Data Point

June Fleet Sales Increase 5%; Fleet Growth Remains on Pace to Set 2019 record

Thursday July 11, 2019

Article Highlights

- In the first half of 2019, the new-vehicle market in the U.S. has been propped up in part by strength in fleet sales.

- Combined rental, commercial and government purchases of new vehicles were up 5% year-over-year in June.

- With over 1.63 million vehicles sold into fleet this year, the industry is well on pace to set the highest volume of new fleet sales in U.S. history.

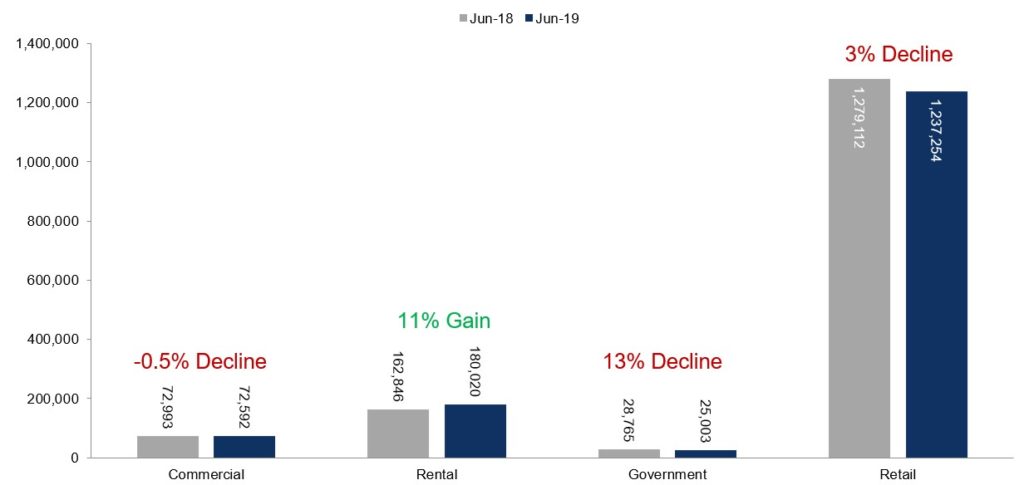

In the first half of 2019, the new-vehicle market in the U.S. has been propped up in part by strength in fleet sales. Combined rental, commercial and government purchases of new vehicles were up 5% year-over-year in June, following an even stronger gain in May. The rental fleet channel was strongest in June, up 11% year-over-year. Retail sales, on the other hand, have struggled in the first six months. They were down 3% in June, leading to a retail SAAR of 14.1 million, down from 14.3 million in June 2018. Year-to-date, fleet sales are up 5.5% and retail sales are down 3.5%. The overall new-vehicle market is down 1.9% this year.

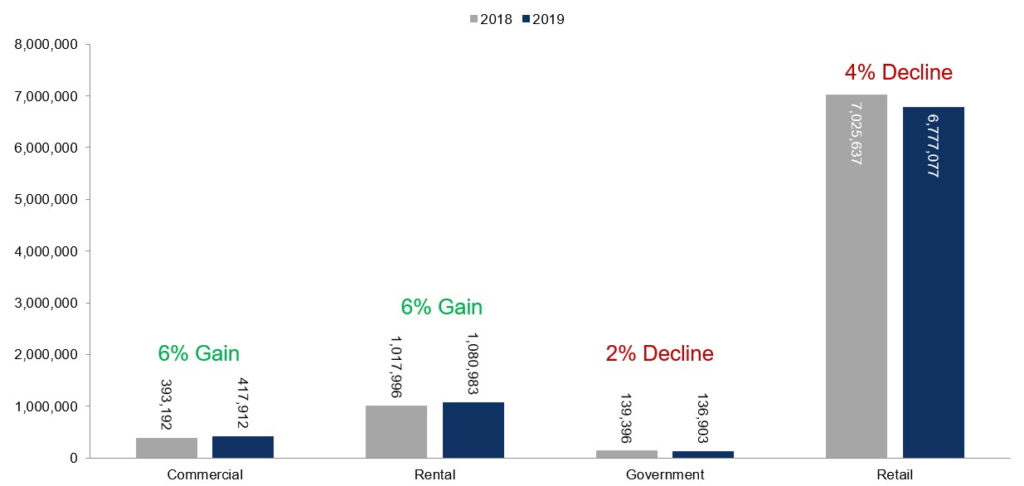

With over 1.63 million vehicles sold into fleet this year, the industry is well on pace to set the highest volume of new fleet sales in U.S. history. Fleet growth this year has been driven mostly by the commercial and rental fleet channels—both up 6% year-to-date—while government fleet is slightly down versus 2018.

Fleet Sales Year to Date as of June 30, 2019