Data Point

Cox Automotive Analysis: Toyota Quarterly U.S. Market Performance

Tuesday February 9, 2021

Article Highlights

- Toyota and Lexus post higher Q4 sales while industry sales dip.

- Toyota incentives trimmed 3% to an average of $2,663 per vehicle.

- Toyota ATP rises 4% to $36,127.

Toyota Motor reported financial results for Q3 FY 2020, the October-to-December 2020 quarter, on Wednesday, February 10, the third quarter of its fiscal year that ends March 31, 2021.

Toyota executives in the U.S. promised the automaker would end calendar year 2020 with one of its best quarters in history, and they delivered. They predict even better results in 2021.

Here are some data for the quarter from Cox Automotive on Toyota’s performance in the U.S., one of the Japanese automaker’s most important markets.

Sales and market share

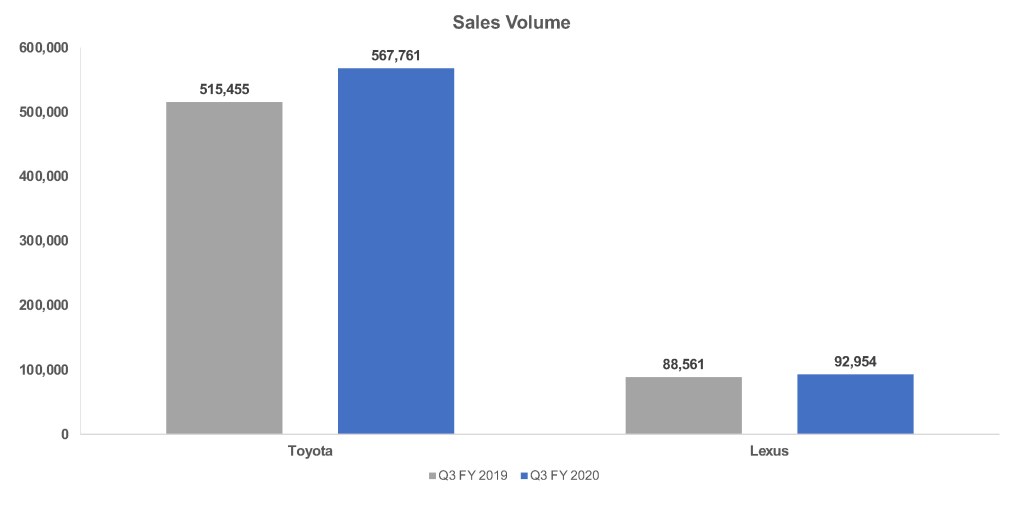

Toyota and Lexus were among only a few brands in the U.S. to post higher sales in Q4 2020 than in Q4 2019, despite both brands experiencing some of the tightest vehicle inventories throughout much of the year.

Toyota and Lexus brands combined sold 660,715 vehicles, up 9% from the year earlier. Toyota brand sales rose 10% to 567,761 vehicles. Lexus sales climbed 5% to 92,954 vehicles. In total, U.S. vehicle sales dipped 2% in the quarter.

Higher sales in a lower market pushed the combined Toyota-Lexus market share close to the 16% mark – 15.77% to be exact – compared with 14.09% in the year-earlier quarter and 14.34% in their second quarter. It was the automaker’s highest market share for any third quarter in the past five years. Toyota/Lexus are second in sales and market share to General Motors, which had 18.32% market share during the same period.

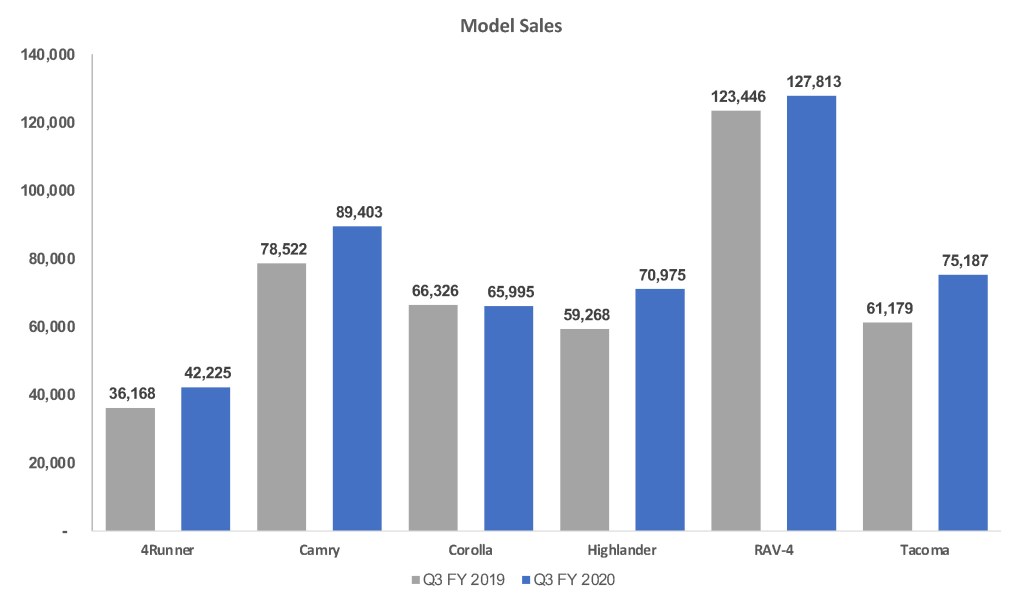

Toyota had a number of models, mostly SUVs and trucks, that posted hefty double-digit sales increases. Despite extremely tight supplies, the midsize Tacoma and full-size Tundra pickup trucks both had sales up more than 20%. The 4Runner, Highlander and Land Cruiser SUVs increased sales by more than 15% each. Camry, Toyota’s volume-selling car, also achieved a double-digit increase while the volume-leading RAV4’s sales increase was a modest 3.5%. Sales of the Corolla, on the other hand, dropped slightly. The new all-hybrid Venza crossover contributed sales of 11,405 units.

Lexus SUVs also sold well, with the UX, NX and GX posting gains. The volume-leading RX was roughly flat. Lexus car sales showed mixed results. The luxury brand is trimming its car line, eliminating the midsize GS.

Incentives

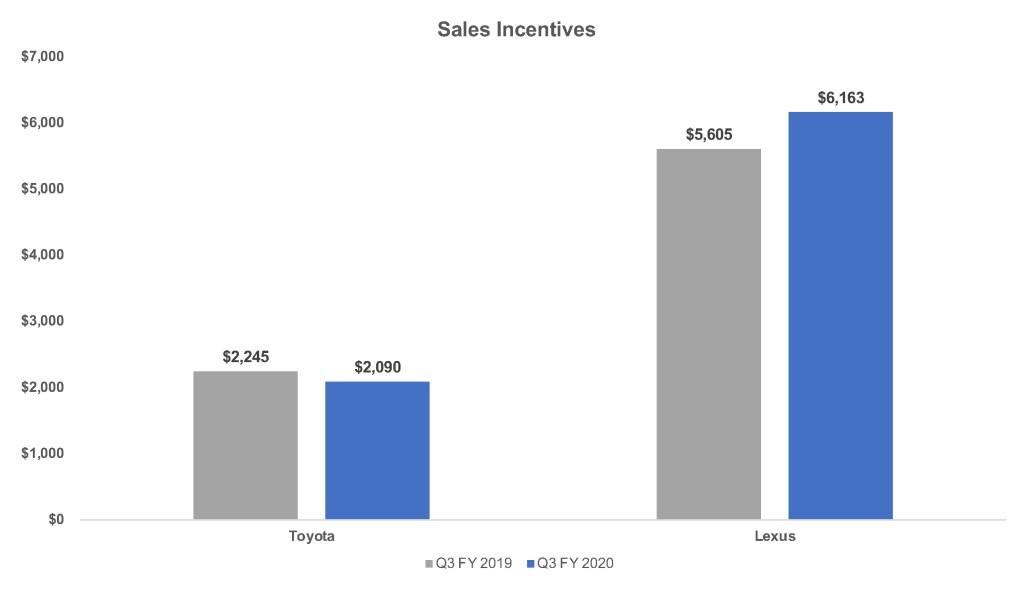

In total, Toyota trimmed incentives. The automaker spent an average of $2,663 per vehicle on incentives during the quarter, according to Kelley Blue Book calculations. That’s down 3% from the year-earlier quarter and down from $2,779 in the second quarter. The automaker’s overall incentive spend has held in a fairly tight range over the past five years.

Toyota brand incentives were scaled back the most. They averaged $2,090 per vehicle, down 7% from a year earlier to one of the lowest levels in the past five years. They were also down from the second quarter.

In contrast, Toyota boosted Lexus brand incentives by 10% to an average of $6,163 per vehicle, the highest for the quarter in five years but down some from the second quarter.

Average Transaction Prices

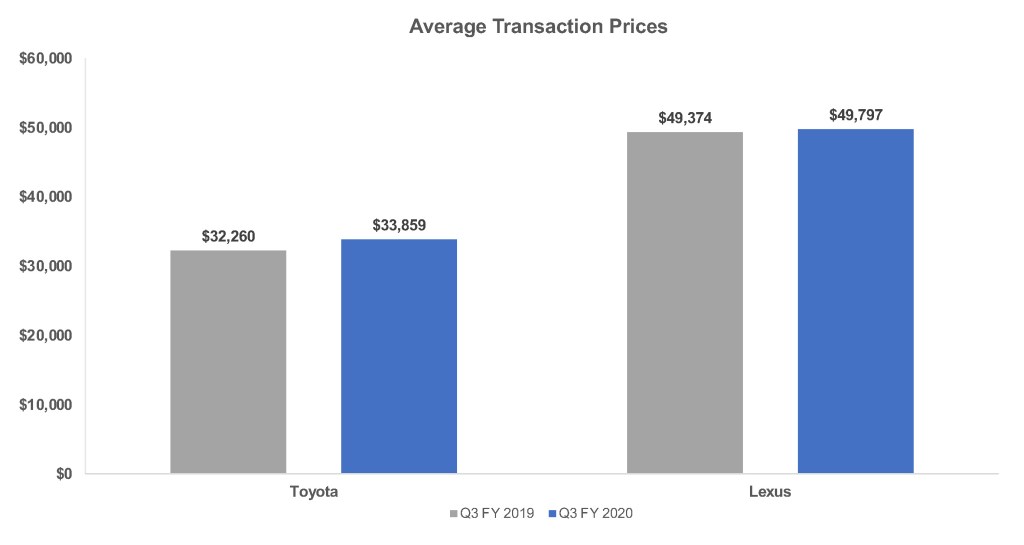

Toyota’s average transaction prices (ATP) rose 4% to $36,127, according to Kelley Blue Book calculations, to a five-year high.

The Toyota brand’s ATP rose 5% to $33,859, the highest level in five years for the quarter. The increase came on the strength of the new Highlander, which saw a 10% hike, and the continued rise of the Land Cruiser’s ATP, hitting $84,389 for the quarter.

New models saw healthy ATPs as well. The redesigned Sienna minivan, now available only as a hybrid, had a 7% increase in its ATP to $41,024, up 7% from the previous model. The new Venza, also hybrid only, carried an ATP of $38,691.