Data Point

New-Vehicle Affordability Improved Again in March

Friday April 14, 2023

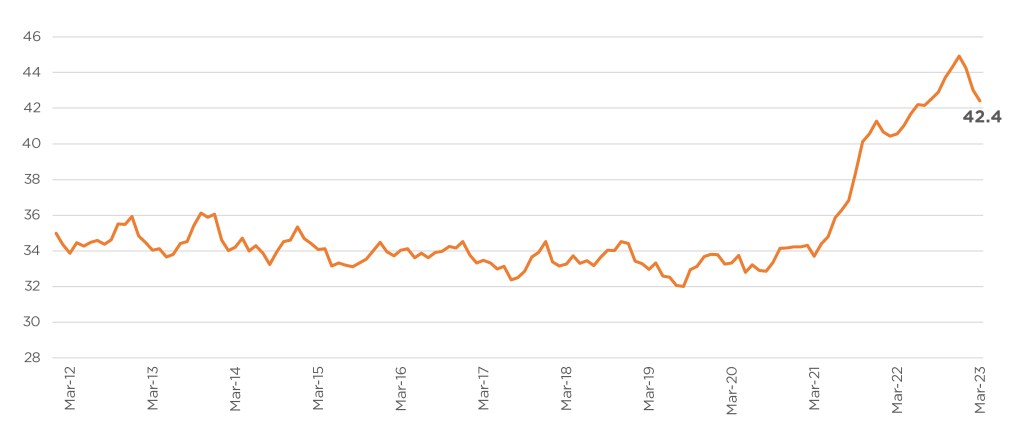

New-vehicle affordability improved again in March and contributed to improving new-vehicle sales, according to the Cox Automotive/Moody’s Analytics Vehicle Affordability Index. All factors helped as declining new-vehicle prices, increasing incentives, improving incomes, and a lower average new auto loan rate reduced the average payment to the lowest level since September 2022. The number of median weeks of income needed to purchase the average new vehicle in March declined to 42.4 weeks from an upwardly revised 43.0 weeks in February.

Cox Automotive/Moody’s Analytics Vehicle Affordability Index

March 2023

Weeks of Income Needed to Purchase a New Light Vehicle

Estimated Typical New Car Monthly Payment Declined to $754

The average transaction price (ATP) for a new vehicle fell to $48,008 in March and was below the manufacturer’s suggested retail price for the first time in 20 months, according to data released by Kelley Blue Book. The March ATP decreased by 1.1% ($550) compared to February. Meanwhile, the median income grew by 0.3%, and incentives from manufacturers increased to the highest level in a year. The average new-vehicle loan interest rate declined 141 basis points to 8.77%1. As a result of these changes, the estimated typical monthly payment for a new vehicle declined 1.1% to $754 from a downwardly revised $762 in February. The average monthly payment peaked at $791 in December 2022.

“Even with three consecutive months of improvement, affordability challenges are limiting access to the new-vehicle market by lower income and lower credit quality buyers, said Cox Automotive Chief Economist Jonathan Smoke. “Subprime lending in the new market has decreased substantially since 2019, and deep subprime has disappeared. This trend induces automakers to focus on profitable products for consumers who can afford to buy, which keeps less affluent consumers out of the new-vehicle market altogether and limits what is available and possible in the used market for years to come.”

New-vehicle affordability in March was worse than a year ago when prices and rates were lower. The estimated number of weeks of median income needed to purchase the average new vehicle in March was up 5% from last year.

Click here for the full methodology for the Cox Automotive/Moody’s Analytics Vehicle Affordability Index.

The next update of the Cox Automotive/Moody’s Analytics Vehicle Affordability Index will be published on May 15, 2023.

1 The index input of the average interest rate paid by consumers is calculated to reflect a 72-month, fixed-rate loan. For the Dealertrack estimated, volume-weighted average new loan rate in March, visit the Auto Market Snapshot.

The Cox Automotive/Moody’s Analytics Vehicle Affordability Index (VAI) is updated monthly using the latest data from government and industry sources, including key pricing data from Kelley Blue Book, a Cox Automotive company. This important industry measure will be released at mid-month to indicate if the prices paid for new vehicles are moving out of consumers’ financial reach or becoming more affordable over time.