Data Point

CPO Sales Regain Momentum in October, Cruise Toward Another Record

Thursday November 14, 2019

Article Highlights

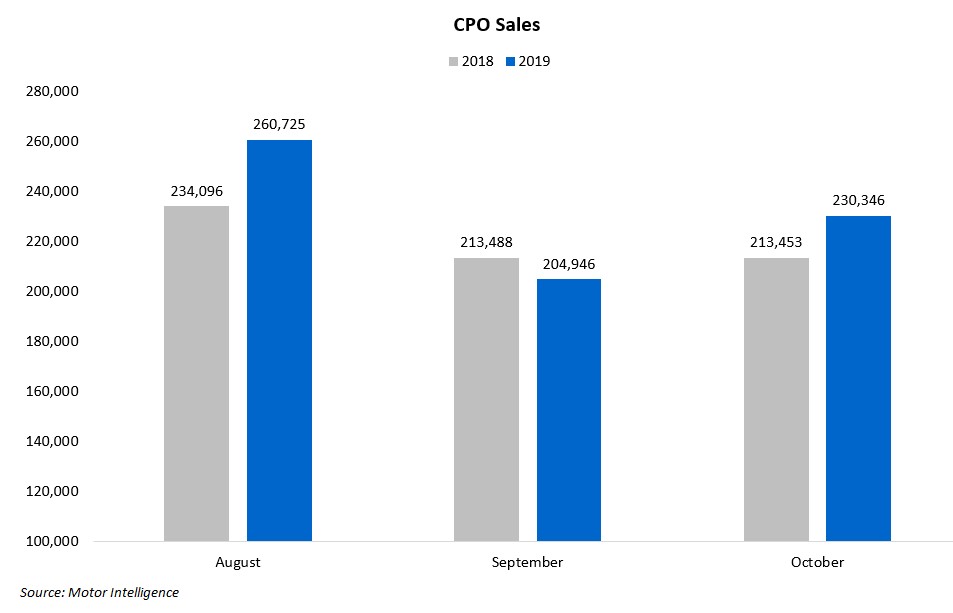

- Sales of certified pre-owned (CPO) vehicles increased 8% year over year in October and were up 12% month over month compared to September. For the month, 230,346 CPO units were sold.

- This year CPO sales are up 2.9% versus 2018, growing at a comfortable pace above 2018’s record-setting performance and exceeding 2.3 million sales through October.

- The CPO market is just 365,000 units shy from matching last year’s record total of 2.70 million vehicles.

Sales of certified pre-owned (CPO) vehicles increased 8% year over year in October and were up 12% month over month compared to September. For the month, 230,346 CPO units were sold.

This year CPO sales are up 2.9% versus 2018, growing at a comfortable pace above 2018’s record-setting performance and exceeding 2.3 million sales through October. This means that the CPO market is just 365,000 units shy from matching last year’s record total of 2.70 million vehicles. That new high represented the eighth straight year of record-breaking CPO sales. The Cox Automotive forecast for 2019 CPO sales is 2.75 million vehicles as the market looks to set another record.

As has been the case all year, Toyota, Honda and Chevy continue to be the biggest players in the CPO market, collectively representing almost a third of all CPO sales. Those three plus Ford and Nissan account for 47% of CPO sales in 2019. Last year, Toyota, Honda, Chevy and Nissan accounted for 48% of the total industry CPO sales.

Interestingly, the latest Shopper Trends Snapshot reveals that 49% of used-vehicle shoppers are open to purchasing a CPO and 91% view CPO “as good as new.” Across the popular SUV and truck segments, cross-shopper behavior demonstrates that used model shoppers are cross-considering CPO alternatives.

As we move into the holiday shopping season, new-vehicle incentive programs will be a headwind facing the CPO market. If incentives increase, consumers will see competitive monthly payments when comparing a new unit and a CPO unit, which could put downward pressure on CPO growth.

It’s worth noting that the Q3 Autotrader Cross-Shopping report found that among savings opportunities offered by dealers on CPO vehicles, incentives have the strongest appeal to consumers who intend to purchase a used vehicle. Download the latest Shopper Trends Snapshot below for more details.

Used to CPO Cross-Shopper Study

This Shopper Trend Snapshot provides study findings on used to CPO cross-shopping.

Download