Data Point

New-Vehicle Transaction Prices Decline for Third Straight Month, but Remain Above MSRP, according to Kelley Blue Book

Monday April 11, 2022

Article Highlights

- Consumers continued to pay well above MSRP for a new vehicle, marking 10 straight months of an “over sticker” market.

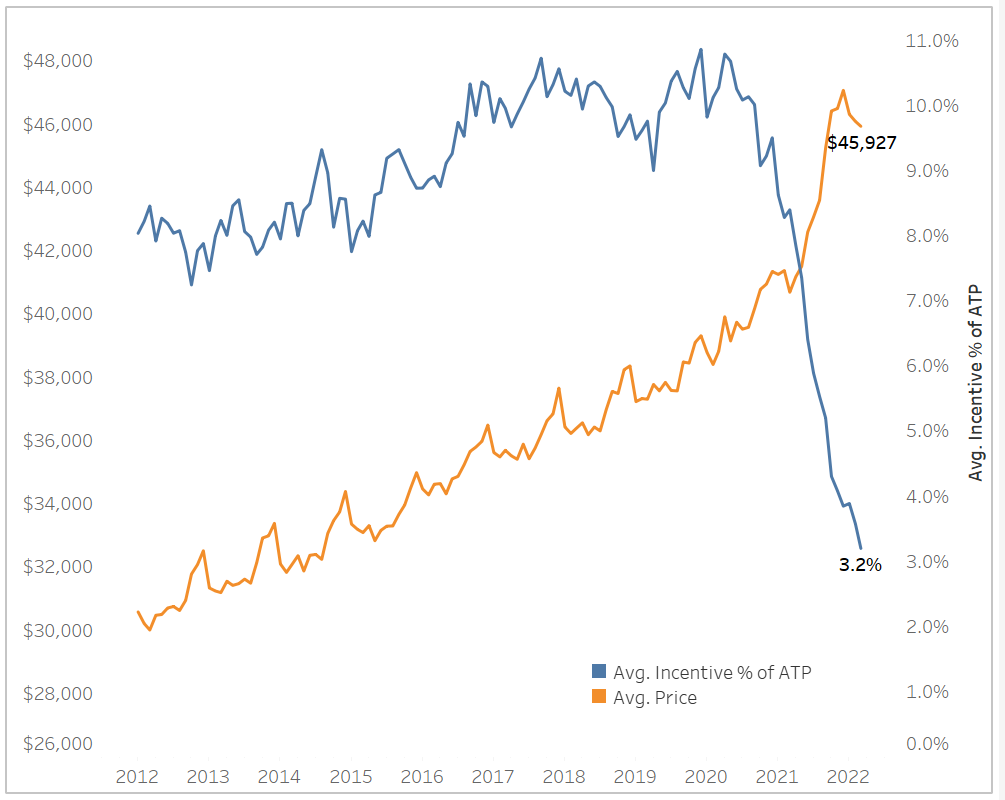

- With low inventory and high demand, incentives dropped to a record low in March, averaging only 3.2% of the average transaction price.

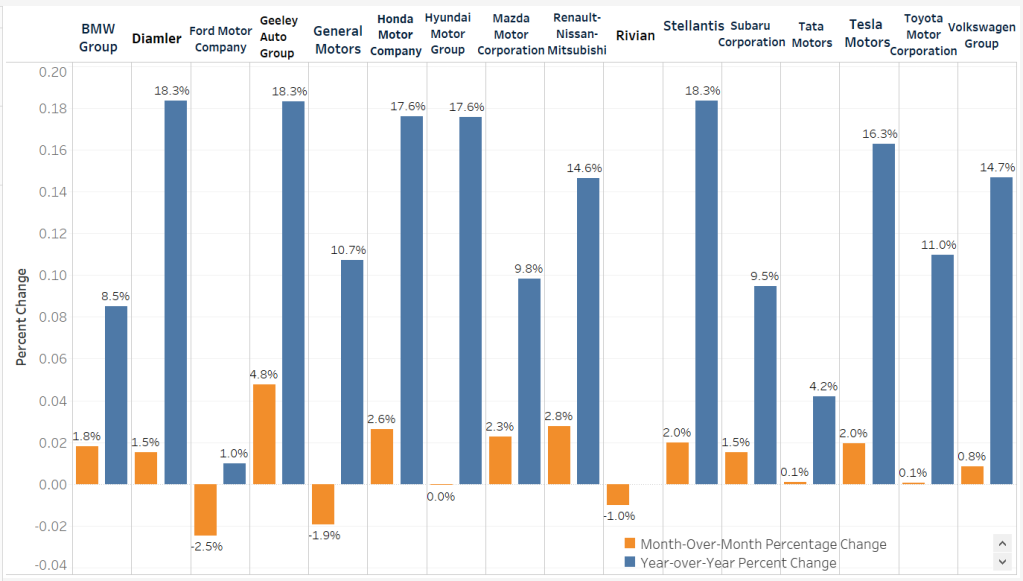

- In March 2022, Mitsubishi and Jeep delivered the largest year-over-year price gains.

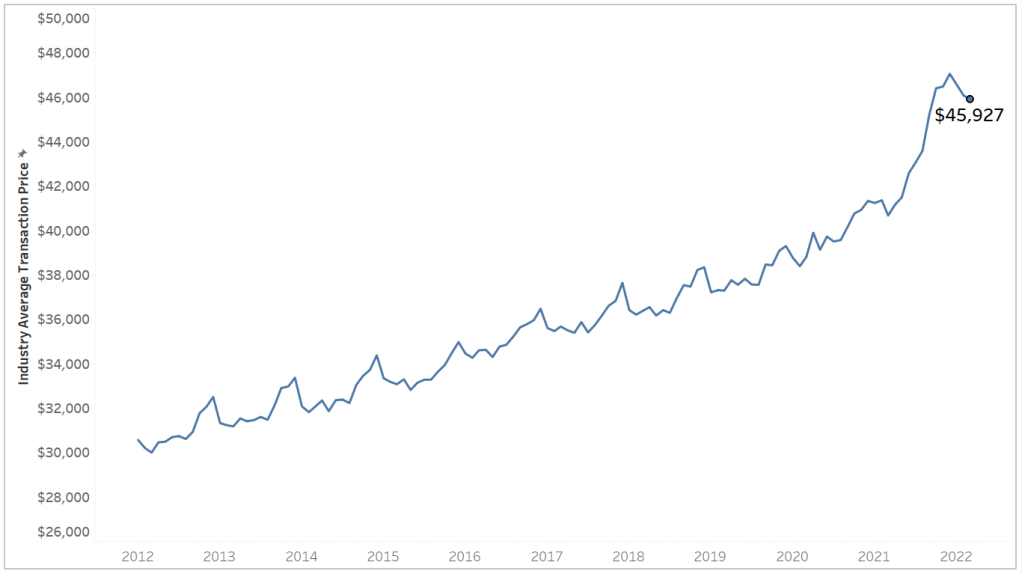

New-vehicle average transaction prices (ATPs) decreased to $45,927 in March 2022 after reaching a record high in December 2021, according to new data released by Kelley Blue Book, a Cox Automotive company. Prices fell 0.3% ($156) month over month, but remain elevated compared to one year ago, up 12.9% ($5,247) from March 2021.

New-vehicle inventory days’ supply was in the low 30s in March while customer demand remained high. These conditions enabled dealers to continue selling inventory at or above the manufacturer’s suggested retail price (MSRP). In March, new vehicles from Kia, Honda and Mercedes-Benz were transacting on average between 7.8% and 9.8% over MSRP. On the other side of the spectrum, Volvo, Buick and Lincoln were selling around 1% below MSRP.

NEW-VEHICLE AVERAGE TRANSACTION PRICE

“With a myriad of supply chain issues disrupting global vehicle production, we expect inventory to remain tight through the rest of the year and prices to remain high,” said Michelle Krebs, executive analyst for Cox Automotive.

The average price paid for a new non-luxury vehicle last month was $42,364, down $53 from February and marking the fifth consecutive monthly decrease for non-luxury. However, while the average MSRP on a non-luxury vehicle has decreased over the past five months, car shoppers still are paying on average more than $970 above sticker price. Consumers have paid more than MSRP for each of the last 10 months, whereas one year ago, non-luxury vehicles were selling for more than $1,300 under MSRP.

In March 2022, the average luxury buyer paid $65,123 for a new vehicle, up $272 month over month and still $2,550 above sticker price. For comparison, luxury vehicles were selling for more than $2,400 under MSRP one year ago. Luxury vehicle share fell to 15.4% of total sales in March, down from 16.3% of total sales in February and down from 18.4% in December 2021, which helped push overall ATPs to a record high of $47,064 at the end of last year.

PRICE CHANGE PERCENTAGE BY AUTOMAKER

New-vehicle average transaction price changes month-over-month by segment saw only cars increasing and all other segments decreasing. Cars had an average transaction price of $41,570 in March, a $216 increase month over month. With an ATP of $47,024, vans saw the largest decrease of $983 in March, followed by trucks ($54,622 ATP) with a $288 decrease. SUVs decreased by $162 to an ATP of $44,645. Meanwhile, vans still had the lowest incentives (expressed as a percent of ATP) at 1.6% and trucks had the highest at 3.7%. Incentives dropped to a record low level in March, averaging only 3.2% of the average transaction price.

INDUSTRY AVERAGE TRANSACTION PRICE VERSUS INDUSTRY AVERAGE INCENTIVE SPEND AS % OF ATP