Data Point

Wholesale Used-Vehicle Prices Decrease Minimally in July from Seasonal Adjustment

Friday August 5, 2022

Article Highlights

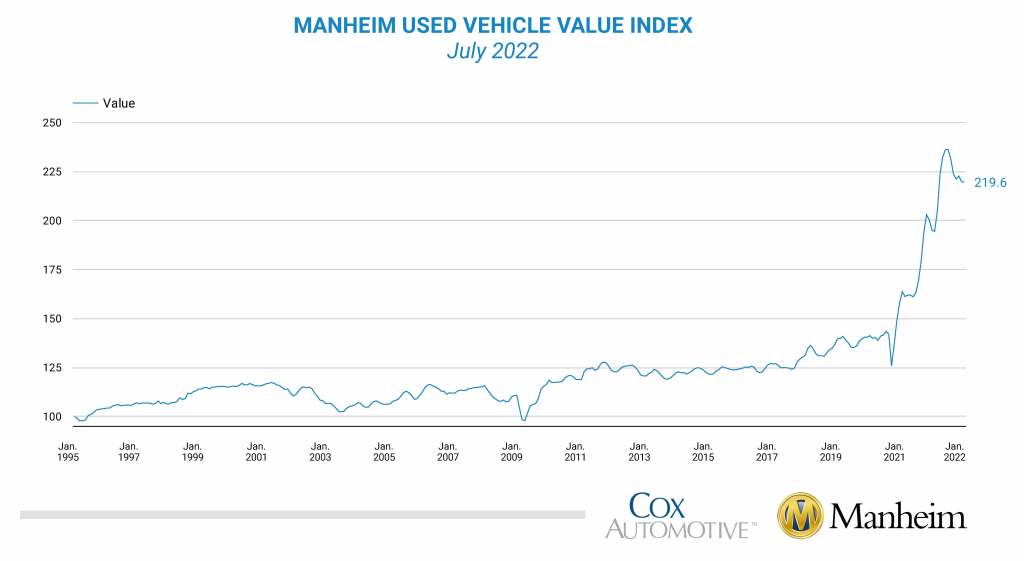

- Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) decreased 0.1% in July from June.

- The Manheim Used Vehicle Value Index declined to 219.6, up 12.5% from a year ago.

- The non-adjusted price change in July decreased 3.2% compared to June, leaving the unadjusted average price up 10.2% year over year.

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) decreased 0.1% in July from June. The Manheim Used Vehicle Value Index declined to 219.6, up 12.5% from a year ago. The non-adjusted price change in July decreased 3.2% compared to June, leaving the unadjusted average price up 10.2% year over year.

In July, Manheim Market Report (MMR) values saw larger-than-normal declines that decelerated as the month progressed. Over the last four weeks, the Three-Year-Old Index decreased a net 2.7%. Over the month of July, daily MMR Retention, which is the average difference in price relative to current MMR, averaged 97.9%, meaning market prices were below MMR values. The average daily sales conversion rate declined to 47.2%, which was a typical seasonal pattern but was at a level below normal for the time of year. For example, the sales conversion rate averaged 56.5% in July 2019. The lower conversion rate indicates that the month saw buyers with more bargaining power for this time of year.

All major market segments once again saw seasonally adjusted prices that were higher year over year in July. Vans had the largest increase at 22.9%, followed by compact, midsize, and sports cars which all had seasonally adjusted year-over-year gains ahead of the overall industry. Compared to June, six of eight major segments’ performance was down. Full-size cars lost nearly 9%, with vans, luxury cars, and sports cars losing 1.5 to 1.6%. Compact and midsize cars were up 0.9% and 0.5%, respectively.

Compared to last year, used retail sales deteriorated in July. Leveraging a same-store set of dealerships selected to represent the country from Dealertrack, we estimate that used retail sales declined 13% in July from June and that used retail sales were down 16% year over year. Compared to 2019, sales were down 29%, which was the worst comparison against 2019 since January.

Using estimates of used retail days’ supply based on vAuto data, July ended at 48 days of supply, down from 52 days at the end of June but higher than how July ended in 2021 at 41 days. Leveraging Manheim sales and inventory data, wholesale supply is estimated to have ended July at 31 days, higher than how July 2021 ended at 22 days and higher than how June ended at 26 days. July’s total new-light-vehicle sales were down 11.9% year over year, with one less selling day than July 2021. By volume, June new-vehicle sales were up 0.1% from June. The July SAAR came in at 13.3 million, a 9.0% decline from last year’s 14.7 million but up 2.6% from June’s 13.0 million pace.

Combined sales into large rental, commercial and government fleets were up nearly 10% year over year in July. Sales into rental were down 7% year over year, while sales into commercial fleets were up 19% and sales into government fleets were up 31%. Including an estimate for fleet deliveries into dealer and manufacturing channels, the remaining retail sales were estimated to be down nearly 13%, leading to an estimated retail seasonally adjusted annual rate (SAAR) of 11.7 million, up 2.9% from last month but down 8.5% from last year. The fleet share declined in July to 12.4% from 12.5% in June and was down from last July’s 12.8%.

Rental risk mileage is nearly unchanged from June, holding stable from last year. The average price for rental risk units sold at auction in July was up 31.9% year over year. Rental risk prices were down 0.5% compared to June. Average mileage for rental risk units in July (at 58,800 miles) was down 33.3% compared to a year ago and up 0.1% from June.

Measures of consumer sentiment improved in July. The Conference Board Consumer Confidence Index® declined 2.7% in July when a smaller decline had been expected, and the June index was also revised down. Most of the index decline was driven by a 4.0% decline in expectations. Plans to purchase a vehicle in the next six months declined to the lowest level so far this year and were down substantially year over year. The confidence index has not fallen as much as the sentiment index from the University of Michigan, but that series improved in July. The Michigan index increased 3% from a record low in June, as it is much more sensitive to inflationary changes and stock market moves. Similarly, the Morning Consult Index of Consumer Sentiment increased by 3.3% in July. These more inflation-sensitive measures moved higher as gas prices declined 16% by the end of July from the peak in June.

The complete suite of monthly MUVVI data for August will be released on Sept. 8, 2022, the fifth business day of the month as regularly scheduled. Register to attend the next quarterly call on Friday, Oct. 7, 2022.

If you have any questions regarding the Index or would like to sign up for updates, please contact the Cox Automotive Industry Insights team at Manheim.Data@coxautoinc.com.