Data Point

June Opens with Higher Used-Vehicle Supply – And Record-High Prices

Wednesday June 23, 2021

Article Highlights

- Used-vehicle inventory began to moderate through May as the spring sales bounce subsided, according to a Cox Automotive analysis of vAuto Available Inventory data.

- Despite a month-over-month rise, the supply remains 5% below the same period in 2020 and 14% below the same time in 2019.

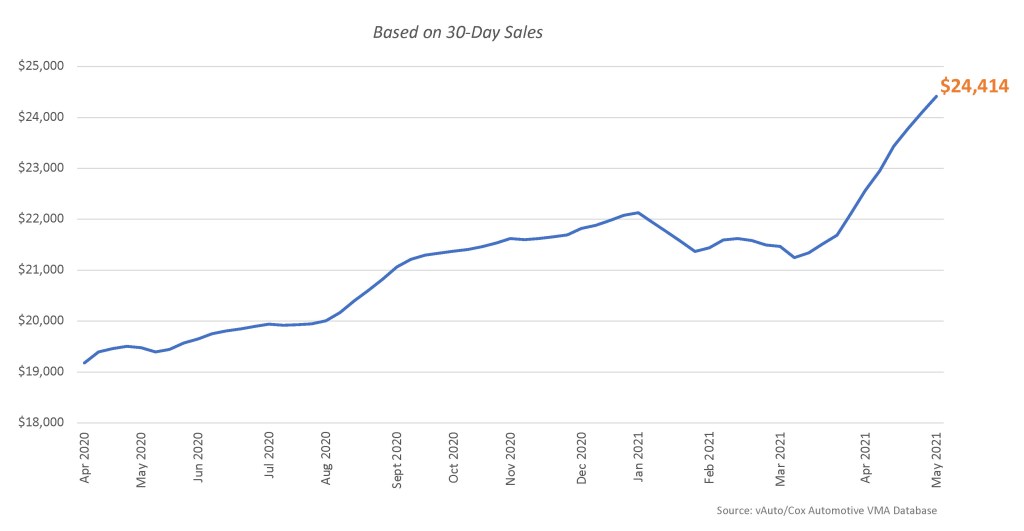

- The average listing price for used vehicles soared to a record-high $24,414 at the start of June.

Used-vehicle inventory levels moderated through May as the spring sales bounce subsided, according to a Cox Automotive analysis of vAuto Available Inventory data. However, used-vehicle prices did not follow suit and instead set new record highs for the start of June.

2.38M

Total Unsold

Used Vehicles

end of May

38

Days’ Supply

$24,414

Average Listing Price

67,458

Average Mileage

The average listing price soared to $24,414 at the start of June. That surpassed the previous record of $22,568 at the beginning of May. The pace of price increases sprinted through May, closing the month nearly 25% higher than the same period in 2020 and 2019. Last summer, the average listing price surpassed the $20,000 mark for the first time and has been rising ever since.

AVERAGE USED-VEHICLE LISTING PRICE

“The days of supply for used vehicles is not worsening but remains in an extremely tight supply situation,” said Charlie Chesbrough, Cox Automotive senior economist. “As a result, prices are rising rapidly. Higher prices likely are slowing the sales pace, which is allowing existing inventory to last longer. With the new-vehicle market still inventory-constrained and consumer interest in all vehicles elevated, high prices and short supply for the used market is likely to linger throughout the summer.”

The total supply of unsold used vehicles totaled 2.38 million units at the end of May, up from the 2.23 million units at the end of April, according to the Cox Automotive analysis of vAuto data. Despite the rise, the supply remains 5% below the same period in 2020 and 14% below the same time in 2019.

The used-vehicle days’ supply ended May at 38, up from 35 at the end of April and 33 at the end of March. At the close of May, the days’ supply was 9% below the year-ago period and 17% below 2019 levels.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period, which ended May 31. Used-vehicle sales peaked in mid-April and were basically flat in May at 1.88 million vehicles. Still, sales were 4% above the last week of May in 2020 and 3% above the last week of May 2019.

Franchised dealers had 1.44 million vehicles in inventory at the end of May, up from 1.34 million at the end of April. That put the days’ supply at 37, compared with 34 the previous month. Used vehicles in franchised dealers’ inventory experienced a big price hike. The average listing price set another record of $26,201, up from the previous record of $24,348 a month earlier.

Independent dealers had slightly improved inventory by the end of May. They had 945,607 vehicles in stock to sell, slightly better than the 937,934 at the end of May. The average listing price was a record $21,677. That is up from $20,034 and far higher than the $18,802 at the end of March.

The average number of miles on used vehicles in inventory dipped back in May to 67,458 after surpassing 68,000 in the previous month. The average miles on used vehicles on franchised dealers’ lots dipped to 61,780 and 76,800 on independent lots.

“More affordably priced 10-year-old vehicles are scarce due to lower new-vehicle sales for several years during the Great Recession,” Chesbrough said. “The average price for a used vehicle is high because we have so few of those older vehicles. Supply is still adequate unless you need an affordable, older car, and then it’s terrible.”

Used vehicles priced below $35,000 had the lowest volume. Days’ supply for vehicles under $10,000 was 29, the lowest of all categories. Inventory for other categories priced at under $35,000 was between 30- and 39-days’ supply. Days’ supply for vehicles priced over $35,000 had the highest days’ supply at nearly 43.

More insights are available from Cox Automotive on used-vehicle inventory, using a 30-day rolling sales methodology to calculate days’ supply.

Michelle Krebs is executive analyst at Cox Automotive.