Data Point

Fleet Volume Continues to Cool Off in December

Thursday January 9, 2020

Article Highlights

- Fleet was the driver of strength in the new-vehicle market for 2019 but continued to cool off in December.

- Combined rental, commercial, and government purchases of new vehicles were down 0.7% year over year in December.

- Total fleet volume in December was 220,034, compared to 221,544 in December 2018.

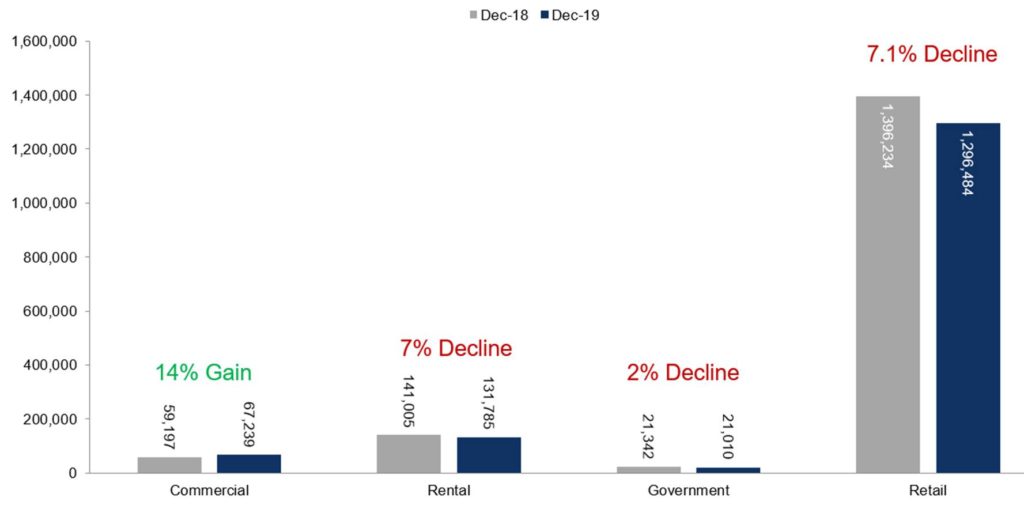

Fleet was the driver of strength in the new-vehicle market for 2019 but continued to cool off in December. Combined rental, commercial, and government purchases of new vehicles were down 0.7% year over year in December. Commercial fleet sales were the strongest segment, up 14% in December. Total fleet volume in December was 220,034, down from 221,544 in December 2018.

Retail sales of new vehicles were down 7.1% in December, leading to a retail SAAR of 14.3 million, down from 15.0 million in December 2018 and down from November’s 14.8 million rate.

General Motors ended 2019 as the top performer for December with fleet sales increasing 23% year over year. Fleet sales at GM are flat year to date through December. According to our analysis of the data, we are estimating that Nissan saw fleet sales drop more than 40% last month compared to December 2018.

Ford and FCA both delivered more favorable fleet sales in December, increasing over 5% year over year. December ended Q4, as expected by our team, with slower fleet sales than the early part of the year and 2018.

Full Year Fleet Sales

Fleet sales were up 2.9% in 2019, and retail sales were down 2.3%, as the overall new-vehicle market finished the year down 1.4%.

So far this year, we have had 2.79 million fleet sales with rental fleet accounting for 62% of fleet sales. Commercial fleet sales are still the strongest year to date, up 9%.

Once manufacturer fleet numbers are reported, Cox Automotive will publish its official fleet sales number for 2019.