Data Point

Most Dealers and Consumers Unaffected by Chip Shortage, So Far

Tuesday February 9, 2021

Article Highlights

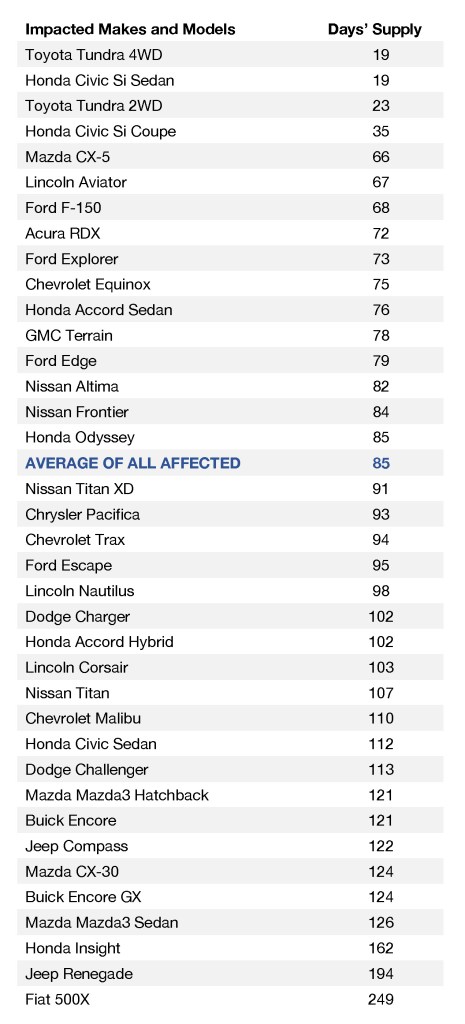

- Around 33 nameplates sold in the U.S. are potentially being affected by the chip shortage.

- The average days’ supply of the models affected stood at 85, well above the national average of 62 in the same week.

- The nameplates affected represented about 27% of all available supply, or 736,184 vehicles.

Dealers and consumers in the U.S. should not see shortages of most models affected by the shortage of computer chips as there is ample vehicle inventory, according to a Cox Automotive analysis of vAuto Available Inventory data.

The global shortage of computer chips for vehicles has caused automakers around the world to trim production. Nearly every major automaker in all regions has been hit, including automakers operating in the U.S.

However, in the U.S., and due perhaps to smart supply chain management by the OEMs, the models that have been affected so far are those with ample and, in some cases, an overabundance of inventory, with a few exceptions.

The chip shortage comes at an inopportune time for Ford. It was forced to trim production of the all-important F-150 that was just launching in its redesigned form. In mid-January, Ford had a 68 days’ supply of the F-150, which includes the new and previous versions. While that’s a bit above the industry average of 62 days’ supply, it represents a tight supply since trucks generally have more inventory than cars due to theirnmany configurations.

The Toyota Tundra has experienced extremely low inventories since last spring, and now production has been trimmed due to the chip shortage. The Tundra’s days’ supply was at 20 in mid-January. Toyota is launching a redesigned version of the full-size pickup later this year.

Potential problems could be ahead for the Mazda CX-5 and Lincoln Aviator if they are victims of the chip shortage as has been suggested. Both popular vehicles were only a bit above the industry average inventory levels with the CX-5 at 66 days’ supply and the Aviator at 67.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period of vehicle listings.

So far, around 33 nameplates sold in the U.S. are potentially being affected by the chip shortage. They tend to have ample supplies and not to be the biggest sellers. They are also in lower price ranges, which have been less popular during the pandemic recession as people with money are in the market buying SUVs and pickup trucks. With their lower prices, the models affected are not the ones that generate big profits for automakers and their dealers.

According to a Cox Automotive analysis of vAuto Available Inventory data for mid-January:

- The average days’ supply of the models affected stood at 85, well above the national average of 62 in the same week.

- The nameplates affected represented about 27% of all available supply, or 736,184 vehicles.

- The nameplates represented about 19% of all sales made in the previous 30 days, or 258,552 vehicles.

- The average listing price of the vehicles affected was $34,203, well below the national average of $40,776, because more lower-cost models were affected.