In April, the electric vehicle (EV) market faced several challenges, reflecting broader economic trends. New EV sales experienced a decline both month-over-month and year-over-year, although the market share in April saw a slight increase compared to March. Manufacturers had mixed results, with some reporting growth and others facing significant decreases. Meanwhile, the used EV market continued to expand, driven by many affordable models. Inventory levels varied, influenced by factors such as production adjustments and consumer demand.

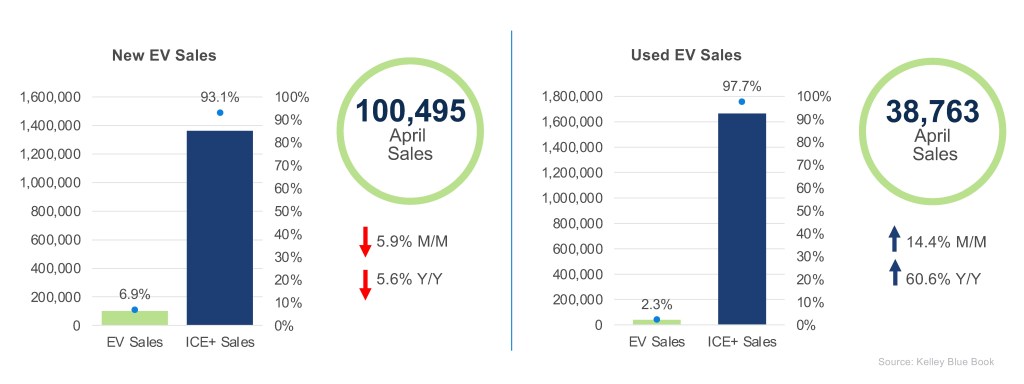

New and Used EV Sales – April

New EV Sales: The new EV market faced several challenges in April, reflecting broader economic trends. The volume of new EV sales declined by 5.9% month over month to 100,495 units, while the EV market share rose slightly to 6.9%. Year over year, the EV sales volume decreased by 5.6%.

While most manufacturers saw a month-over-month decline in volume, GM, Tesla, and Nissan reported notable growth in EV sales; Ford, Hyundai Group and VW Group experienced declines. Tesla’s market share remained below 50%, but it increased by 3.7 percentage points in April, driven by the success of the Model Y, which sold 25,231 units and held a 25.1% market share. GM brands had a strong month as well, achieving a combined market share of 14.4%, a 2-percentage-point increase from the previous period. Uncertainty in the market and tariffs, however, will continue to impact EV sales going forward. A recent consumer survey conducted by Cox Automotive indicates that nearly half of the respondents believe tariffs will have a significant impact on their decision to purchase an EV.

Used EV Sales: The used EV market saw significant growth in April, driven by strong sales across several key models. Used EV sales grew by 14.4%, reaching a total of 38,763 units and increasing market share to 2.3%, the highest volume and share to date. Year-over-year growth was 60.6%. Tesla continued to dominate the used EV market, with a 27.0% increase in volume month over month, boosting its market share by 4.7 percentage points to 47.0%. Chevrolet and Ford followed, holding market shares of 8.9% and 6.0%, respectively, with both brands experiencing modest growth in sales volume. This growth in used EV sales comes at a time when new EV sales are facing challenges due to affordability and availability, making used EVs an option for many buyers.

New and Used EV Days’ Supply – April

New EV Days’ Supply: In April, the new EV days’ supply increased by six days, up 4.2%, month over month, rising to 99 days. Year over year, the new EV days’ supply is down nearly nine days (19.9%), marking the widest gap between EV and ICE+ days’ supply since July 2024. Days’ supply varied significantly by make. Lexus and Genesis had some of the tightest inventory, while Ford, Audi and VW saw stocks increase in April. Days’ supply has shifted of late, which is the dynamic nature of the EV market that is being influenced by factors such as production adjustments, consumer demand, and inventory management strategies.

Used EV Days’ Supply: In April, the days’ supply of used electric vehicles declined by 0.2% month over month and year over year. Last month, used EVs had a six-day higher supply than ICE+ vehicles. Now, with ICE+ supply flat and used EV supply declining, the average supply of used EVs is two days lower. Similar to the new EV market, the days’ supply for used EVs varies by make. As used EVs remain an attractive option, inventory will continue to tighten.

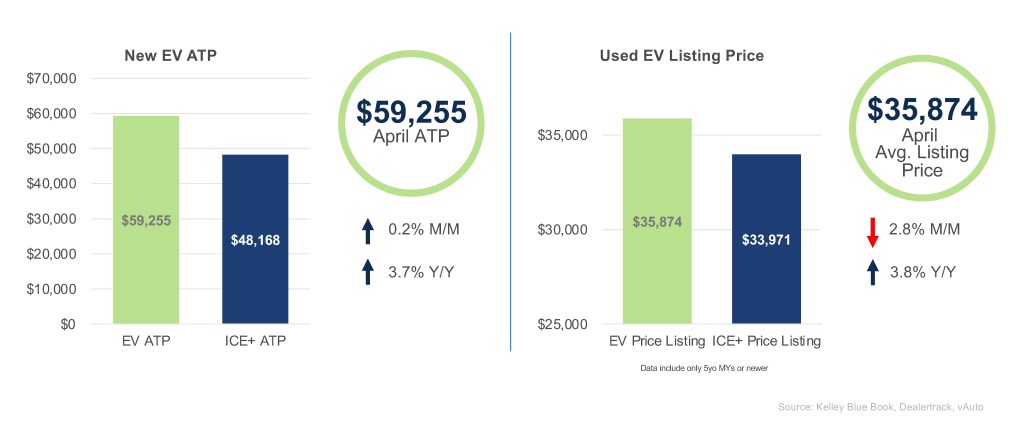

New and Used EV Prices – April

New EV Average Transaction Price: In April, the average transaction price (ATP) for new electric vehicles was $59,255, showing a 0.2% increase from the previous month and a 3.7% increase from the previous year. The price difference between EVs and ICE+ dropped to $11,087, driven by a 2.6% month-over-month increase in ICE+ ATP. Tesla’s ATP increased by 2.6% month over month to $56,120, the highest this year. EV incentives declined by 14% to $6,886, which is 11.6% of the ATP and the lowest dollar amount since June 2024. Despite this decline, EV incentives are still more than double the ICE+ average.

Used EV Average Listing Price: In April 2025, the average listing price for used electric vehicles (EVs) was $35,874, showing a 2.8% decline from the previous month but a 3.8% increase compared to the same period last year. The price gap between used EVs and internal combustion engine (ICE) vehicles moved below $2,000, the lowest it’s been since July 2024. Tesla’s prices also saw a decrease, with a month-over-month decline of 1.8%. However, some brands experienced month-over-month price increases, with Volvo leading at a significant 9.6%, followed by Toyota at 4.4%. Affordable options remain available, with 41% of units sold priced below $25,000. Now is the time to get those used EVs under that threshold while the used EV tax credit is still in place.

The EV Market Monitor gauges the health of the new and used electric vehicle (EV) markets by monitoring sales volume, days’ supply and average pricing. Each metric will be measured month over month and year over year. For a detailed new-EV sales report, see the Q1 Electric Vehicle Report, the official quarterly report of EV data.