Data Point

Lower Incentives, Higher Sales: The U.S. Auto Industry Carries Momentum Into 2021

Monday February 1, 2021

Article Highlights

- Looking at incentive spend by month, we see the beautiful resilience of our auto market.

- Incentives in Q4 were down – a sign of industry health.

- The more we look at Q4 2020, the more we see a surprisingly healthy business running at a near-normal sales pace.

January U.S. auto sales will be confirmed by many automakers on Tuesday, and the Cox Automotive Industry Insights team is forecasting healthy numbers. Our forecast, shared last week, calls for volume of approximately 1.1 million vehicles, down from a year ago, but moving at a good pace similar to last month. The January seasonally adjusted annual rate (SAAR) is expected to be near 16.3 million, a sales pace that places the industry on course for a solid year. Our full-year forecast is 15.7 million, up 8% from 2020.

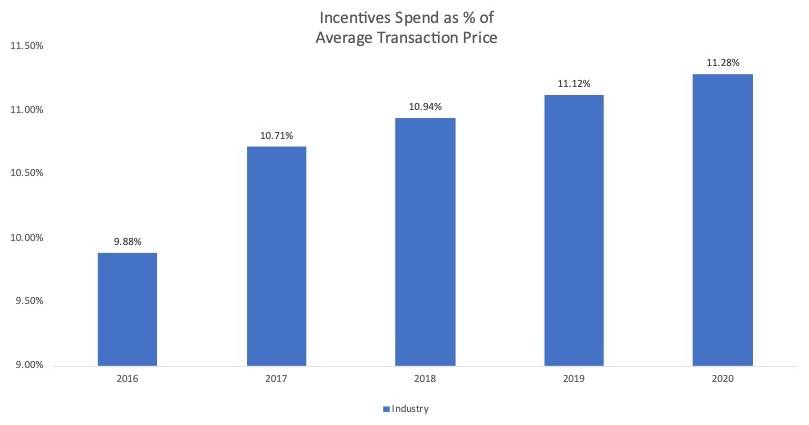

Incentive spend is often a shorthand measure of sales health, as lower incentives mostly indicate aligned supply and demand. Full-year incentive spending in 2020 (measured by Kelly Blue Book as incentive spend versus average transaction price) was up only modestly over the 2019 level. The small increase was driven by heavy spending in the springtime to help motivate shoppers after the global pandemic drove the economy right off the road.

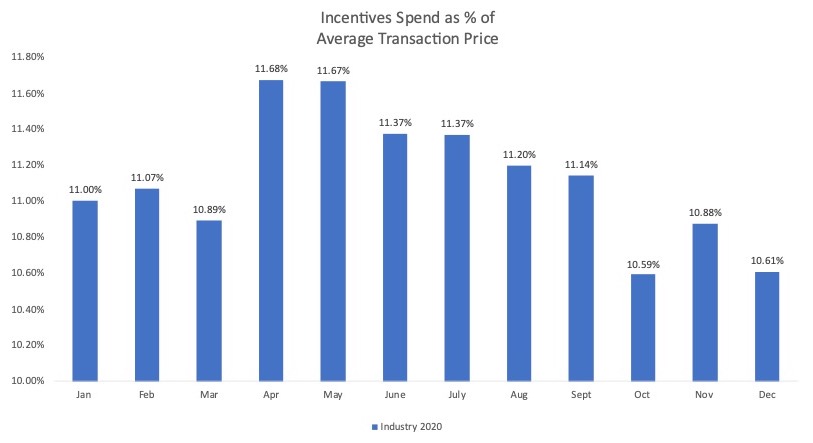

Looking at incentive spend by month, however, we see the beautiful resilience in our auto market. By the second half of the year, things were rolling, new-vehicle buyers were back, and lower industry inventory, caused by pandemic-driven plant closures, was mostly aligned with demand. Incentives began dropping while profits increased. In fact, in Q2, the Detroit 3 automakers lost a collective $2 billion. In Q3, they made 10. Results for Q4 will be reported soon, and positive numbers are expected.

The more we look at Q4 2020, the more we see a surprisingly healthy business running at a near-normal sales pace, despite serious pandemic issues and swirling, negative political news. Sales volume in Q4 was down only 2% compared to Q4 2019. Better still – and a sign of industry health – incentives in Q4 were down. Some automakers increased incentives in the final months of the year – Mitsubishi, Jaguar, Infiniti, and others – but a vast majority dialed back. Healthy sales, lower incentives: These are the positive signs we’re here for.

As we head into 2021 and begin to measure industry progress in Q1, we remain optimistic that the year ahead will be better than the year behind. We’re hopeful the Q4 momentum keeps rolling.