CAMIO

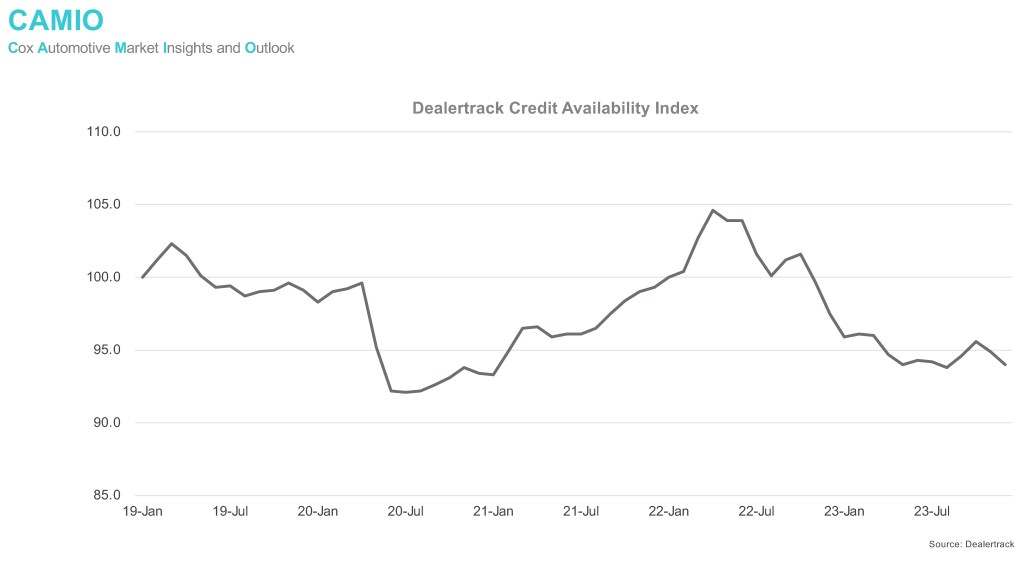

Dealertrack Credit Availability Index Declines Substantially

Wednesday March 20, 2024

Takeaway: Access to auto credit has consistently declined since the spring of 2022, a trend that continued through most of 2023. In December, credit tightened across most channels and across all lender types, according to the Dealertrack Credit Availability Index. The All-Loans Index declined for the third straight month in December, falling another 0.9% to 94.0, reaching its lowest level since August. Credit access in all channels and lender types ended 2023 tighter than a year ago and well below the levels seen in 2019.

What’s next: To date, in 2024, yield spreads have increased, and access to auto credit has declined further, reaching the lowest level since August 2020. However, if rates begin coming down later this year, the market could see an improvement in affordability, which might help the subprime share of the market. Lower rates may also lead lenders to believe the economy is improving, resulting in lower credit spreads and improving credit availability, but the path there may be bumpy.