Data Point

Wholesale Vehicle Prices Decline in First Half of February

Thursday February 17, 2022

Article Highlights

- Wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) declined 1.5% in the first 15 days of February compared to the full month of January.

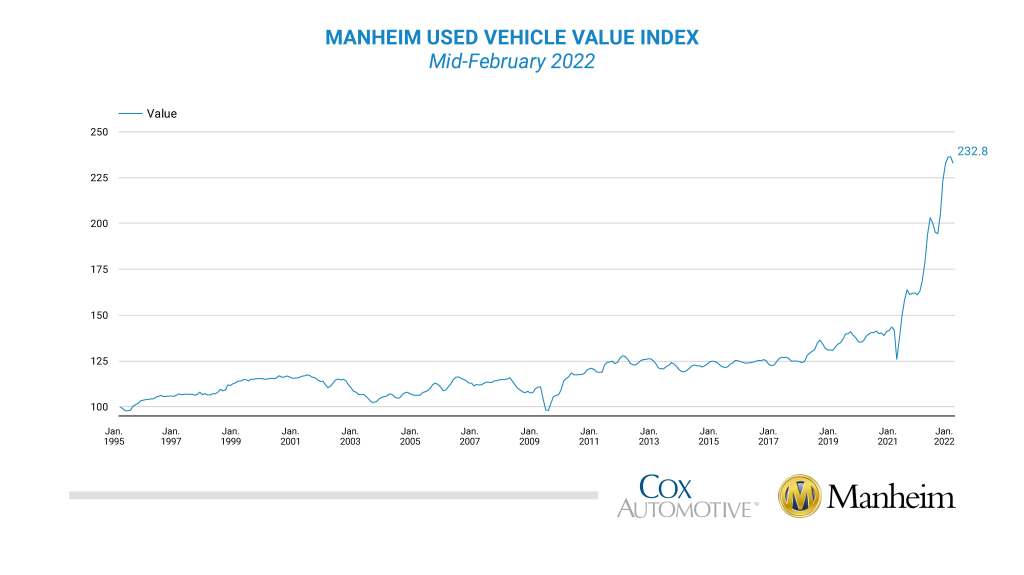

- This brought the Manheim Used Vehicle Value Index to 232.8, which was up 37.6% from February 2021.

- The non-adjusted price change in the first half of February was a decline of 1.4% compared to January, leaving the unadjusted average price up 33.5% year over year.

Wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) declined 1.5% in the first 15 days of February compared to the full month of January. This brought the Manheim Used Vehicle Value Index to 232.8, which was up 37.6% from February 2021. The non-adjusted price change in the first half of February was a decline of 1.4% compared to January, leaving the unadjusted average price up 33.5% year over year.

Manheim Market Report (MMR) prices saw accelerating declines through the first two weeks of February. The Three-Year-Old MMR Index, which represents the largest model year cohort at auction, experienced a 1.7% cumulative decline over the last two weeks. Over the first 15 days of February, MMR Retention, which is the average difference in price relative to current MMR, averaged 98%, which indicates that market prices are trending down faster than valuation models. The average daily sales conversion rate of 47.5% in the first half of February declined relative to January’s daily average of 49% and is lower than average for this time of year. The latest trends in the key indicators suggest wholesale used-vehicle values will likely see further declines in the second half of the month.

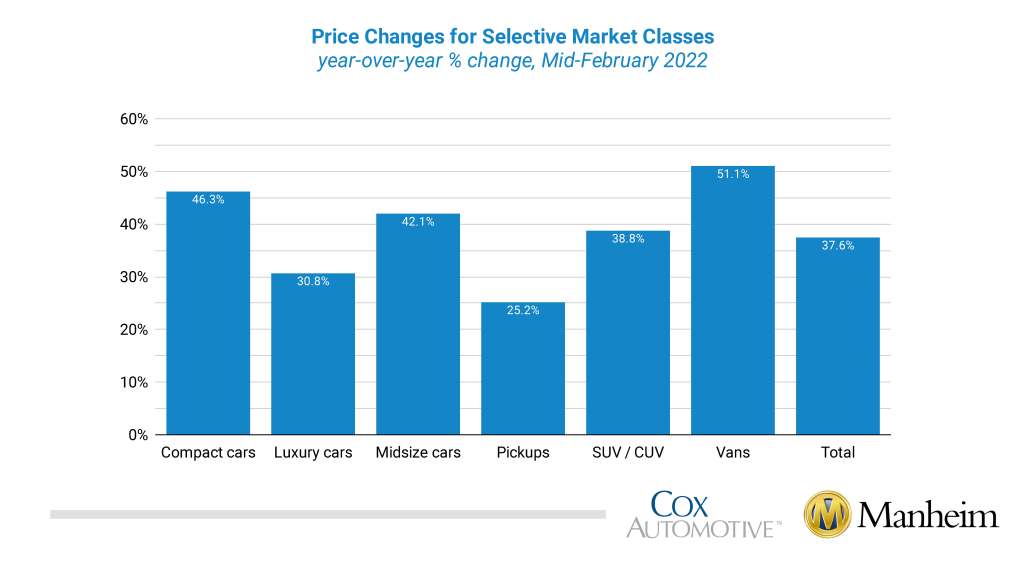

On a year-over-year basis, all major market segments saw seasonally adjusted price gains through the first 15 days of February. Pickups had the smallest year-over-year gains, vans had the largest at 51.1%, and both non-luxury car segments outpaced the overall industry in seasonally adjusted price growth. Compared to January, all major segments except vans saw price declines, with mid-size cars declining the most.

Used supply trended higher in January. Using estimates of used retail days’ supply based on vAuto data, January ended at 56 days, up six days from December and up 12 days year over year. Leveraging Manheim sales and inventory data, we estimate that wholesale supply ended January at 31 days, up five days from December and up three days year over year. As of Feb. 15, wholesale supply was at 29 days, down two days from the end of January.

Rental risk pricing also declines. The average price for rental risk units sold at auction in the first 15 days of February was up 33.0% year over year. Rental risk prices were down 2.4% compared to the full month of January. Average mileage for rental risk units in the first half of February (at 59,353 miles) was up 13% compared to a year ago and up 0.1% month over month.

Auto loan delinquencies back to normal, but defaults remain low. Auto loan performance deteriorated again in January as the abnormally strong credit performance for much of the pandemic has returned to more normal patterns of delinquencies. The over 60-day delinquencies increased in January for the eighth month in a row and were up 2.9% year over year. In January, 1.51% of auto loans were severely delinquent, which was an increase from 1.45% in December and the highest severe delinquency rate since February 2020. Compared to a year ago, the severe delinquency rate was 7 basis points higher. In January, 5.74% of subprime loans were severely delinquent, which was an increase from 5.48% in December and the highest severe delinquency rate since January 2020. The subprime severe delinquency rate was 53 basis points higher year over year. Higher delinquencies are not leading to pre-pandemic levels of defaults yet. Loan defaults declined 7% in January from December and were down 5.7% year over year. Auto credit access expanded in January. The Dealertrack Credit Availability Index measured auto credit as looser in January compared to any month since November 2018.

The complete suite of monthly MUVVI data for February will be released on March 7, 2022, the fifth business day of the month as regularly scheduled. If you have any questions regarding the Index or would like to sign up for updates, please contact the Cox Automotive Industry Insights team at Manheim.Data@coxautoinc.com.