Last month, new electric vehicle (EV) sales slightly declined but reached a record high for February, with luxury brands performing well. Used EV sales also declined month over month but grew significantly year over year. Days’ supply increased for both new and used EVs but remained significantly lower than the prior year. Pricing trends showed a decrease in new EV transaction prices, aided by incentives, making them more affordable, while used EV prices increased slightly.

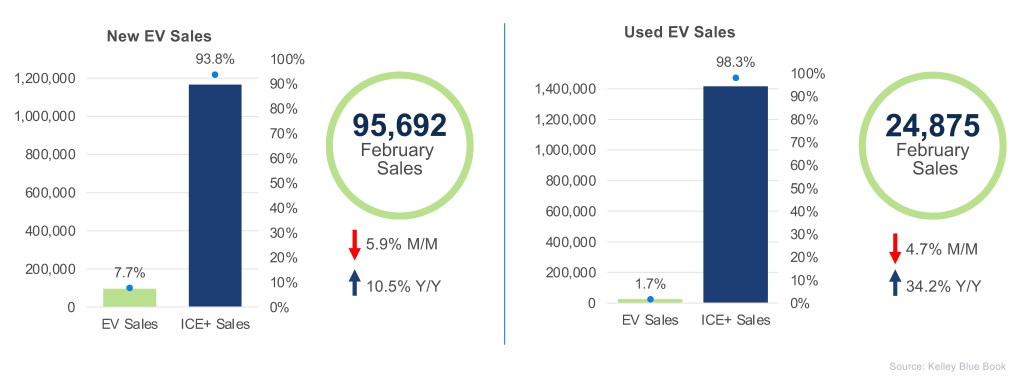

New and Used EV Sales – February

New EV Sales: In February, the volume of new EV sales declined by 5.9% month over month to 95,692 units, though it was the highest volume ever reported for the month of February. Year over year, the volume increased by 10.5%, but market share declined to 7.7%. It was a good month for luxury brands, with both BMW and Rivian selling more than 4,000 units, representing increases of 20.9% and 34.0%, respectively, compared to the previous month. Tesla’s overall sales were down by 10.0%, driven by declines in the Cybertruck (down 32.5%), Model 3 (down 17.5%), and Model Y (down 3.1%). The top five selling models, ranked by sales volume, were the Tesla Model Y, Tesla Model 3, Ford Mustang Mach-E, Honda Prologue, and Rivian R1S.

Used EV Sales: In February, used electric vehicle sales declined by 4.7%, reaching 24,875 units. Despite this decline, there was a year-over-year growth of 34.2%. Tesla maintained its dominant position in the used EV market with a substantial 39.9% sales share despite a 9.2% decline in month-over-month sales volume.

New and Used EV Days’ Supply – February

New EV Days’ Supply: In February, the new EV days’ supply increased by 16.8% month over month, reaching 104 days, surpassing the ICE+ days’ supply after being below it last month. Year over year, the new EV days’ supply is down 31.7%, indicating a significant improvement in inventory turnover compared to the previous year.

Used EV Days’ Supply: In February, the days’ supply of used electric vehicles reached 49 days, an increase of 5.9% month over month but a 21.5% year-over-year decrease. Last month, used EVs had a five-day lower supply than ICE+ vehicles. However, with ICE+ days’ supply declining by 6.5% month over month, the gap has now narrowed to just one day. The low days’ supply for EVs indicates a healthy and dynamic market driven by the increasing availability of more affordable options.

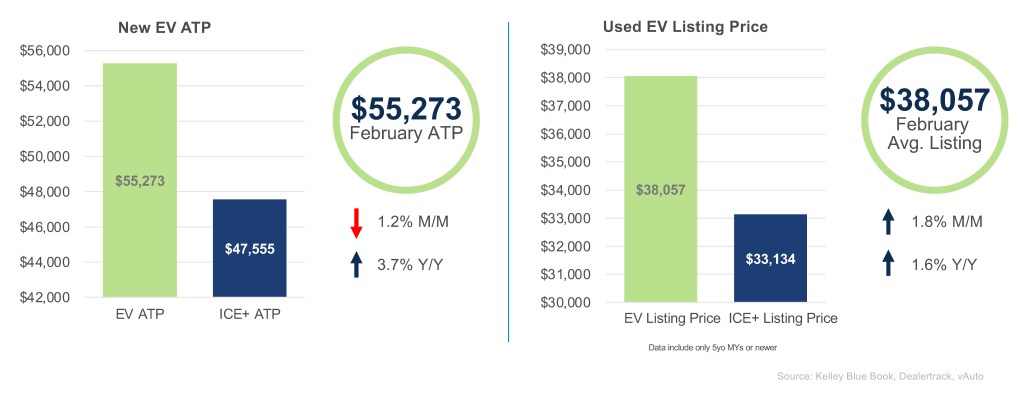

New and Used EV Prices – February

New EV Average Transaction Price: In February, the average transaction price (ATP) for new electric vehicles was $55,273, showing a 1.2% decline from the previous month and a 3.7% increase from the previous year. On average, EVs had a price premium of 16.2%. Incentive spending reached its highest level at 14.9% of ATP, which was 4.4% higher than the prior month.

Used EV Average Listing Price: The average listing price for used EVs was $38,057, reflecting a 1.8% increase month-over-month and a 1.6% increase year over year. Twelve brands had listing prices below those of their internal combustion engine (ICE+) models. Affordable options remain available, with 39% of units sold priced under $25,000.

The EV Market Monitor gauges the health of the new and used electric vehicle (EV) markets by monitoring sales volume, days’ supply and average pricing. Each metric will be measured month over month and year over year. For a detailed new-EV sales report, see the Q4 Electric Vehicle Report, the official quarterly report of EV data.