Data Point

Surge in Wholesale Prices Slowing

Thursday June 17, 2021

Article Highlights

- Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 0.29% in the first 15 days of June compared to the month of May.

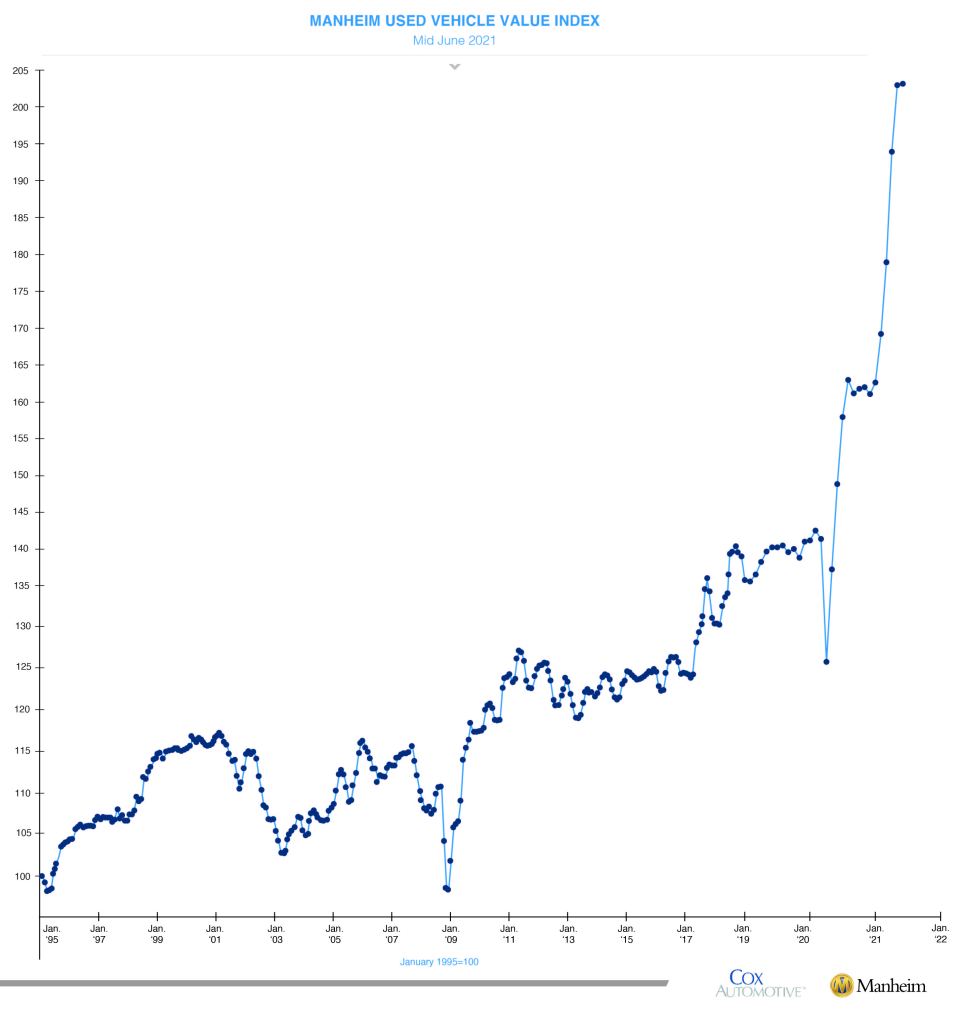

- This brought the mid-month Manheim Used Vehicle Value Index to 203.6, a 36.4% increase from June 2020.

- Pickup trucks and vans outperformed the overall market, while most other major segments underperformed the overall market.

Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 0.29% in the first 15 days of June compared to the month of May. This brought the mid-month Manheim Used Vehicle Value Index to 203.6, a 36.4% increase from June 2020.

Manheim Market Report (MMR) prices continued to increase but at a decelerating pace in the first two weeks of June. The Three-Year-Old MMR Index, which represents the largest model year cohort at auction, experienced a 0.8% cumulative increase over the last two weeks, with last week recording the lowest weekly increase in 20 weeks. Over the first 15 days of June, MMR Retention, which is the average difference in price relative to current MMR, averaged 99.6%. This indicates valuation models are more closely reflecting market prices than we have seen since early January. The sales conversion rate declined in the first half of June relative to May but remained elevated from historical norms. Sales efficiency last week was more than 6 percentage points higher than the average sales efficiency in June 2019. The latest trends in the key indicators suggest wholesale used vehicle values likely peaked last week.

On a year-over-year basis, all major market segments saw seasonally adjusted price increases in the first 15 days of June. Pickup trucks and vans outperformed the overall market, while most other major segments underperformed the overall market.

Access the Mid-Month Update for the full report.

The complete suite of monthly MUVVI data for June will be released on Thursday, July 8, 2021, the fifth business day of the month as regularly scheduled and the day of the next quarterly call.

If you have any questions regarding the Index, please contact the Cox Automotive Industry Insights team at Manheim.Data@coxautoinc.com.