Commentary & Voices

Incentives Help Cure the January Hangover

Wednesday February 5, 2020

Article Highlights

- When sales slow, incentives often get more aggressive and complex with additional targeting, driving the total program volume number even higher.

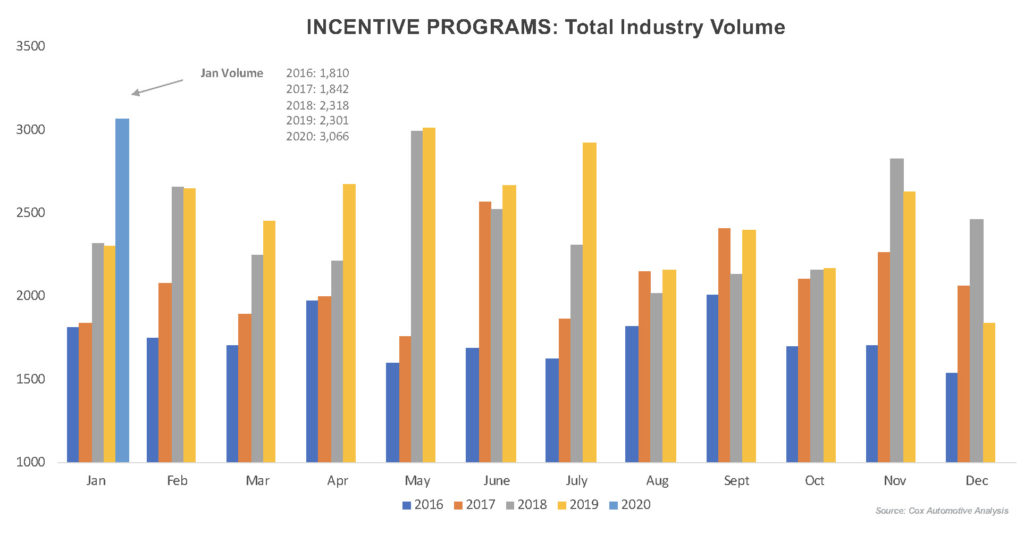

- Our Cox Automotive Rates & Incentives team tracks incentive program volume across the industry, and the January incentive volume was the highest we’ve seen in the past five years.

- Program volumes were up for 20 of the 29 top brands our team researches, so the majority had more offers in place.

January auto sales were pretty much a mixed bag, as forecast, with sales coming in at approximately 1.1 million units, putting the seasonally adjusted annual rate (SAAR) near 16.7 million units. January sales typically suffer from a bit of a hangover after the crazy, aggressive year-end-holiday sell down. When sales slow, incentives often get more aggressive and complex with additional targeting, driving the total program volume number even higher.

Our Cox Automotive Rates & Incentives team tracks incentive program volume across the industry, and the January incentive volume was the highest we’ve seen in the past five years. Program volumes were up for 20 of the 29 top brands our team researches, so the majority had more offers in place. But there were notable differences in how various brands approached the market. For example, Nissan and BMW bucked the trend last month, with the number of offers available down notably from January 2019. While the cost-cutting trend continues for Nissan and is nothing new for their dealers and customers, the complaints are starting to get louder as retailers point out more openly the lack of incentives to move the metal when compared to what they’ve grown accustomed to in the past. It will be interesting to see how this plays out during the year.

For example, Nissan and BMW bucked the trend last month, with the number of offers available down notably from January 2019. While the cost-cutting trend continues for Nissan and is nothing new for their dealers and customers, the complaints are starting to get louder as retailers point out more openly the lack of incentives to move the metal when compared to what they’ve grown accustomed to in the past. It will be interesting to see how this plays out during the year.

Ford chose a different route. Ford typically has a lot of incentive programs in place across its many regions, and that was the case in January even more than usual. The Blue Oval continued to extend new incentives to clear 2019 models, reshuffling, improving and extending their offers on leftovers on their dealer lots. There was not only a large amount of dealer cash on the usual suspects such as the discontinued Fusion, but also a significant amount of dealer cash on the Edge, Escape, and even the recently revamped Expedition. From our analysis, it appears Ford added and changed its programs throughout the month, driving the volume number even higher.

While these programs give dealers the flexibility to apply discounts where they need to, the volume and complexity of incentives available from Ford can baffle its dealers and consumers at times. Did these changes have an impact? All indications are that Ford finished the month close to where our team forecast, as it sold down discontinued models and ramped up new offers like the Escape and the Explorer.

Expect more of the same in 2020, as Ford – and others – continue to revamp their product lines and work their incentive programs to stay competitive in the marketplace. While specific approaches can vary depending on the brand, we expect the overall incentive trend in 2020 to be higher program volume, more complexity, and more targeted offers available in the marketplace. Our guess: As the market slows, incentives will grow.

Todd Somerville is practice leader at Cox Automotive Rates & Incentives. The Cox Automotive Rates & Incentives (CAR&I) team has developed a methodology for measuring the accuracy of data used to calculate pricing and payment information presented through dealer service provider tools (e.g., dealer websites, inventory management, digital retailing & advertising, desking, equity, etc.). Approximately 17,500 individual dealerships – rooftops, in automotive parlance – in the U.S. rely on CAR&I incentive data for powering 5 different software applications through Cox Automotive native software/sites and our many industry partners. In all, an estimated 90,000 applications are relying on CAR&I data in a given month, providing valuable information to 40 million shoppers.