Data Point

January Fleet Sales Reflect Expected Slowdown

Thursday February 6, 2020

Article Highlights

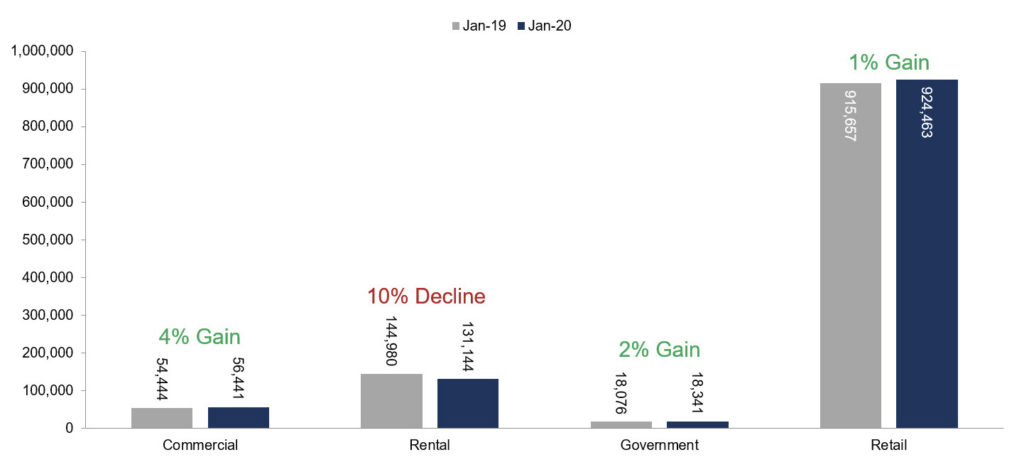

- Combined rental, commercial and government purchases of new vehicles were down 5.3% year over year in January.

- Total fleet volume in January was 205,926, down from 217,500 in January 2019.

- Commercial vehicle sales were up 3.7% year over year in January.

Fleet drove the strength in the new-vehicle market for 2019 whereas 2020 is expected to be more moderate. Combined rental, commercial and government purchases of new vehicles were down 5.3% year over year in January. Total fleet volume in January was 205,926, down from 217,500 in January 2019. Commercial vehicle sales were up 3.7% year over year in January.

Retail sales of new vehicles were up 1.0% in January, leading to a retail seasonally adjusted annual rate (SAAR) of 13.8 million, up from 13.5 million last January and down from December’s 14.2 million rate.

January total new-vehicle sales were down 0.2% year over year, with the same number of selling days compared to January 2019. Leading to a 16.8 million SAAR, an increase from last year’s 16.7 million and up from December’s 16.7 million rate.

General Motors started 2020 as the top performer for January with fleet sales increasing 37% year over year. Nissan saw the largest fleet sales drop at 42%, according to our analysis of the data, compared to January 2019.

Toyota and Ford had lower sales in January, decreasing slightly below 20%. January started Q1, as expected by our team, with slower fleet sales than the prior year.