Data Point

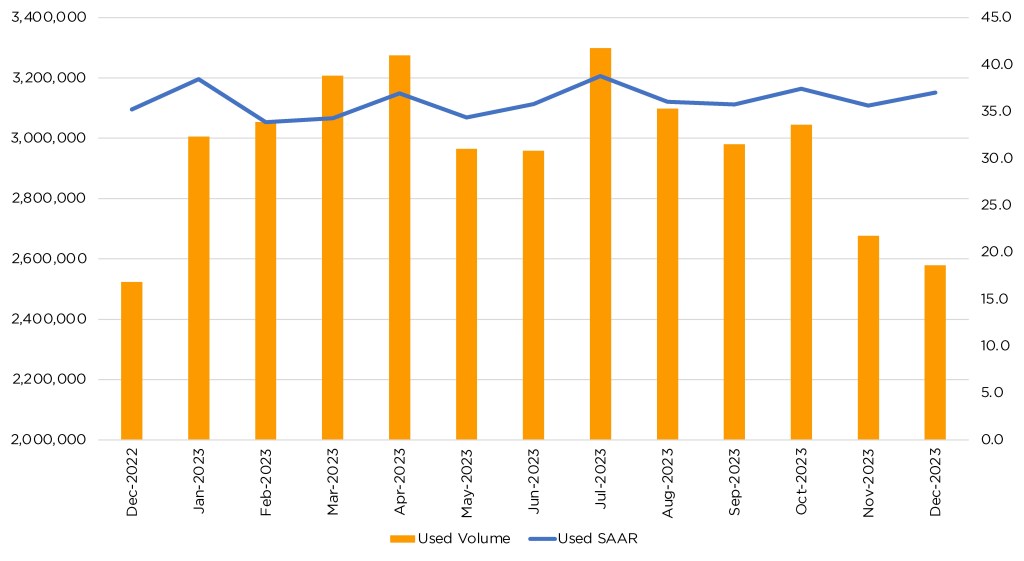

Estimated Monthly Used-Vehicle SAAR and Volume

Tuesday January 16, 2024

Starting in January 2024, Cox Automotive aligned its monthly used-vehicle sales reporting to vAuto used retail data. A monthly post will be published using vAuto Live Market Live data and can be found within the used-vehicle sales tag.

According to Cox Automotive estimates based on vehicle registration data, total used-vehicle sales in December finished near 2.6 million units, up 2.1%, around 54,000 units, from December 2022. Used retail sales are estimated to have finished December near 1.4 million, up 2.6% from last year’s volume, or just over 35,000 units.

Estimates based on registration data indicate that the used-vehicle sales pace — both total and retail — in December improved compared to the market’s pace of one year ago. The seasonally adjusted annual rate (SAAR) is estimated to have finished at 37.0 million, above last December’s pace of 35.2 and ahead of November’s revised 35.6 million level.

Total Used Volume and Used SAAR

“Overall, December used sales were a little soft when we think about the sales momentum we had since the summer, including lower prices all year,” said Chris Frey, senior manager of Economic and Industry Insights at Cox Automotive. “Regardless of the December figures, we have to cheer the way the year ended, with the SAAR up from November and finishing above our full year January 2023 SAAR forecast.”

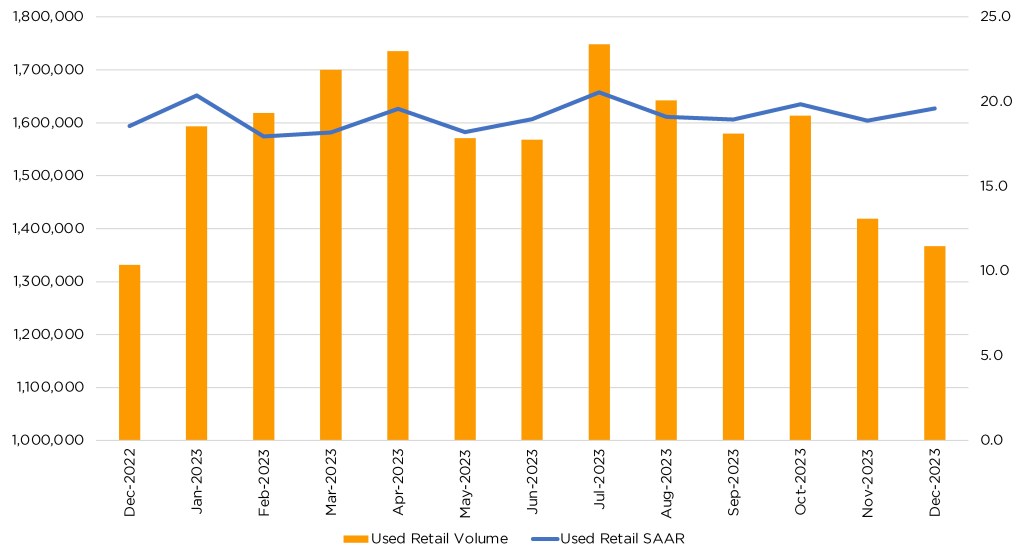

Retail used-vehicle sales — the volume of vehicles sold via a dealership, thus removing private party sales — are estimated to be 1.37 million in December, down 3.7% from the 1.42 million recorded in November, with one more selling day. The used retail sales pace rose to 19.6 million in December from November’s revised 18.9 million level.

RETAIL USED VOLUME AND USED SAAR

The retail used-vehicle sales estimates based on registration data generally align with the used sales estimates based on observed changes in units tracked by vAuto, a Cox Automotive company specializing in inventory management. The vAuto estimates suggest that used retail vehicles sales volume in December was up 3% compared to November, with year-over-year volumes up 1%.

2023 Total Used Sales Exceeded Forecasts, Retail Constrained by Supply

In Q4, weekly used sales remained fairly steady and ended the year with estimated sales running about 4% higher versus last year. For the full year, estimated sales for used retail were down about 3%, curtailed by a constrained supply of newer used vehicles into the ecosystem.

Overall, Cox Automotive estimates the used-vehicle market, from all retail and private transactions, likely beat its forecast and finished 2023 near 35.9 million, just below last year’s 36.3 million. Retail likely closed out 2023 at 19.0 million. Starting in February, used-vehicle sales will be reported based on vAuto data only.

Normalcy and Balance Expected to Return to Used Market in 2024

Cox Automotive set its 2024 forecasts for used-vehicle sales volume at 36.2 million, with used retail sales forecast to reach 19.2 million.

“The used-vehicle market is expected to regain some normalcy and balance in 2024,” noted Frey. “However, the effects of lower new-vehicle sales in 2021 and 2022 are anticipated to keep the used supply constrained.”

The Cox Automotive estimated total and retail used-vehicle SAAR and volume are updated monthly and are subject to change due to market volatility.