Data Point

New-Vehicle Sales Incentives Climb Higher in July, According to Kelley Blue Book Estimates

Tuesday August 13, 2024

ATLANTA, Aug. 13, 2024 – New-vehicle prices were lower year over year for the 10th consecutive month in July. Higher inventory levels and higher incentives have shifted the U.S. auto market to favor buyers, but high loan rates and tight credit conditions continue to hold industry sales below potential.

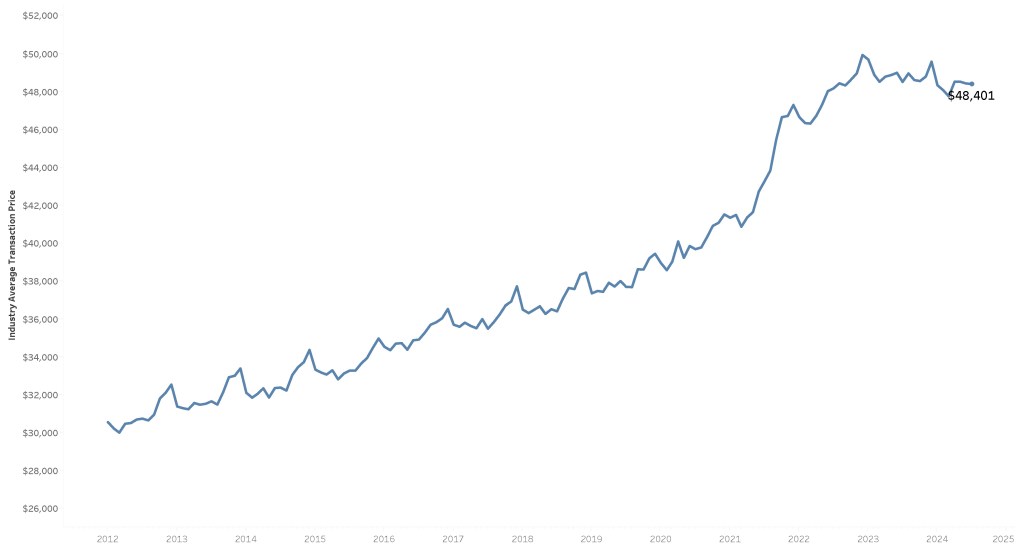

In July, according to data released today by Kelley Blue Book, the average transaction price (ATP) for a new vehicle in the U.S. was $48,401. New-vehicle prices in July were mostly unchanged from the revised-lower June ATP of $48,424 (lower by $23) and last year ($106). According to Kelley Blue Book, new-vehicle ATPs were lower in July by 3.1% from the peak in December 2022 at $49,929.

NEW-VEHICLE AVERAGE TRANSACTION PRICE

Healthy inventory levels – 2.91 million vehicles at the start of July, higher by 52% year over year, according to Cox Automotive’s vAuto Live Market View – continue to keep downward pressure on vehicle prices. But stubbornly high auto loan rates, which make monthly payments higher, are leading many consumers to stay on the sidelines or hunt for affordable options. Only one new vehicle in July posted an ATP below $20,000, the Mitsubishi Mirage, which will be discontinued at the end of the year.

Many popular vehicles in the U.S. market continue to transact for well below the industry’s ATP. Affordable vehicles from the Compact and Subcompact SUV segments are very popular in today’s market, accounting for approximately 1 in 4 sales in July. Incentive levels in these two segments are above the industry average and ATPs, at $36,621 and $29,827, respectively, are well below the industry average.

Sales of expensive, full-size pickup trucks continue pushing the industry’s ATP higher. Expensive full-size pickups accounted for 14% of sales in the U.S. last month, and the average price paid for a new, full-size truck was $65,713. Incentive levels for full-size pickups were 8.1% in July, higher than the industry average.

The two best-selling vehicles in the U.S. in July were full-size trucks, the Ford F-series and the popular Chevrolet Silverado, which the Chevrolet Rado will possibly replace in model year 2026. The average transaction price for the F-Series in July was over $67,000; the Silverado ATP was over $60,000. Last month, two all-electric pickup trucks transacted for over $100,000 – the GMC Hummer EV Pickup ($111,242) and the Tesla Cybertruck ($111,018), the best-selling vehicle in the U.S. priced over $100,000.

“The thing about the U.S. is its diversity, and that goes for the U.S. auto market as well,” said Erin Keating, executive analyst at Cox Automotive. “There are many expensive, high-profile vehicles out there, but consumers have many good options priced well below industry average. We hear this from the large dealers all the time: No matter the budget, chances are we can make something work. This is particularly true where inventory is higher, and incentives are following.”

Incentives Growing

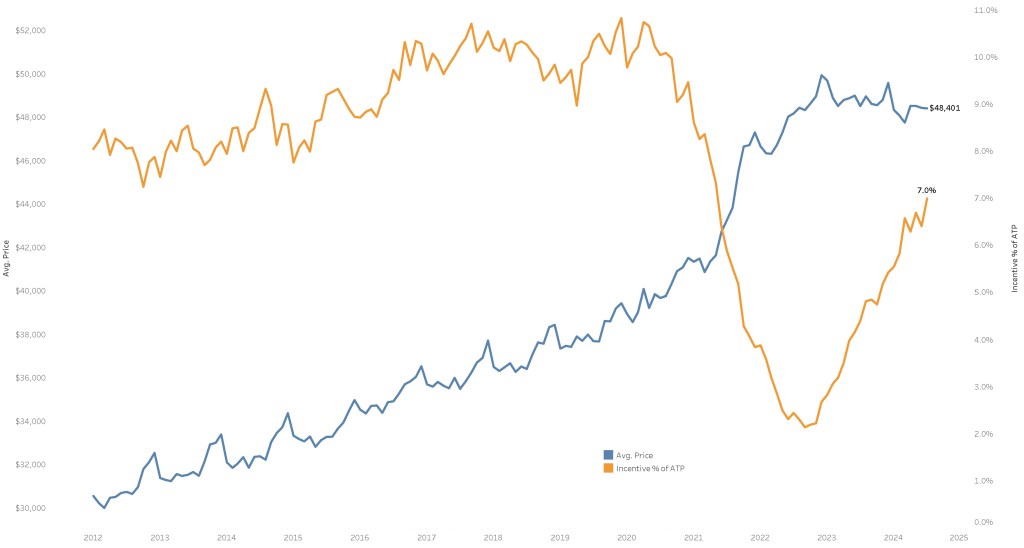

Average incentives in July rose to 7.0% of the average transaction price – $3,383 – up from 6.4% in June and the most generous level seen in 2024. Incentives are now higher by 59.1% compared to one year ago when the average incentive package was 4.4% of ATP in July 2023. New-vehicle incentives in July were at the highest point in more than three years.

INDUSTRY AVERAGE TRANSACTION PRICE VERSUS INDUSTRY AVERAGE INCENTIVE SPEND AS % OF ATP

Nearly every major brand – except for Ram – had higher incentive levels year over year in July, with the highest incentive spend among volume automakers at Infiniti, Volkswagen, Audi and Nissan. Surprisingly, despite industry-leading inventory levels, incentive spending at the core Stellantis brands – Chrysler, Dodge, Jeep and Ram – remains below the industry average.

“Not every brand is seeing sky-high days’ supply, but, in most cases, where there is excess, incentives are climbing,” added Keating. “The higher incentives are helping consumers, but stubbornly high interest rates and tighter credit conditions continue to make affordability challenging. If we are going to see the market live up to its potential, we will need to see rates lower, and credit loosen.”

EV Incentives Track Higher as Prices Hold Steady

The average transaction price for an EV in July, at $56,520, was higher than in June but lower year over year by 1.5%. The average incentive package offered with a new EV in July was over 12% of the transaction price, the highest level in more than three years and roughly twice the level seen in July 2023 when typical incentive packages were equal to 6.0% of ATP. EV incentives in July were 73% higher than the industry average.

Average transaction prices at Tesla continue to move higher after dropping to near the industry average in December 2023. In July, Tesla ATPs were $59,593, up 11% from one year ago and at the highest point since February 2023. Success of the popular new Cybertruck is likely pulling Tesla prices higher, although the volume products, the Model 3 and Model Y, have seen prices rise consistently through the year. In July, the ATP for the Model Y was $52,055, up 5% from January, while the Model 3 was $53,878, up a remarkable 30% from January when Model 3 ATPs were $41,531. The Model Y and the Model 3 are the top-selling EVs in the U.S. market.