Data Point

Automotive Market Shifts to Favor Buyers as U.S. New-Vehicle Prices Down Record 2.4% Year Over Year in December 2023

Wednesday January 10, 2024

Article Highlights

- The average transaction price (ATP) for a new vehicle in December 2023 was $48,759, an increase from November 2023 but down 2.4% from an all-time high reached in December 2022.

- Incentives and discounts continue to increase as inventory climbs, reaching 5.5% of ATP in December, up from 2.7% one year ago.

- Luxury vehicle prices in December were lower by nearly 9% year over year; luxury share of the U.S. market reaches above 20% for second straight month.

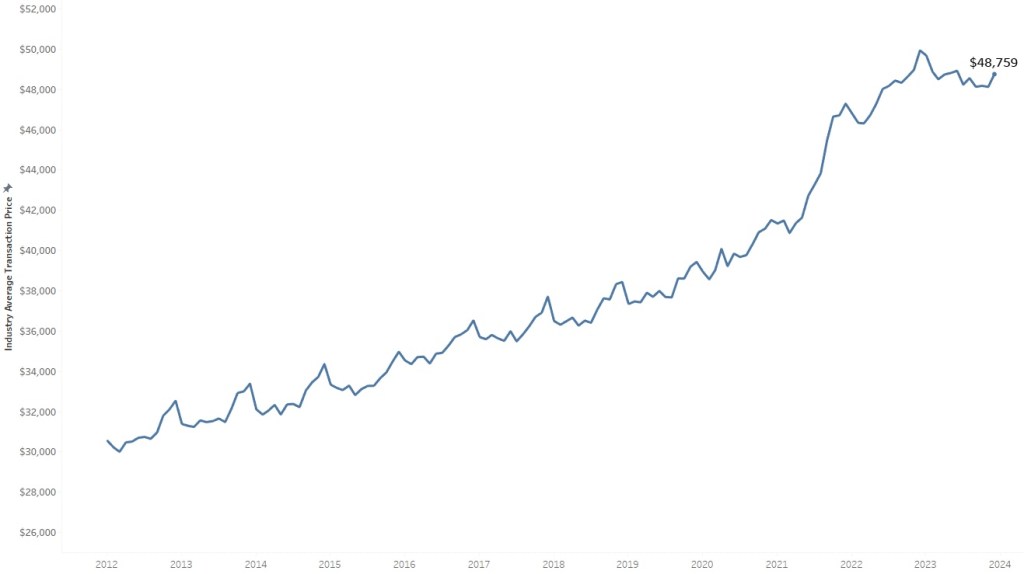

ATLANTA, Jan. 10, 2024 – The U.S. new-vehicle average transaction price in December 2023 was $48,759, an increase of 1.3% month over month but down 2.4% year over year, according to data released today from Kelley Blue Book, a Cox Automotive company. December marks the fourth consecutive month that new-vehicle transaction prices were lower year over year, a unique milestone for the industry, which typically sees year-over-year increases.

“When we look at price strength, the pandemic created a seller’s market in which new vehicles were transacting above manufacturers’ suggested retail price in 2022,” said Michelle Krebs, executive analyst for Cox Automotive. “That market is all but gone now, as higher inventory has led to higher incentives and discounts – lower margins for dealers – and vehicles are now typically selling for under MSRP. The shift from a seller’s market to a buyer’s market is well underway.”

NEW-VEHICLE AVERAGE TRANSACTION PRICE

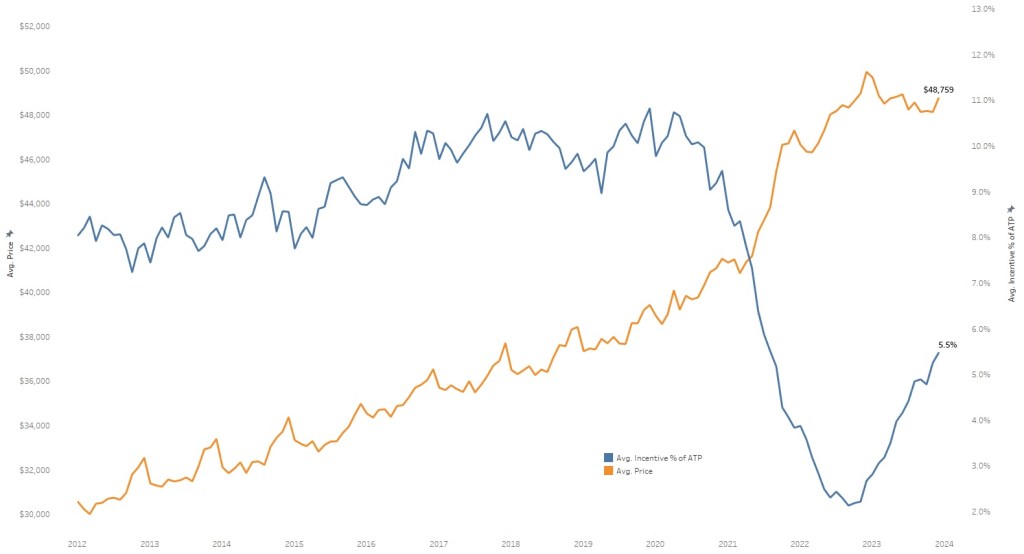

New-vehicle sales incentives climbed for the second month in a row in December after retreating slightly in October, reaching 5.5% of the average transaction price (ATP) for the first time since August 2021. For comparison, one year ago, incentives were 2.7% of ATP. In December, incentives for luxury cars and electric vehicles were higher than 8%, well above the industry average. Conversely, full-size SUVs, minivans and small/mid-size pickups had some of the smallest incentives last month, all well below 3%.

INDUSTRY AVERAGE TRANSACTION PRICE VERSUS INDUSTRY AVERAGE INCENTIVE SPEND AS % OF ATP

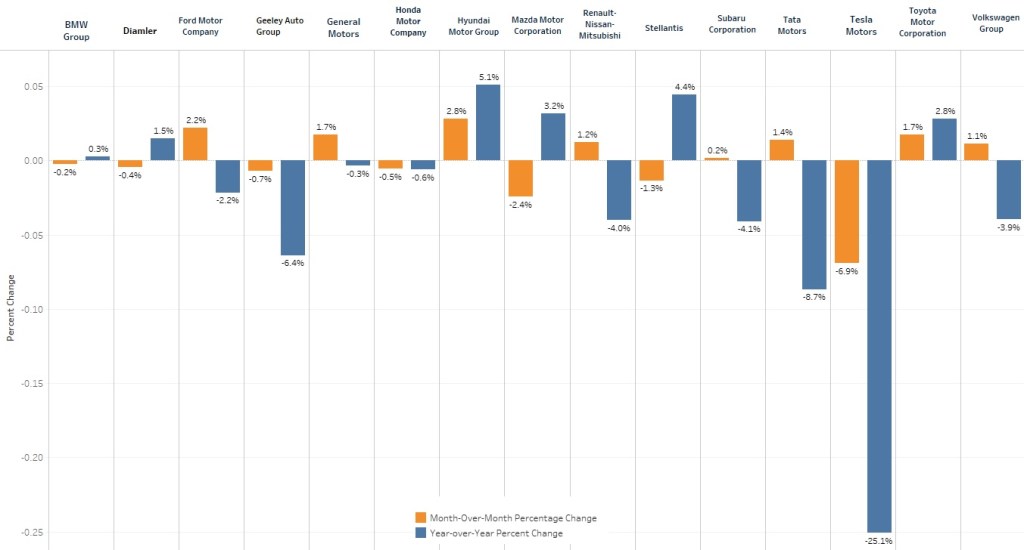

Of the 35 brands that Kelley Blue Book included in its December 2023 analysis, 18 had year-over-year price declines in December, with the largest declines recorded for Tesla (-25.1%), Land Rover (-10.2%) and Volvo (-6.7%). The largest year-over-year transaction price increases came from Ram (11.5%), Hyundai (8.4%), and Porsche (6.1%).

Luxury Vehicle Prices Remain Steady While Non-Luxury Prices Increase Slightly

The average price paid for a luxury vehicle in December 2023 was $62,523, a decrease of less than 1% from November but down 8.8% year over year. Luxury brand incentives averaged 6.2% of ATP in December, up from 5.8% in November and 4.5% in October. Tesla, Buick, Land Rover, Volvo and Acura had the largest ATP declines last month among luxury brands in the Kelley Blue Book database.

Spurred in part by lower prices, luxury brand sales in December jumped 22.1% year over year in a market that increased just over 13%. Non-luxury vehicle sales increased approximately 11.1%. Luxury share of the U.S. market was 20.2% in December, after reaching a record high of 20.3% and climbing above 20% for the first time on record – in November, according to the Kelley Blue Book data.

For non-luxury brands, the average price paid in December 2023 was $45,283, an increase of $901 (up 2%) from November but lower year over year by 0.8%. Among non-luxury brands, Ram (11.5%), Hyundai (8.4%) and Dodge (4.3%) posted the largest year-over-year ATP increases, while Nissan (-4.7%), Subaru (-4.1%) and Ford (-2.5%) posted the largest declines.

PRICE CHANGE PERCENTAGE BY AUTOMAKER

EV Prices End the Year Down Nearly 18% from January

The average price paid for a new electric vehicle in December 2023 was $50,798, down from a revised $52,362 in November and supported by incentive levels well above the industry average. In December, EV incentives reached their highest point of 2023 at 10.6% of ATP. A year ago, EV incentives were less than 2% of ATP.

Thanks mostly to significant price cuts from Tesla, average EV prices in December were down 17.7% from January 2023. According to estimates by Kelley Blue Book, EV sales in the U.S. reached a record 1.2 million units in 2023, up 46.3% from 2022. A full report on EV sales volumes in the U.S. in 2023 is available in the Cox Automotive Newsroom.

“2023 was a milestone year with 1,189,051 pure battery electric vehicles sold, accounting for 7.6% of all new-vehicle sales,” added Stephanie Valdez Streaty, director of Industry Insights at Cox Automotive. “Last year’s main story was Tesla price cuts that shook up the market and challenged the profitability picture for all automakers. Tesla is by far the dominant force in electric vehicles – when they cut prices, everyone takes notice.”