Data Point

Auto Credit Availability Improves Slightly in December, But Trends Varied By Channel and Lender

Monday January 10, 2022

Article Highlights

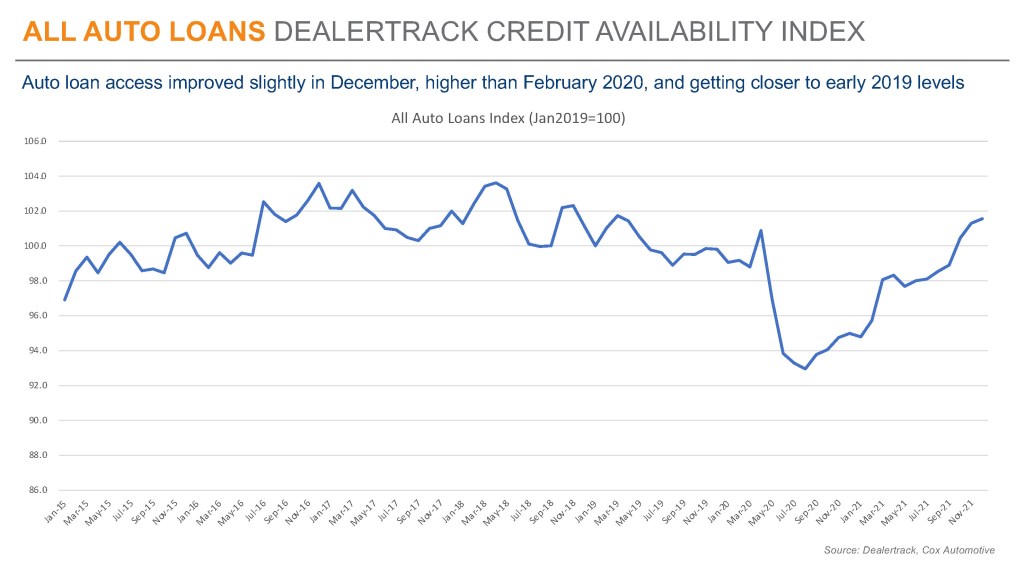

- Access to auto credit expanded slightly in December, according to the Dealertrack Credit Availability Index for all types of auto loans.

- The All Loans Index increased 0.3% to 101.6 in December, reflecting that auto credit was easier to get in the month compared to November.

- Access was looser by 6.9% year over year and compared to February 2020, access was looser by 2.4%. The index was last higher in April 2019.

Access to auto credit expanded slightly in December, according to the Dealertrack Credit Availability Index for all types of auto loans. The All Loans Index increased 0.3% to 101.6 in December, reflecting that auto credit was easier to get in the month compared to November. Access was looser by 6.9% year over year and compared to February 2020, access was looser by 2.4%. The index was last higher in April 2019.

Not all loan types saw easing in December. Franchised used loans, CPO loans, and the aggregate measure for all used loans saw slight tightening for the month. Used loans at independent dealers and non-captive new loans loosened the most. On a year-over-year basis, all loan types were easier to get with non-captive new loans having loosened the most.

Credit trends were also varied by lender type in December. Banks tightened while auto-focused finance companies and captives loosened, and credit unions were unchanged. On a year-over-year basis, all lenders had looser standards with captives having loosened the most.

Each Dealertrack Auto Credit Index tracks shifts in loan approval rates, subprime share, yield spreads and loan details including term length, negative equity, and down payments. The index is baselined to January 2019 to provide a view of how credit access shifts over time. Across all auto lending in December yield spreads narrowed, terms lengthened, down payments declined, and the approval rate increased, and the moves in those factors made credit more accessible. However, the subprime share declined, and the negative equity share declined, and the moves in those factors made credit less accessible.

The Dealertrack Credit Availability Index is a monthly index based on Dealertrack credit application data and will indicate whether access to auto loan credit is improving or worsening. The index will be published around the 10th of each month.