Data Point

July Fleet Sales Improve, Remain Down 40% From 2019

Wednesday August 5, 2020

Article Highlights

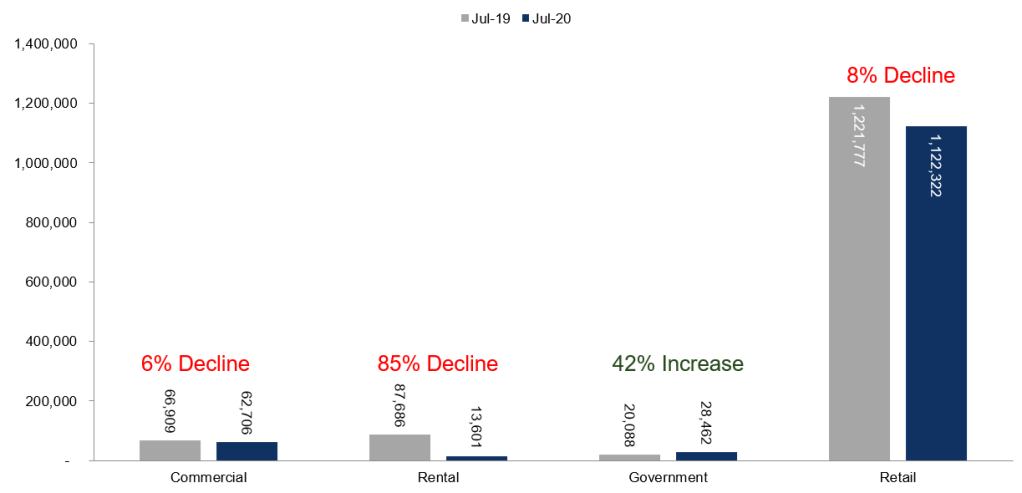

- Fleet sales showed month-over-month improvements but combined rental, commercial and government purchases of new vehicles remained down 40% year over year in July.

- Total fleet volume in July was 104,769, down from 174,683 in July 2019.

- Government units were up 42% year over year, on a small base, while rental units were down 84.5% year over year in July and an improvement over the 94.5% year over year drop in June.

Fleet sales showed month-over-month improvements, but combined rental, commercial and government purchases of new vehicles remained down 40% year over year in July. Total fleet volume in July was 104,769, down from 174,683 in July 2019. Government units were up 42% year over year, on a small base, while rental units were down 84.5% year over year in July, which is an improvement over the 94.5% year over year drop in June.

Retail sales of new vehicles were down 8% year over year in July, leading to a retail SAAR of 13.3 million, down from 14.8 million last July but up from June’s 12.1 million rate.

July total new-vehicle sales were down 12% year over year, with one more selling day compared to July 2019. The July SAAR came in at 14.5 million, a decrease from last year’s 17.0 million but up from June’s 13.1 million rate, indicating the recovery continues.

Looking at automakers, all manufacturers saw year-over-year declines in fleet sales ranging from -15.5% to -71.8% due to the ongoing impact of the COVID-19 pandemic. Toyota and Nissan saw the largest decreases in fleet sales this month, according to our data analysis, compared to July 2019. GM and Ford were the top sellers of fleet vehicles by volume last month.