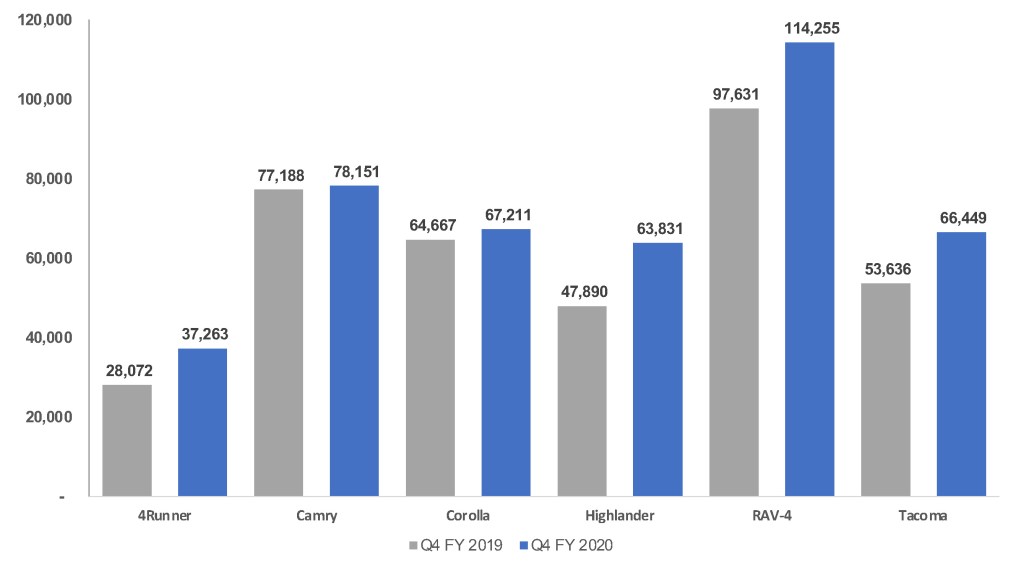

In contrast, Tacoma, which dominates the midsize truck segment, also is extremely inventory constrained but still posted a 24% sales increase. Tacoma sales surpassed the 60,000-unit mark for the first time in the quarter since at least 2015 with sales of 66,449.

Toyota’s high-volume SUVs boosted overall sales the most. Toyota’s highest volume model, the RAV4, with its popular hybrid versions, had a 17% sales hike to 114,255 units, far surpassing the 100,000 mark for the timeframe. Both the 4Runner and Highlander saw 33% sales gains.

Model Volume

Buyers, apparently, decided to buy the Land Cruiser while they could. The SUV is being discontinued after more than a six-decade run. Toyota sold 1,896 of them, more than double the sales in any January-to-March quarter since 2015.

Even Toyota car sales rose, though they remain lower than in the past with consumers preferring SUVs over cars.

Sales of the redesigned Sienna, now available only as a hybrid, rose 124% to 26,578 units, the highest level of sales since the same quarter in 2016. The new hybrid-only Venza crossover pitched in nearly 14,000 units of sales, double the previous version in 2015.

Toyota sold 869 Mirai fuel cell cars. That is a significant advance for the fuel cell model that is only sold in California, considering Toyota sold a total of 1,364 of the Mirai in the quarter from 2011, when it was introduced, through 2020.

Every Lexus model posted a sales hike except the GS sedans, which are being discontinued. The volume-leading SUVs from Lexus, the RX and NX, posted double-digit sales increases and set new sales records for the quarter, despite extremely low inventories.

Incentives and Prices

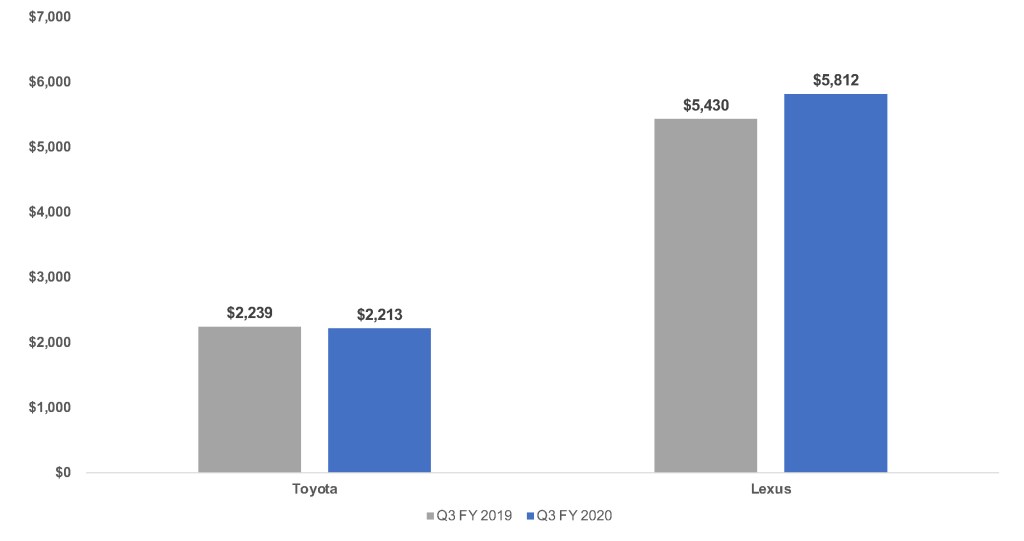

Toyota is generally among the lowest spenders on incentives. In the quarter, Toyota overall bumped incentives 2% higher to a still-low average of $2,566 per vehicle, according to Cox Automotive calculations. That was its highest spend in the same timeframe since at least 2015.

Sales Incentives

The automaker boosted Lexus incentives by 7%, an average of $5,812 per vehicle, the highest for Lexus in the quarter since at least 2015. The automaker trimmed Toyota incentives by 1% to an average of $2,213, its second-highest for the quarter since 2015 but still low compared with its non-luxury competitors.

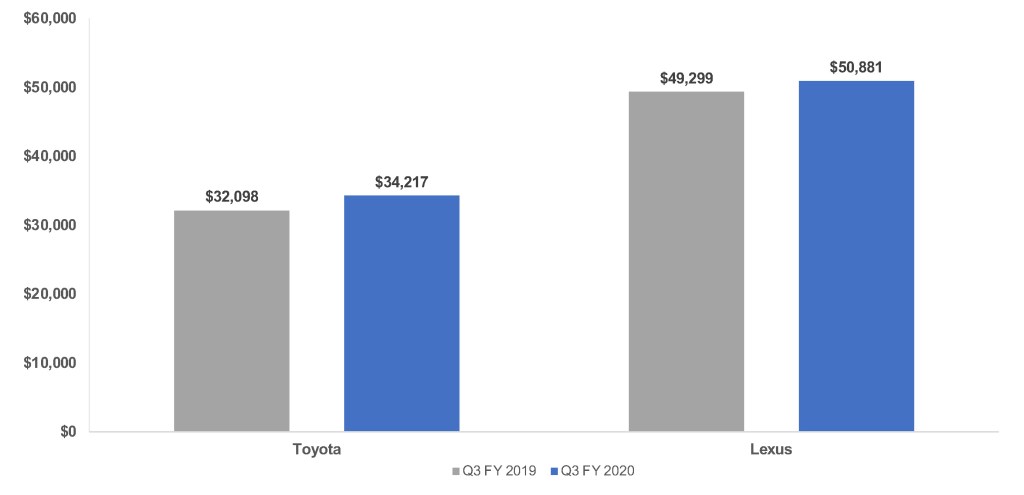

The higher incentive spend was offset by much higher average transaction prices (ATP), which on every level hit new highs. In total, Toyota’s ATP rose 7% to $36,269, according to Cox Automotive calculations.

Average Transaction Prices

Toyota brand’s ATP rose 7% to $34,217. Almost every model gained in pricing. The Highlander, up 7% to $43,159, and Sienna, up 9% to $41,797. had the biggest hikes in ATPs. The soon-gone Land Cruiser carried Toyota’s highest ATP at $85,656.

Lexus’ ATP edged 3% higher to $50,881, its first time surpassing the $50,000 milestone. Almost every model eked out a gain, except the GS that is being discontinued. The LC is Lexus’ most expensive vehicle with an ATP of $85,656, up 11% from the year-ago quarter, the biggest rise.