In March, the electric vehicle (EV) market experienced shifts in both new and used segments. While sales increased for both new and used EVs, the market share for new EVs saw a slight decline. Inventory levels tightened across the board as recent tariff announcements influenced consumer behavior. New EV transaction prices rose, whereas used EV prices saw a slight decrease, with many affordable options still available.

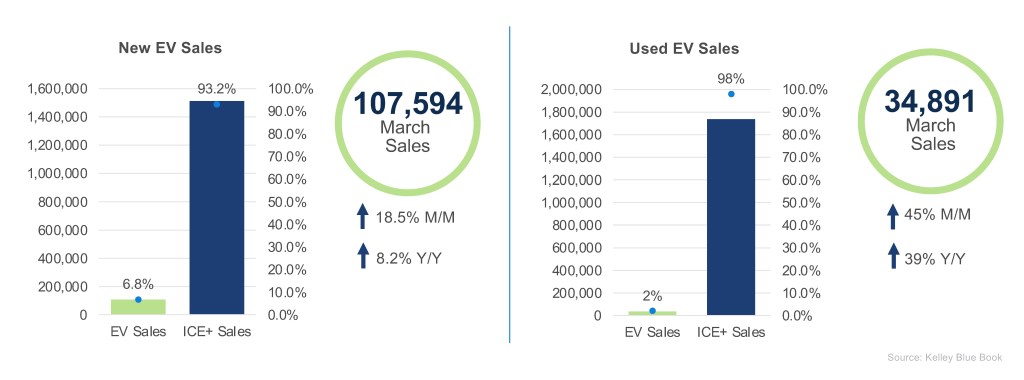

New and Used EV Sales – March

New EV Sales: In March, the volume of new electric vehicle (EV) sales increased by 18.5% month over month to 107,594 units, although the EV market share dropped to 6.8%. Year over year, the new EV sales volume increased by 8.2%. Tesla’s market share fell by 5 percentage points to 42%, although the Model Y and Model 3 remained the top-selling vehicles. It was a strong month for Chevrolet, Hyundai, Genesis and Cadillac, with each brand experiencing a month-over-month volume increase of 50% or more. The top five selling new EV models, ranked by sales volume, were the Tesla Model Y, Tesla Model 3, Ford Mustang Mach-E, Chevrolet Equinox and Hyundai Ioniq 5. With over 70 models available, competition in the EV market is fierce.

Used EV Sales: In March, used electric vehicle sales surged by 45% month over month, reaching a total of 34,891 units, up from 24,875 in February. Retail share for EVs in the used market hit 2% for the first time ever. Year-over-year used EV sales growth was 39%. Tesla continued to dominate the used EV market with a 54.5% share. The EV pioneer increased its share of the used EV market by 300 basis points to 43%, thanks in part to a growing availability of used Tesla models. Chevrolet and Ford followed, holding market shares of 9.2% and 6.8%, respectively. The top five selling models by volume were the Tesla Model 3, Model Y and Model S, followed by the Ford Mustang Mach-E and Chevrolet Bolt, collectively accounting for 48% of the market share for the month.

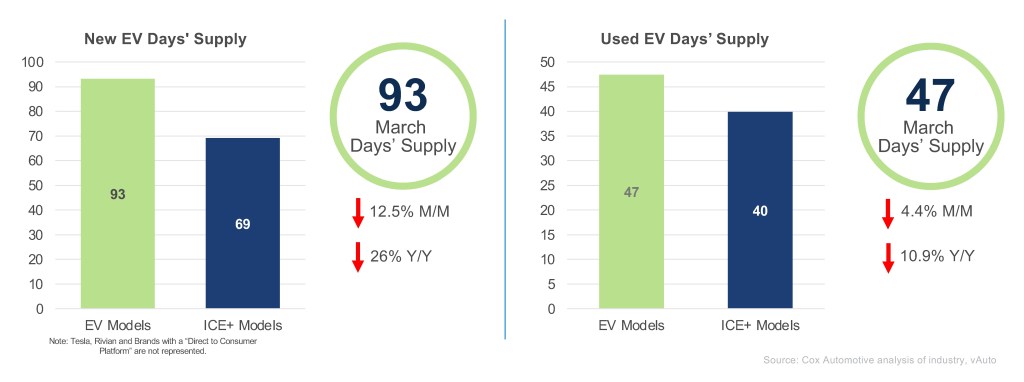

New and Used EV Days’ Supply – March

New EV Days’ Supply: In March, the new EV days’ supply declined by 12.5% month over month, dropping to 93 days. Year over year, the new EV days’ supply is down 26%. The gap between days’ supply for EVs and ICE+ models doubled in March, reaching 24 days. Days’ supply varied significantly by make. GMC had the highest days’ supply at 170 days, while Kia had the lowest at 23 days. BMW experienced the largest month-over-month decline in days’ supply, dropping by 49 days to end the month at 80 days. In contrast, Volkswagen saw the highest increase, rising by 47 days to 82 days, which remains below the monthly average. The recent tariff announcements have influenced buying behavior, leading to a surge in vehicle purchases and impacting inventory levels.

Used EV Days’ Supply: In March, the days’ supply of used electric vehicles declined by 4.4% month over month and decreased by 10.9% year over year. Last month, used EVs had a one-day higher supply than ICE+ vehicles. However, with ICE+ days’ supply declining by 18.1% month over month, the gap has now increased to seven days. Similar to the new EV market, the days’ supply for used EVs varies by popular makes. Similar to the new EV days’ supply, there is a tightening of inventory in the used EV marketplace.

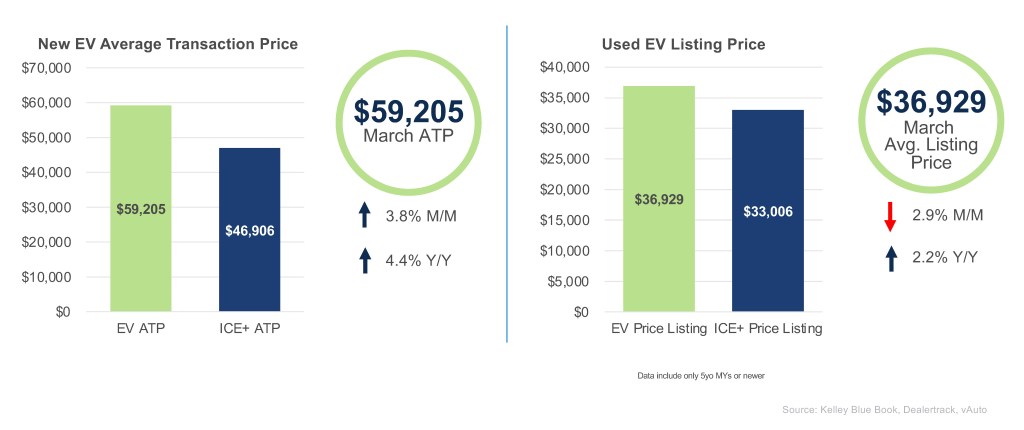

New and Used EV Prices – March

New EV Average Transaction Price: In March, the average transaction price (ATP) for new electric vehicles was $59,205, showing a 3.8% increase from the previous month and a 4.4% increase from the previous year. The EV price premium over ICE+ vehicles increased to $12,229, the highest it’s been in a couple of years. Incentives continue to be above the industry average at 13.3%, slightly down one percentage point from the prior month. The Nissan Leaf, Kia EV6, Mercedes EQB and Nissan Ariya had incentive levels exceeding 30% of their ATP. Recent tariffs on imported EV batteries and components from China, which accounted for approximately $1.9 billion worth of lithium-ion batteries in 2024, could further increase transaction prices, as these tariffs could raise the cost of imported materials by up to 82%.

Used EV Average Listing Price: The average listing price for used electric vehicles (EVs) was $36,929, marking a 2.9% decrease from the previous month and a 2.2% increase compared to the same period last year. This adjustment has brought the price premium to under $4,000. Notably, 12 brands had listing prices lower than their internal combustion engine (ICE) counterparts. Affordable options are still available, with 40% of units sold priced below $25,000.

The EV Market Monitor gauges the health of the new and used electric vehicle (EV) markets by monitoring sales volume, days’ supply and average pricing. Each metric will be measured month over month and year over year. For a detailed new-EV sales report, see the Q1 Electric Vehicle Report, the official quarterly report of EV data.