Data Point

Access to Auto Credit Flat in January

Monday February 10, 2025

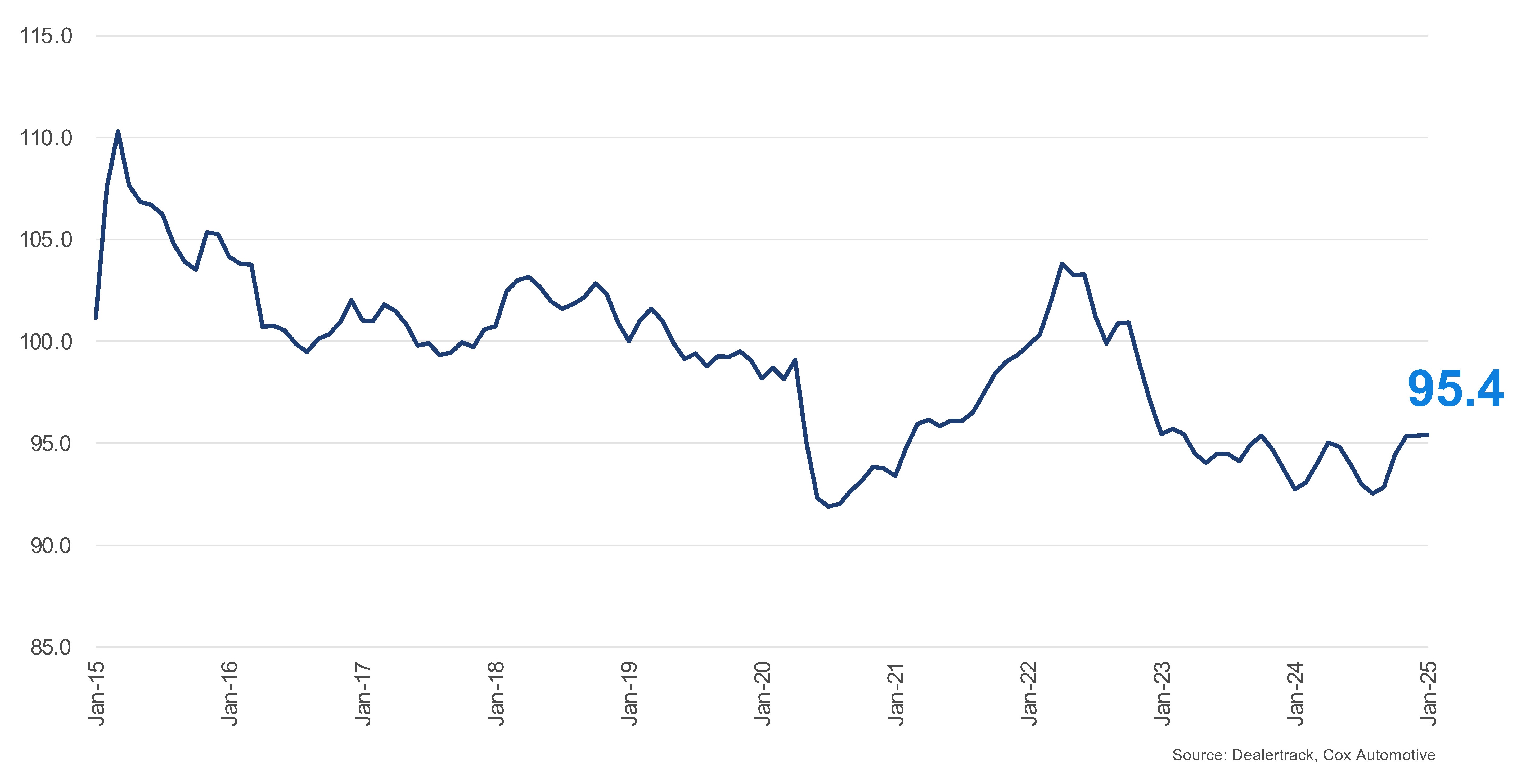

In January 2025, the Dealertrack Credit Availability Index reported an improvement in auto credit accessibility across all channels, with varying results among different types of lenders. The All-Loans Index reached 95.4, flat from December but a 2.9% rise year over year. This remains the highest level of auto credit access since March 2023, considering December’s slight downward revision.

Dealertrack Credit Availability Index

Auto loan access was flat in January but was up year over year

All Auto Loans Index (Jan2019=100)

Key Drivers of Credit Access

- Approval Rates: In January, the approval rate decreased by 160 basis points (BPs). The decrease in approval rates and the widening yield spreads mean fewer consumers are getting approved for loans – and at worse rates. These downward trends were the most restrictive measures observed of all credit factors.

- Yield Spreads: The 5-year U.S. Treasury increased by 18 BPs in January, leading to a larger yield spread. Yield spreads expanded by 28 BPs, making auto loan rates more favorable than bond yields. The average auto loan rate increased by 46 BPs from January. Notably, this is the first rate increase since March 2024. The widening yield spreads and the increase in average loan rates make borrowing conditions less favorable for consumers, leading to higher monthly payments and increased overall loan costs.

- Subprime Loan Share: The subprime share increased by 100 BPs in January, and an even larger increase was seen year over year. This is the largest share of subprime loans seen since April 2024. The larger presence of high-risk loans loosened access for some borrowers, and the impact was by far the most favorable factor of credit availability this month.

- Loan Term Length: The share of loans with terms greater than 72 months grew by 50 BPs, breaking a four-month trend of decreasing long-term loans. Longer loan terms could mean lower monthly payments, which help consumers. It also means consumers will pay off the loan more slowly and potentially spend more on interest over the life of the loan. Though there was an increase in January, that was the second-lowest share of loans with terms greater than 72 months since September 2021.

- Negative Equity: Loans with negative equity increased sharply by 120 BPs in January and remained up year over year. This sharp increase offsets the sharp decrease seen in December. While more negative equity loans can signify worsening financial conditions overall, they may expand access for some borrowers.

- Down Payment Percentage: The down payment percentage decreased by 10 BPs compared to last month and fell slightly compared to January 2024. Higher down payments can challenge consumers but can also lead to lower monthly payments and less interest over time.

Channel and Lender Trends

- Channels: Credit access improved across all sales channels in January, with certified pre-owned loans experiencing the most loosening. Used-vehicle loans from franchised dealers loosened the least.

- Lender Types: Lender types saw mixed results with access to credit availability. Credit unions showed the most tightening, while banks showed the most loosening.

Year-Over-Year Comparison

Credit access in January was looser than a year ago. This improvement was observed across all channels and lender types. Credit access loosened the most for non-captive new-vehicle sales and the least for independent used sales. Among lender types, credit unions showed the most significant loosening over the past year, while auto-focused finance companies loosened the least.

Implications

The January Dealertrack Credit Availability Index illustrates mixed results of credit access for auto loans. Consumers benefited significantly from the growth of subprime loans, followed by an increase in loans with negative equity, loans with extended term lengths, and a decrease in the down payment amount. Meanwhile, the persistence of certain tightening factors – decreasing approval rates and widening yield spreads – was enough to offset all the loosening and hold the index flat.

This means better borrowing conditions and easier access to auto financing for consumers, particularly when purchasing certified pre-owned vehicles. Lenders are also navigating a mixed environment as credit demand intersects with loosening policies for banks and captives but tightening at auto-focused finance companies and credit unions.

The Dealertrack Credit Availability Index tracks six factors that affect auto credit access: loan approval rates, subprime share, yield spreads, loan term length, negative equity and down payments. Reported monthly, the index indicates whether access to auto credit is improving or declining. This typically means that it is cheaper and easier for consumers to obtain a loan or more expensive and harder. The index is published around the 10th of each month.

Jonathan Gregory

Jonathan Gregory is a Senior Manager on Cox Automotive’s economic and industry insights team, which works to find actionable insights for the industry posed by Cox Automotive clients. Jonathan works with the Sales, Finance, and Data Science organizations and creates innovative solutions often combining proprietary data from other Cox Automotive brands. Jonathan joined Cox Automotive in 2022.