Data Point

Model Year Sell Down Season in High Gear

Monday September 30, 2019

Article Highlights

- We’re seeing a consistent transition from general incentive offers to more specific discounts.

- The U.S. auto market continues to be hypercompetitive, which is driving the large volume of unique rates and incentive programs.

- We expect to see an increase of program offers to earn consumers who are in the market for a great product looking for end-of-year discounts.

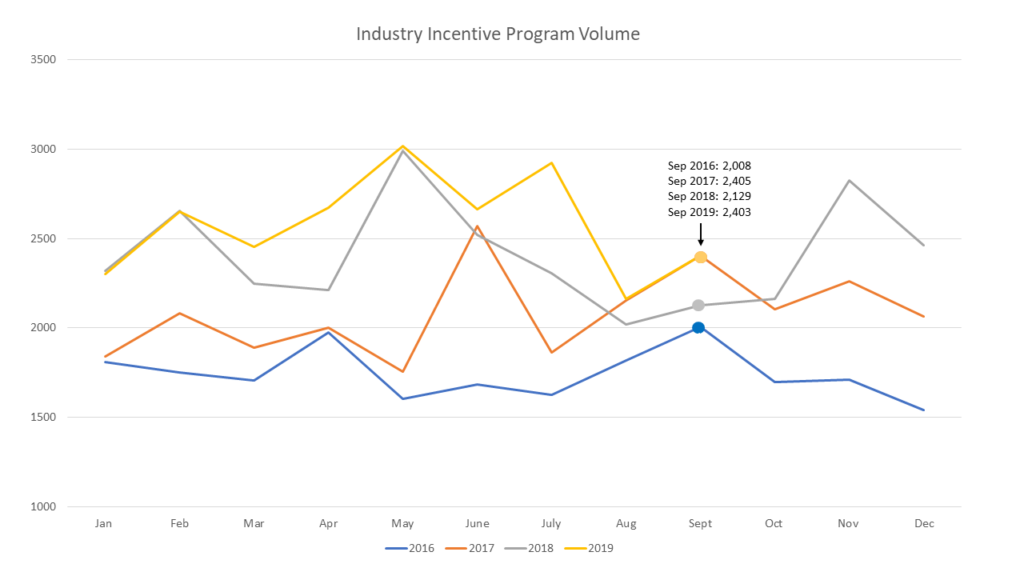

As 2019 continues to deliver strong new vehicle sales, we’re seeing a consistent transition from general incentive offers to more specific discounts, which is driving record volume of incentive programs being offered to consumers and dealers (see chart below). This transition is indicative of an industry moving from fewer, broad-brush offers to many, very specific bonuses based on, among other factors, geography, vehicle option packages, and length of time in dealer inventory. We continue to track more VIN-specific incentive packages as well.September is typically the time of year dealers are carrying up to three model year vehicles (2018, 2019 and 2020), and OEM’s are applying rates and incentives to each in different ways. This adds a level of complexity in the offer structures for both dealers and consumers.

Source: Cox Automotive Rates & Incentives

Here are examples of how the triage of model years are being handled:

- 2018 models (4.1% of July retail sales) are transitioning to final pay incentives—direct to dealer—allowing more discounts on the transaction. We also see attention-grabbing, advertising-driven offers such as “22% off MSRP” on Buick Regal Sportbacks.

- 2019 models (90.4% of July retail sales) have a wide variety of VIN-level incentives, package/option code discounts, special APR offers and regional incentives. This variety of incentives are marketing tools for inventory reduction. For example, GM is now offering a 60-month lease on select models in select markets.

- 2020 models (5.4% of July retail sales) typically have far fewer programs being used at this point in the year, however, the trend is toward broad-brush, general incentives with more emphasis on vehicle attributes and option packages.

The majority of incentives currently active are focused on model year 2019 product which dealers and OEMs need to move to replace with 2020 models. Heavy emphasis from OEMs are on regional discounts to help address inventory glut or use increased discounts on specific model/trim combinations to win payment battles for market-share gain. This is the height of price and payment competitiveness to close out the 2019 model year inventory and a great time for consumers to get great deals.

Auto makers are also working closely with their dealers to maximize attributes and option packages that customers value (i.e., infotainment/navigation, heated/cooled seats, adaptive cruise control, power lift gates, second-row captain’s seats, etc.). These packages are built by the OEMs at a relatively low cost and can be used as a discount with minimal effect on profitability. These special package incentives result in far less margin compression compared with traditional offers such as discounted APR, bonus cash or special lease rates.

The U.S. auto market continues to be hypercompetitive, which is driving the large volume of unique rates and incentive programs. Incentive volume was high in September, even without a Labor Day weekend. As this is “sell down season” and with the industry working through a lengthy GM strike, the chances of incentive volumes being reduced is very low. We expect to see an increase of program offers to earn consumers who are in the market for a great product looking for end-of-year discounts.

What’s not to like about buying a vehicle this time of year?

Note: Chart shows total volume of unique incentive programs, across all makers, as counted by AIS Rebates, a Cox Automotive company. This number does not indicate value of the programs, only volume. Total volume in September was 2,403, nearly equal to September 2018. Worth noting, the Labor Day holiday, which is often associated with many unique incentive offers, fell in September last year. The high total this past month, without unique Labor Day deals, keeps the industry on track for a record number of incentive programs in 2019, a reflection of how the industry is aggressively applying incentives to help maintain sales and profitability.