Data Point

Auto Credit Availability Improves in February as Rates Kept Moving Higher

Thursday March 10, 2022

Article Highlights

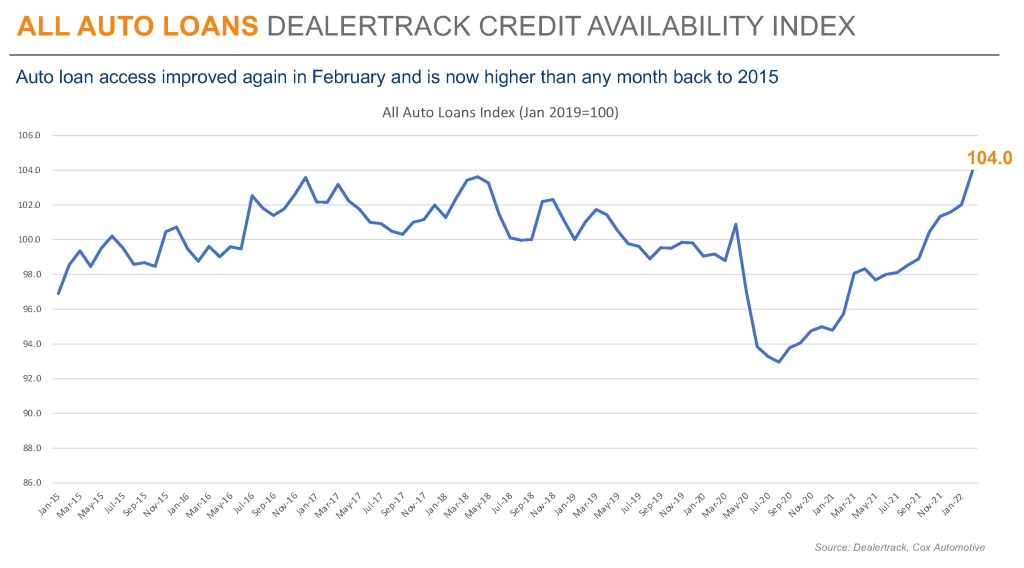

- Access to auto credit expanded in February according to the Dealertrack Credit Availability Index for all types of auto loans.

- The All Loans Index increased 1.9% to 104.0 in February, reflecting that auto credit was easier to get in the month compared to January.

- Access was looser by 8.6% year over year, and compared to February 2020, access was looser by 7.6%.

Access to auto credit expanded in February according to the Dealertrack Credit Availability Index for all types of auto loans. The All Loans Index increased 1.9% to 104.0 in February, reflecting that auto credit was easier to get in the month compared to January. Access was looser by 8.6% year over year, and compared to February 2020, access was looser by 7.6%. The index in February was the highest recorded in the data series going back to January 2015.

A key reason for the improvement in credit availability in February was that the average yield spread on auto loans narrowed to the lowest level in the monthly data series. Even though the average auto loan saw a higher rate in February compared to January, bond yields increased by a larger amount, resulting in the lower observed yield spreads. Yield spreads were not the only factor favorable for consumers as most factors moved to support access.

All loan types saw credit easing in February with CPO loans and used loans through franchised dealers easing the most. On a year-over-year basis, all loan types were easier to get with CPO loans having loosened the most.

Credit access also improved across lender types in February with banks having loosened the most. On a year-over-year basis, all lenders had looser standards with credit unions having loosened the most.

Each Dealertrack Auto Credit Index tracks shifts in loan approval rates, subprime share, yield spreads and loan details including term length, negative equity, and down payments. The index is baselined to January 2019 to provide a view of how credit access shifts over time. Across all auto lending in February, yield spreads narrowed, the subprime share grew, terms lengthened, negative equity grew, and down payments declined, and the moves in those factors made credit more accessible. However, the approval rate declined, so that factor moved against accessibility.

Consumer sentiment fell again in February. Consumer Confidence according to the Conference Board declined 0.5% in February. The underlying measures of present situation and future expectations moved in opposite directions as present situation improved but future expectations declined. Plans to purchase a vehicle in the next six months declined and are now down year over year. The consumer sentiment index from the University of Michigan declined 8.1% in February as both current conditions and expectations declined. The Michigan reading was up from mid-month but recorded the lowest full-month reading since August 2011. The Morning Consult daily index also declined in February, as it declined 1.7% in the final week of the month and ended down 1.3% for the month and down 9.1% year over year.

The Dealertrack Credit Availability Index is a new monthly index based on Dealertrack credit application data and will indicate whether access to auto loan credit is improving or worsening. The index will be published around the 10th of each month.