Data Point

Inventory Declines Continue after Strong November Sales

Thursday December 12, 2019

Article Highlights

- Robust November sales and a UAW strike against GM left inventories low to close out 2019; GM is rebuilding.

- BMW and Mercedes battle for luxury leadership with low inventories entering December, a strong month for luxury.

- Kia was second only to Subaru in low days’ supply.

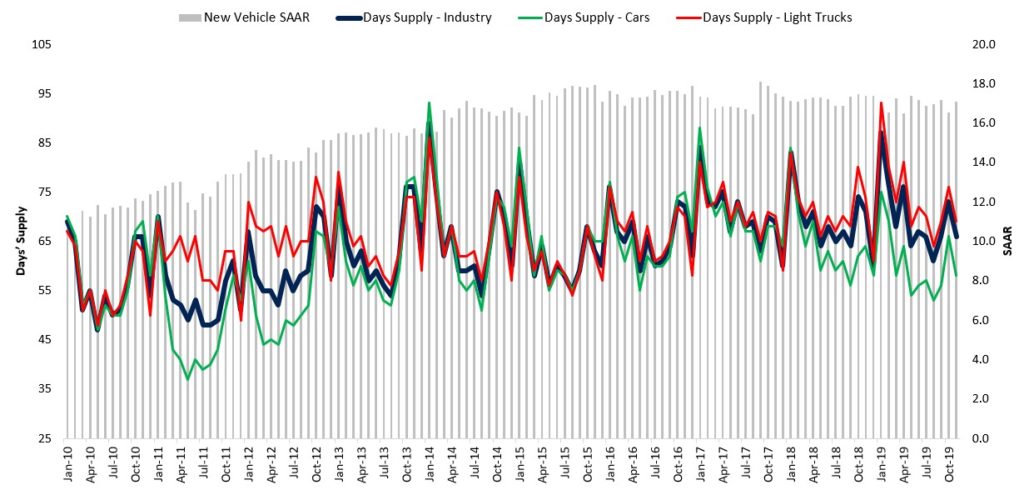

The number of new vehicles in inventory at the start of December declined after a strong November sales month.

New-vehicle inventory for November came in at 3.6 million units, slightly lower than October. It was the seventh consecutive month that the industry’s inventory was below 4 million units. The average days’ supply of all new vehicles was 66 for November, down a full week from October and down five days from November 2018.

Inventory levels are an important indicator for the industry. High inventories mean automakers have to cut production, boost incentives or do both. Tight inventories generally result in fewer incentives.

Inventories of both cars and light trucks fell from October as well as from year-ago levels. About 60 days’ supply used to be considered normal, but that was before the recent dramatic shift from cars and to trucks and SUVs. Days’ supply of trucks tends to be higher because of the large number of configurations of pickups.

The average days’ supply of cars, which represented only 23% of total inventory in November, came in at 58, down eight days from October and six days from November 2018. The average days’ supply of light trucks – pickup trucks and SUVs combined – stood at 69 in November, down a full week from October and down five days from November 2018.

Inventory levels vary widely by brand. As has been the case, Subaru had the lowest days’ supply at 24, but Kia, which has enjoyed strong sales largely due to the addition of new models including the three-row Telluride SUV, wasn’t far behind at 34 days. Toyota had a 59 days’ supply, down a week from October and up a couple of days from a year ago.

In contrast, Mitsubishi had the highest days’ supply at 106. Fiat Chrysler, which Bloomberg News had reported was pressuring dealers to take excess inventory in October, got its days’ supply down to 80 in November, a drop of eight days from October and 15 days from November 2018.

In raw numbers, Ford had the biggest amount of inventory with more than a half-million vehicles in stock in November. Ford’s average days’ supply stood at 91, about the same as in October but up six days from November 2018. Ford’s line is mostly trucks and SUVs as it gradually deserts the car business, except for the Mustang. The Focus and Fiesta are now gone.

After a 40-day strike this fall that shut down all U.S. factories, General Motors had a 70 days’ supply for November, down 14 days from October and 13 days from a year ago. GM has scheduled hefty amounts of overtime and weekends, including Sundays, which is unusual, at its truck plants to catch up. As a result, Chevrolet had the second largest amount of raw stock at 400,000 units. Chevrolet’s truck inventory increased about 5% from October, but still lags last November by almost 9%.

With Mercedes-Benz and BMW locked in a battle for the 2019 luxury sales crown, both enter December, a traditionally vibrant month for luxury vehicle sales, with relatively low inventories. In raw numbers, BMW, which posted a 10% year-over-year gain in sales in November, had the lowest amount of stock in the industry with 8,000 vehicles. Mercedes had one of the lowest days’ supply at 35, a full week less than October and 10 days less than a year ago.