CAMIO

Fleet Sales Outperformed New-Vehicle Sales

Wednesday March 20, 2024

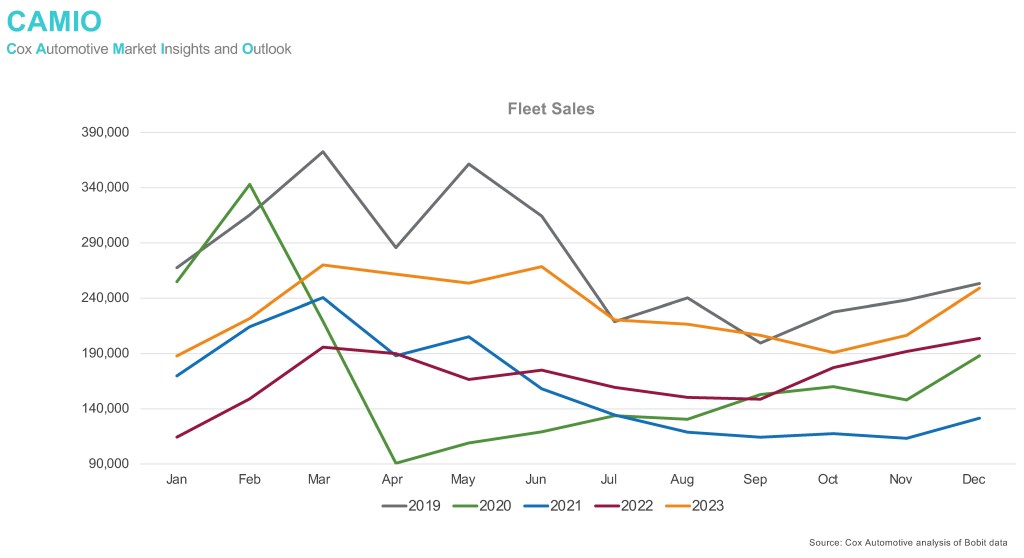

Takeaway: The new-vehicle market’s success in 2023 was driven in large part by a notable increase in fleet sales – and mostly sales to commercial and rental businesses. Fleet sales outperformed retail new-vehicle sales in 2023, ending the year with 2.7 million units sold, up 34% compared to 2022, when fleet sales totaled just over 2 million units. Fleet sales in 2023 were the highest since 2019 and more in line with the long-term averages from 2012 to 2019. As new-vehicle inventory levels returned to normal in 2023, so too did fleet sales. The total fleet share of new-vehicle sales in 2023 was 17.5%, a level typically seen prior to the pandemic and well ahead of 2021 and 2022, when fleet sales averaged just 13.5% of total sales.

What’s next: Fleet sales are expected to increase to 3.0 million units. The key question for 2024 is how much growth can be achieved following the significant increase in 2023. Some of the pent-up demand for fleet, particularly rental and commercial fleets, has already been satisfied, so any further growth is likely to be more challenging.