Commentary & Voices

General Motors: Truck, SUV Sales Should Help Prop Up Q2 Results

Wednesday July 31, 2019

Article Highlights

- Wall Street analysts expect lower earnings on lower revenues, though they are hopeful for an upside surprise as GM delivered in Q1.

- In the U.S., GM sold 744,316 vehicles in Q2, down nearly 2% from the year-ago quarter.

- GM improved its overall average transaction prices (ATP) by nearly 3% to $41,947, its highest level ever, according to Kelley Blue Book.

General Motors reports second-quarter financial results before the stock market opens August 1.

Wall Street analysts expect lower earnings on lower revenues, though they are hopeful for an upside surprise as GM delivered in Q1.

In the U.S., GM sold 744,316 vehicles in Q2, down nearly 2% from the year-ago quarter. Total industry sales for the quarter slipped 1%, according to Cox Automotive data. That put GM’s market share for the quarter at 16.8%, roughly flat with the past few years.

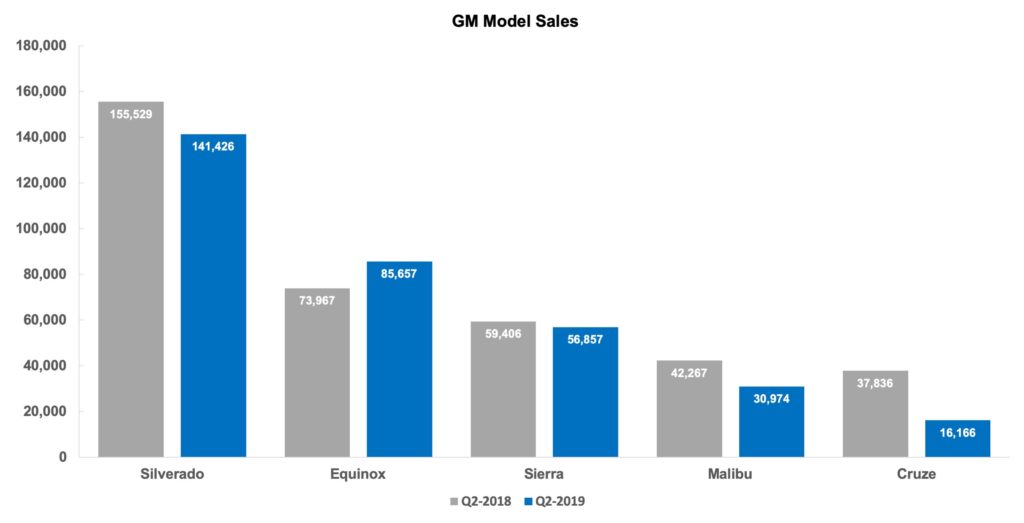

GM’s sales decline came from its highest-volume brand, Chevrolet, with sales down 6%. Chevrolet is dropping some cars from its product line, including Chevrolet Cruze compact, a move that led to the recent closing of the Lordstown, Ohio, assembly plant, and the Chevrolet Volt. Though the Malibu remains in the line, sales plummeted by 27% in the quarter. Chevrolet Silverado sales fell 9%, losing second place in sales to the Ram 1500. GM is in the process of ramping up all versions of the Silverado and GMC Sierra, including the heavy-duty ones. Equinox sales soared 16%.

GMC, an all truck and SUV brand, posted a nearly 10% increase in sales. Buick sales rose nearly 5%. Cadillac, just starting to launch new sedans and SUVs as it winds down the old ones, edged up 1% while luxury sales in total were up 2%.

GM dialed back incentives by about 5% overall for an average of just under $5,000 per vehicle, according to Kelley Blue Book data. Chevrolet and Buick had the biggest declines in incentive spend. Cadillac remains No. 1 for incentive spending among luxury brands, around $9,000 per vehicle.

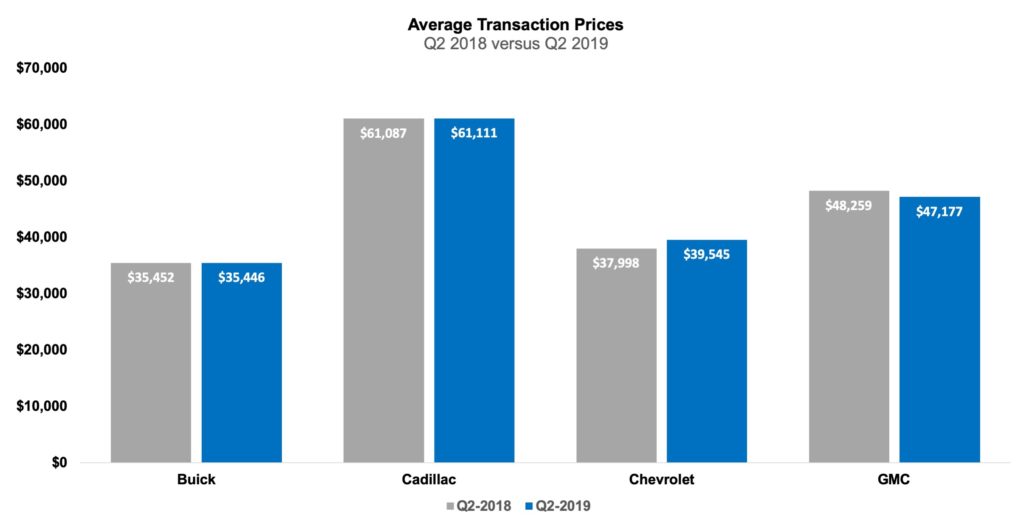

GM improved its overall average transaction prices (ATP) by nearly 3% to $41,947, its highest level ever, according to Kelley Blue Book.

Buick and Cadillac ATPs were flat at $35,446 and $61,111, respectively. Chevrolet’s rose 4% to $39,545, due to eliminating lower priced cars, like the Cruze, from its line and the rising Silverado ATP now at $48,000. GMC’s ATP slipped to $47,177, despite a 5% increase in the Sierra’s ATP of $55,621, surpassing Ford’s F-Series.