Updated, Aug. 15, 2025 – Everyone is hunting for clear evidence of higher prices on new vehicles driven by tariffs, and yet, the story just hasn’t materialized. Automakers continue to hold their fire on raising the manufacturer’s suggested retail prices (MSRPs) significantly as demand remains tepid and policy has yet to be solidified. New-vehicle inventory has started to grow as next-model-year vehicles (MY2026) begin to show up on dealer lots, although the volume of these vehicles is still down more than 20% from last year at this time, according to the Cox Automotive analysis of vAuto Live Market View data.

2.71M

Total Inventory

as of July 7, 2025

80

Days’ Supply

$48,634

Average Listing Price

The data above have been updated to reflect revisions. See the latest new-vehicle inventory report for the most current data.

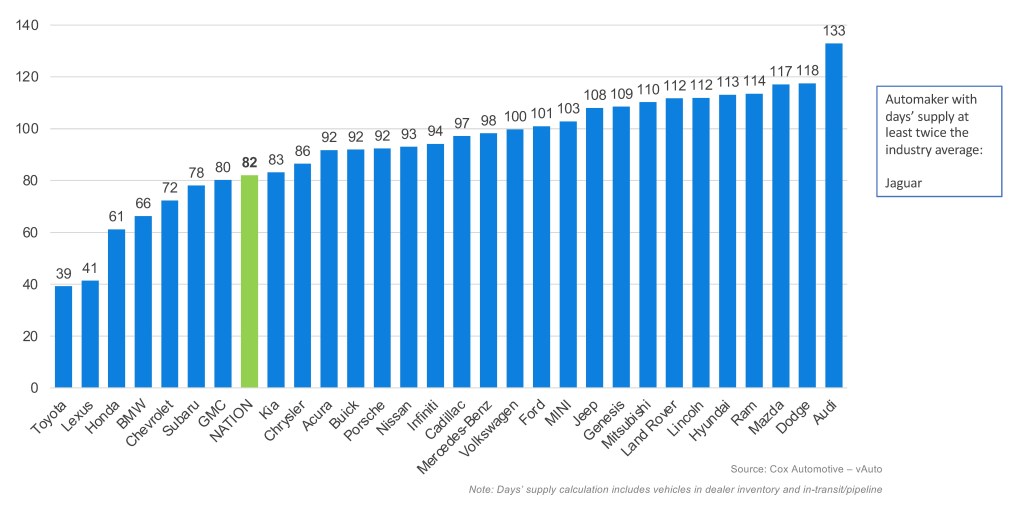

July opened with 2.83 million new vehicles available on dealer lots across the U.S., representing a 14.5% increase from 2.47 million units measured at the beginning of June, but still 1.4% lower than the same period last year. The supply increase was generally observed across all automakers, with none standing out as a significant contributor to the overall rise. Despite this, sales have not kept pace with the increased supply, resulting in new-vehicle days’ supply reaching 82 at the start of July, which is 12 days higher than the month earlier measure.

Cox Automotive’s vAuto Live Market View days’ supply is based on the estimated daily retail sales pace for the most recent 30-day period. The 30-day sales pace measured at the end June was mostly flat compared to the previous month – up approximately 0.5% month over month – but is notably lower than the pace in April and May. Year over year, the June sales pace was higher by 2.2% from June 2024.

June Days’ Supply of Inventory by Brand

Next-model-year inventory has increased to over 7% of the total, a jump of 95% month-over-month, but is still approximately 21% lower than what was reported at the same time last year. As tariffs particularly impact luxury makes from Europe, a careful look at the those brands suggests BMW continues to differ from its German compatriots in growing its Model Year 2026 vehicle inventory to over a third of available inventory, while Mercedes-Benz shows under 2% and Audi shows none, the latter two likely carefully managing shipments of tariffed vehicles.

However, when reviewing the mix of models being replenished on showroom floors, imports of some of the most affordable product seems to have been mostly uninterrupted, despite tariff challenges. Some of the biggest increases in stock have been in volume models coming out of South Korea, such as the Buick Encore GX, Chevrolet Trax and Chevrolet Trailblazer, as well as from Mexico, including the Chevrolet Equinox, Ford Maverick and Honda HR-V.

New-Vehicle Listing Prices Flat in June

The average new-vehicle listing price at the end of June remained essentially flat month over month, down by only $84 to $48,749. Compared to last year, average listing prices were 3.1% higher. Nearly every automaker’s average listing price swung less than 2% higher or lower than the previous month. Interestingly, both BMW and Mercedes-Benz, with new model year inventory, show a month-over-month decrease in average listing price. At the same time, Audi has increased despite holding back on the fresher metal.

According to our Kelley Blue Book team, the average transaction price (ATP) of a new vehicle was $48,907 in June, representing a month-over-month increase of $108. In other words, flat. New-vehicle sales incentives are holding mostly steady, increasing month over month in June by just 0.1 percentage point to 6.9% of ATP. [The full ATP report will be published on July 14.]

As inventory levels rise and new model year vehicles begin to populate dealer lots, the automotive market finds itself in a delicate balance. Supply growth has not been matched by demand, pushing days’ supply higher, and average listing prices have largely plateaued. With incentives holding relatively firm as well, shoppers can expect a market marked by incremental change rather than dramatic shifts. Tariff negotiations have been kicked down the road for another three weeks, which means it could be the fourth quarter before we see any significant movement in overall consumer prices. For now, patience remains a virtue, and attentive consumers may find value by tracking nuanced movements in pricing and inventory as the year progresses.