Data Point

New-Vehicle Affordability Improves Again in February

Friday March 14, 2025

New-vehicle affordability improved in February to the best level since the summer of 2021, according to the Cox Automotive/Moody’s Analytics Vehicle Affordability Index.

“Affordability is relative,“ noted Jonathan Smoke, chief economist at Cox Automotive. “We’re back to a K-shaped economy where higher-income individuals are faring much better, while lower-income individuals face more challenges. In February, the average price of a new vehicle decreased again, improving affordability. This decrease, combined with higher incomes, more than offset reduced incentives and slightly higher interest rates.”

The estimated average auto loan rate rose by 5 basis points to 10.16%1 in February, representing the highest average rate in four months. The average price of new vehicles decreased by 1.3% for the month, according to Kelley Blue Book. Affordability was further supported by income growth, which increased by 3.5% year over year.

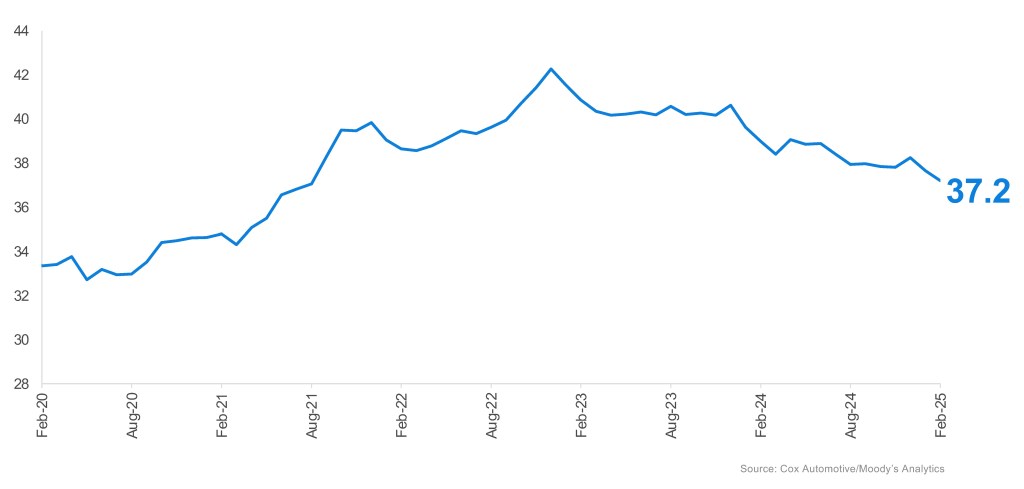

In February, the typical payment declined by 1.1% to $748, which was down 1.3% year over year. The number of median weeks of income needed to purchase the average new vehicle declined to 37.2 weeks from 37.7 weeks in January. The average monthly payment had previously peaked at $795 in December 2022.

COX AUTOMOTIVE/MOODY’S ANALYTICS VEHICLE AFFORDABILITY INDEX

February 2025

Weeks of Income Needed to Purchase a New Light Vehicle

New-vehicle affordability in February was better than a year ago when it took 39.0 weeks of median income to buy an average new vehicle, an improvement of 4.5% year over year. A year ago, prices were 1.0% lower, but interest rates were higher. Incomes and incentives were also lower in February 2024.

Click here for the full methodology for the Cox Automotive/Moody’s Analytics Vehicle Affordability Index.

The next update of the Cox Automotive/Moody’s Analytics Vehicle Affordability Index will be published on April 15, 2025.

1 The index input of the average interest rate paid by consumers is calculated to reflect a 72-month, fixed-rate loan. For the latest Dealertrack estimated, volume-weighted average new loan rate, visit the Auto Market Snapshot.

The Cox Automotive/Moody’s Analytics Vehicle Affordability Index (VAI) is updated monthly using the latest data from government and industry sources, including key pricing data from Kelley Blue Book, a Cox Automotive brand. This important industry measure will be released at mid-month to indicate if the prices paid for new vehicles are moving out of consumers’ financial reach or becoming more affordable over time.