Commentary & Voices

Lessons Learned While Listening Carefully at NADA 2024

Tuesday February 13, 2024

It was good to be back in Las Vegas for NADA 2024, which included my first trip to the Sphere to see U2. The pre-show DJ must have known the venue was packed with auto industry leaders when he rode around the crowd in an elevated faux car playing The Beatle’s hit “Drive My Car.”

But the point of attending NADA is not about listening to live music. It’s about listening and learning from the voices of the industry: dealers, automakers, and solution providers. The various events, workshops, and random hallway conversations provide great insight into the industry’s current state. A top-performing dealer once told me that “being a student of the game” was the key to his success. Those words have always stuck with me, and I do my best to listen like a straight-A student every year at NADA. Here’s what I heard this year:

“Expenses are on the rise, and grosses are on the dive.” – President Large Dealer Group

I spoke with the president of a large dealer group in the Midwest, who told me that “expense infrastructure” is their focus for 2024. He explained that front-end grosses (not including doc fee, F&I, or factory money) fell 30% last year, tumbling from $2,650 in 2022 to $1,850 in 2023. In addition, he’s had nearly $5 million in EV infrastructure expenses incurred between fast chargers, tooling, and training, but EV grosses are abysmal at a negative $1,500 per unit. There is increasing downward pressure on dealership profitability.

To combat this challenging environment, he’s implementing a three-pronged strategy:

- Reducing labor expenses – Being judicious about backfilling jobs and thinning the management layer. “Without realizing it, the number of managers we have has grown a lot from 2019.”

- Centralized appraisals – Appraisal variability across stores can be significant. It’s common to see 10%-15% variances in cost-to-market averages between used car appraisers. His group has adopted vAuto’s ProfitTime metrics to assess each vehicle’s worth in a non-emotional fashion to create more consistency.

- Improving sales throughput per employee – 65% of their sales consultants have only sold vehicles during the “best of times” in the last 2-3 years. Salespeople must embrace the daily blocking and tackling activities necessary to sell in a more competitive marketplace vs. taking orders from willing buyers.

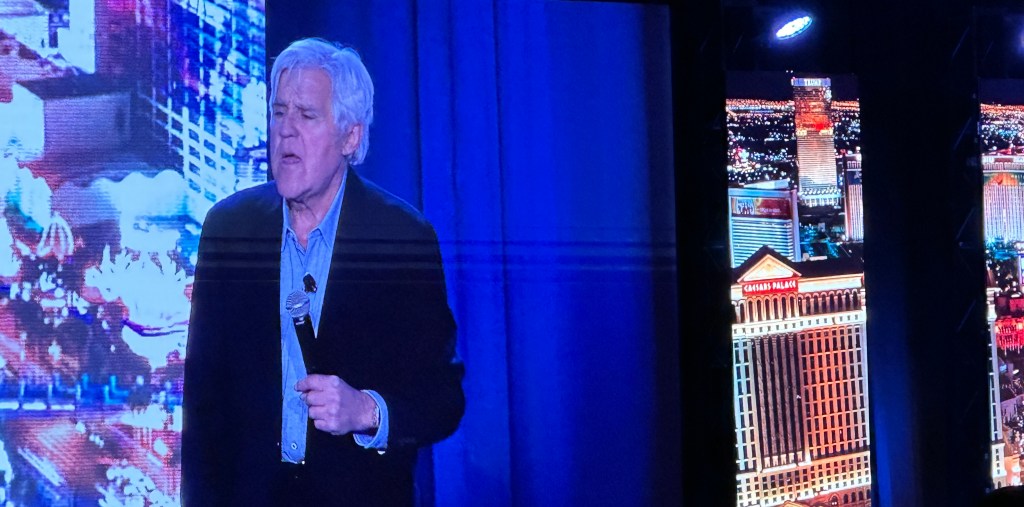

“Gas cars are like smoking; they will be hard to put down.” – Jay Leno

Jay Leno shared a few jokes and his perspective on the industry at the J.D. Power Auto Summit. When asked about EVs, he commented, “Everyone likes progress; it’s the change nobody likes.”

Dealers are beginning to resist the change to EVs, with nearly 5,000 dealers signing a letter to President Joe Biden in late January requesting less strict fuel economy standards.

Their letter said, “With each passing day, it becomes more apparent that this attempted electric vehicle mandate is unrealistic based on current and forecasted customer demand. Already, electric vehicles are stacking up on our lots, which is our best indicator of customer demand in the marketplace.”

Automakers face the daunting challenge of navigating competing priorities: Corporate Average Fuel Economy standards are only getting tougher, and consumer demand for EVs is beginning to soften. Even Tesla is feeling the pain: The EV leader posted a 22,000-unit volume decline from Q2 to Q4 in California, their #1 state for sales.

General Motors President Mark Reuss told the J.D. Power event audience: “EVs are an AND to the current offerings,” but acknowledged, “I don’t have a crystal ball as to how this will all play out.” GM announced during their recent quarterly earnings call their intention to bring back plug-in hybrids.

Leno mentioned driving a Chevrolet Volt plug-in hybrid for 90,000 miles and only using gas for 3,500 miles. Maybe Americans are taking notice of a guy who used to make $25 million a year, saving money on gas and reducing CO2 emissions by driving a hybrid. Despite all the EV media attention, hybrid sales rose nearly 80% in 2023. With the hybrid average MSRP at $42,381 versus an EV average of $55,353 – it’s not hard to see why hybrid popularity is growing.

“I could really use some inexpensive inventory.” – Every dealer at NADA

Over the past few years, automakers have practically abandoned the lower end of the market, creating an opportunity for brands willing to embrace it. At the J.D. Power conference, it was revealed that, in 2018, 49% of all new cars sold were below $30,000. Today, the number is just 19%.

High MSRPs coupled with higher interest rates are pricing a significant percentage of buyers out of the market. Judy Wheeler, Vice President of Sales at Nissan, told dealers at the Nissan make meeting they will be focused on gaining share in the less expensive segments with: Versa, Kicks, and Sentra. Industry analysts predict production will increase this year from 16 million in 2023 to 16.5 million. If those incremental 500,000 units are priced below $30,000, they will sell quickly and help companies like Nissan gain market share.

NADA Delivers Return on Investment

I watched an Automotive YouTube channel recap of the NADA when I returned home, and the question posed to guests on the panel was, “What’s your ROI on NADA?” It’s an interesting question because the vendor costs for participating at NADA can be astronomical, while incremental revenues are not guaranteed. The panelists and I agree that the ROI on NADA is very positive because of the invaluable learnings gained from listening to one another on the convention floor, in the hallways, or even at a U2 concert.

Brian Finkelmeyer

Brian Finkelmeyer is Senior Director of Enterprise Insights and Advisory at Cox Automotive. Brian leads a team dedicated to providing car companies with actionable business intelligence to drive their performance. Brian has spent his entire career in the auto industry, working at Nissan for nearly 20 years in various sales leadership positions. Upon joining Cox Automotive, Brian was responsible for the vAuto New Car Inventory solution – Conquest. Brian lives in Nashville, TN.