Data Point

Auto Credit Availability Improved Again in March as Rates Kept Moving Higher

Monday April 11, 2022

Article Highlights

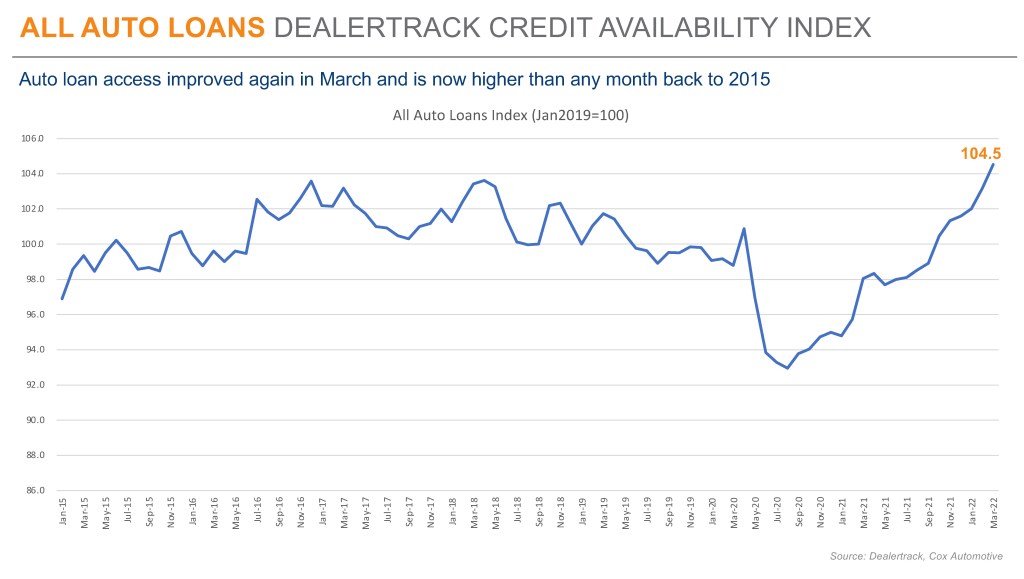

- Access to auto credit expanded again in March according to the Dealertrack Credit Availability Index for all types of auto loans.

- The All Loans Index increased 1.3% to 104.5 in March, reflecting that auto credit was easier to get in the month compared to February. Access was looser by 6.6% year over year, and compared to February 2020, access was looser by 5.4%.

- The index in March was the highest recorded in the data series going back to January 2015.

Access to auto credit expanded again in March according to the Dealertrack Credit Availability Index for all types of auto loans. The All Loans Index increased 1.3% to 104.5 in March, reflecting that auto credit was easier to get in the month compared to February. Access was looser by 6.6% year over year, and compared to February 2020, access was looser by 5.4%. The index in March was the highest recorded in the data series going back to January 2015.

While the average yield spread on auto loans widened in March, other factors improved to more than compensate. The average auto loan increased by 53 basis points (BPs) in March compared to February, while the 5-year U.S. Treasury increased by 28 BPs, resulting in wider observed yield spreads.

All loan types saw credit easing in March with certified pre-owned (CPO) loans easing the most. On a year-over-year basis, all loan types were easier to get with CPO loans having loosened the most.

Credit access also improved across most lender types in March with credit unions having loosened the most. On a year-over-year basis, all lenders had looser standards with auto-focused financed companies having loosened the most.

Each Dealertrack Credit Availability Index tracks shifts in loan approval rates, subprime share, yield spreads and loan details including term length, negative equity, and down payments. The index is baselined to January 2019 to provide a view of how credit access shifts over time. Across all auto lending in March, the approval rate increased, the subprime share grew, and negative equity grew, and the moves in those factors made credit more accessible. However, yield spreads widened, terms shortened, and down payments grew, so those factors moved against accessibility.

Measures of consumer sentiment were mixed in March. Consumer Confidence according to the Conference Board increased 1.4% in March when a decline had been expected; but the February index was revised down, so the March index came in very close to expectations. The underlying measures of present situation and future expectations moved in opposite directions as present situation improved but future expectations declined. Plans to purchase a vehicle in the next six months declined and remained down year over year. The sentiment index from the University of Michigan declined 5.4% in March as both current conditions and expectations declined, with inflation accelerating. The Morning Consult daily index declined 1.4% in March, but it was down 6% at midmonth at the peak of gas prices and recovered much of the early March decline as gas prices stopped increasing and moderated slightly.

The Dealertrack Credit Availability Index is a new monthly index based on Dealertrack credit application data and will indicate whether access to auto loan credit is improving or worsening. The index will be published around the 10th of each month.