Data Point

Large Dealer Groups Continue to See Used-Vehicle Sales Gains in Q2

Wednesday August 7, 2019

Article Highlights

- A shift in vehicle demand, away from new and toward used, can been seen clearly in the Q2 financial results of the largest players in the auto industry: franchised dealer groups.

- Looking at Q2 performance of these publicly traded dealer groups, the trend in our industry is crystal clear: New sales are down, used sales are up.

- In total, the large dealer groups are selling more used units which follows general industry guidelines for dealer operations.

New-vehicle sales remain weak versus last year and are down 2% year-to-date in 2019. It would be worse without strong fleet sales. Retail sales are down 3% and fleet sales are up 6% this year. The used-vehicle market, on the other hand, continues to see favorable performance. Affordability concerns driven by higher vehicle prices and interest rates have reduced the pool of people who can afford to buy new. With attractive off-lease supply available, the used-vehicle market is benefiting from robust demand. In fact, supply is more of a concern in the used-vehicle market than demand.

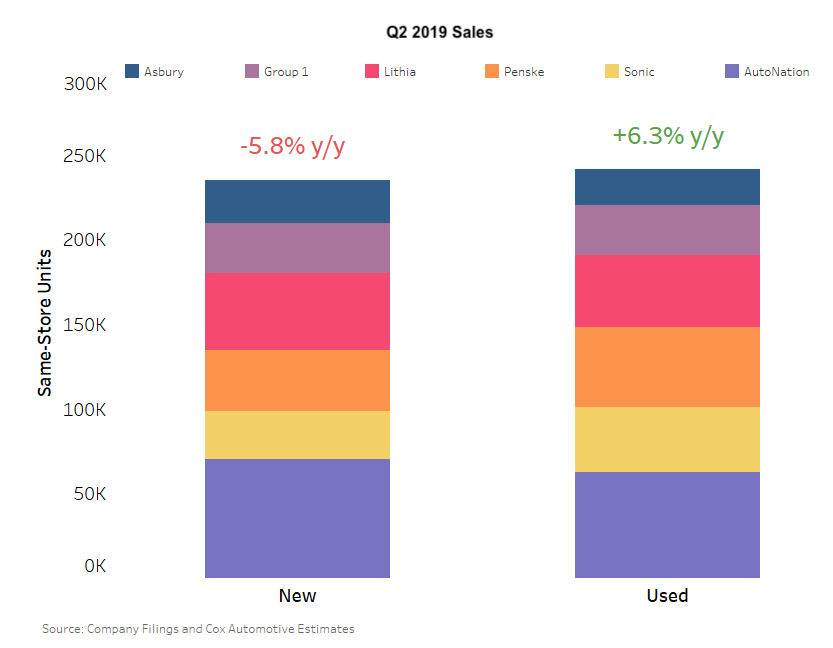

This shift in vehicle demand, away from new and toward used, can been seen clearly in the Q2 financial results of the largest players in the auto industry: franchised dealer groups. Looking at Q2 performance of these publicly traded dealer groups, which accounted for roughly 5% of new-vehicle sales in the U.S., the trend in our industry is crystal clear: New sales are down, used sales are up. Consistent in their filings was recognition that the used-car business was one of the bright spots last quarter.

Looking at aggregate same-store sales, new-vehicle sales were down almost 6% while used-vehicle sales were up 6%. In total, the large dealer groups are selling more used units which follows general industry guidelines for dealer operations. How much they can skew to used-vehicle sales will be contingent on used-vehicle supply. And it will only get more difficult going forward, as the largest driver of high-demand, high-profit supply—off-lease units—are at their peak this year.