Data Point

New-Vehicle Affordability Declines Again in May

Tuesday June 15, 2021

Article Highlights

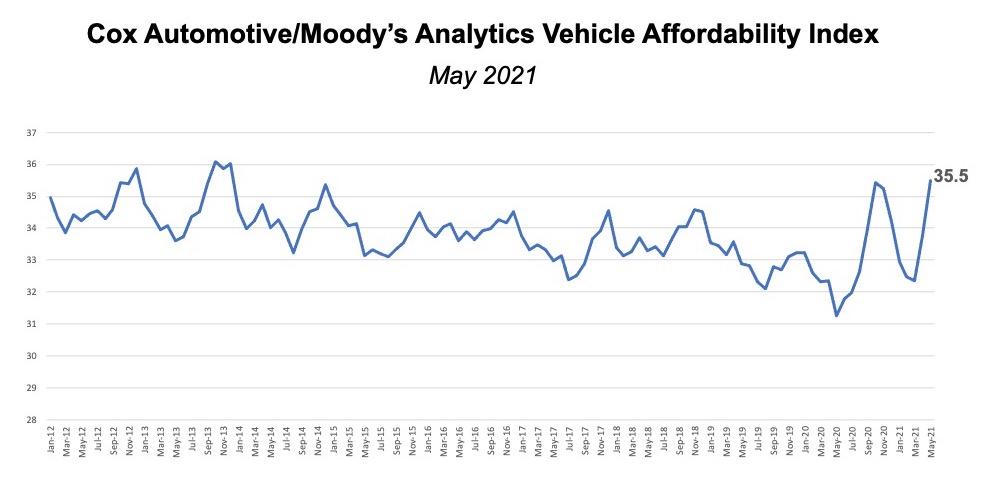

- With extremely strong vehicle demand this spring resulting in ever tightening supply, new-vehicle affordability would have had challenges with higher prices and lower incentives. Adding in the effect of waning stimulus support, affordability declined again in May and reached challenging levels last seen in December 2013.

- The number of median weeks of income needed to purchase the average new vehicle increased to 35.5 weeks in May from 33.8 weeks in April.

- With the decline in May, new vehicle affordability was much worse than a year ago when prices were lower, incentives were much higher, and elements of the CARES Act continued to boost incomes.

With extremely strong vehicle demand this spring resulting in ever-tightening supply, new-vehicle affordability would have had challenges with higher prices and lower incentives. Adding in the effect of waning stimulus support, affordability declined again in May and reached challenging levels last seen in December 2013. The number of median weeks of income needed to purchase the average new vehicle increased to 35.5 weeks in May from 33.8 weeks in April.

The price paid moved higher in May and incentives declined, but the average financing rate slightly decreased, which helped to limit what would have been an even higher increase in the monthly payment. However, median incomes declined again in May from much higher levels in February and March, which were boosted by the effect of stimulus payments from two different stimulus packages.

With the decline in May, new vehicle affordability was much worse than a year ago when prices were lower, incentives were much higher, and elements of the CARES Act continued to boost incomes. Affordability in May was worse than in February 2020 before the pandemic began and slightly worse than October 2020 when incomes were also less supported. The last time median weeks of income was higher was in December 2013.

Click here for the full methodology for the Cox Automotive/Moody’s Analytics Vehicle Affordability Index.

The next update of the Cox Automotive/Moody’s Analytics Vehicle Affordability Index will be published on July 15, 2021.

The Cox Automotive/Moody’s Analytics Vehicle Affordability Index (VAI) is updated monthly using the latest data from government and industry sources, including key pricing data from Kelley Blue Book, a Cox Automotive company. This important industry measure will be released at mid-month to indicate if the prices paid for new vehicles are moving out of consumers’ financial reach or becoming more affordable over time.