Data Point

Access to Auto Credit Improves in February

Monday March 10, 2025

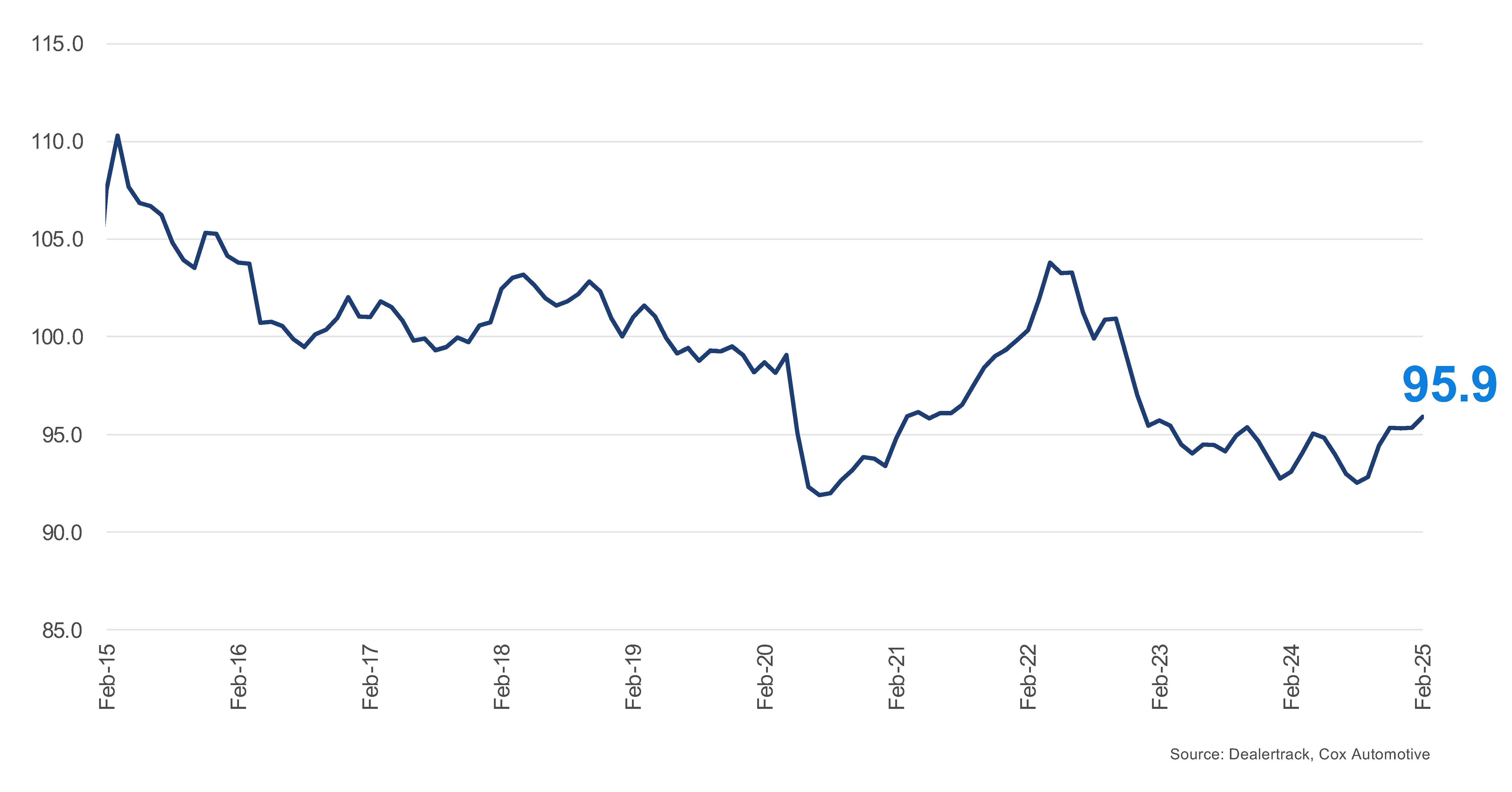

In February 2025, the Dealertrack Credit Availability Index revealed improvement in auto credit access across all channels, except new, and was mixed across lender types. The All-Loans Index reached 95.9, up from January and a 3.0% rise year over year. This is the highest level of auto credit access since December 2022.

Dealertrack Credit Availability Index

Auto loan access was up in February and year over year

All Auto Loans Index (Jan2019=100)

Key Drivers of Credit Access

- Approval Rates: The approval rate for auto loans increased by 10 basis points (BPs) in February. This slight increase indicates that more consumers could secure auto loans, reflecting a marginally more favorable lending environment. Higher approval rates can be attributed to lenders’ confidence in the economic outlook and consumers’ ability to repay loans.

- Subprime Loan Share: The subprime share of loans, representing loans given to borrowers with lower credit scores, increased by 150 BPs in February. This significant rise suggests lenders are more willing to extend credit to higher-risk borrowers. The increase in subprime lending can be seen as a double-edged sword: while it expands access to credit for consumers with lower credit scores, it also introduces higher risk into the lending portfolio.

- Yield Spreads: The 5-year U.S. Treasury decreased by 14 BPs in February, leading to a larger yield spread. Yield spreads expanded by 50 BPs, making auto loan rates more favorable compared to bond yields. The average auto loan rate decreased by 36 BPs from January. Higher yield spreads indicate higher costs for borrowers, which could be a response to the increased risk associated with a higher subprime share. This trend suggests that lenders are willing to take on more risk.

- Loan Term Length: The share of loans with terms greater than 72 months increased by 50 BPs in February. Longer loan terms can make monthly payments more affordable for consumers, but they also result in higher overall interest costs over the life of the loan. The increase in longer-term loans may indicate that consumers are seeking ways to manage their monthly expenses, even if it means paying more interest over time.

- Negative Equity: The negative equity share, representing the proportion of borrowers who owe more on their loans than the value of their vehicles, increased by 110 BPs in February. This rise is an important indicator of financial stress among borrowers. Higher negative equity share can lead to increased default rates, as borrowers may struggle to keep up with payments on loans that exceed the value of their assets.

- Down Payment Percentage: The average down payment percentage required for loans increased by 10 BPs compared to January. Higher down payments can reduce the loan amount and the risk for lenders, but they can also pose a challenge for consumers who may not have sufficient savings. The slight increase in down payment requirements suggests that lenders are taking a cautious approach to mitigate risk.

Channel and Lender Trends

- Channels: Credit access improved across all sales channels in February, except new, with used loans from franchised dealers experiencing the most loosening. New-vehicle loans tightened slightly.

- Lender Types: Lender types saw mixed results with access to credit availability. Captives showed the most tightening, while auto-focused finance companies showed the most loosening.

Year-Over-Year Comparison

Credit access in February was looser than a year ago. This improvement was observed across all channels and lender types. Credit access loosened the most for non-captive new-vehicle sales and the least for independent used sales. Among lender types, credit unions showed the most significant loosening over the past year, while auto-focused finance companies loosened the least.

Implications

For consumers, the improved access to auto credit is a positive development, particularly for those with lower credit scores. However, the higher yield spreads and down payment requirements mean that borrowing costs may be higher. For lenders, the increased subprime share and longer loan terms indicate a willingness to take on more risk. However, the higher yield spreads and down payment requirements suggest that lenders are also taking steps to mitigate this risk. Lenders will need to balance their risk appetite with prudent lending practices to ensure the stability of their loan portfolios.

Overall, the February Dealertrack Credit Availability Index saw notable improvements in auto credit availability, reflecting both lender behavior and broader economic conditions. Consumers benefited from higher approval rates, increased access to subprime loans, longer-term loans, and increased ability to roll over negative equity. Meanwhile, the persistence of certain tightening factors – widening yield spread and higher down payment amounts – did not offset all the loosening, leading to increased credit availability for consumers.

The Dealertrack Credit Availability Index tracks six factors that affect auto credit access: loan approval rates, subprime share, yield spreads, loan term length, negative equity and down payments. Reported monthly, the index indicates whether access to auto credit is improving or declining. This typically means that it is cheaper and easier for consumers to obtain a loan or more expensive and harder. The index is published around the 10th of each month.

Jonathan Gregory

Jonathan Gregory is a Senior Manager on Cox Automotive’s economic and industry insights team, which works to find actionable insights for the industry posed by Cox Automotive clients. Jonathan works with the Sales, Finance, and Data Science organizations and creates innovative solutions often combining proprietary data from other Cox Automotive brands. Jonathan joined Cox Automotive in 2022.