CAMIO

New-Vehicle Affordability Declines to New Low in 2022

Wednesday June 7, 2023

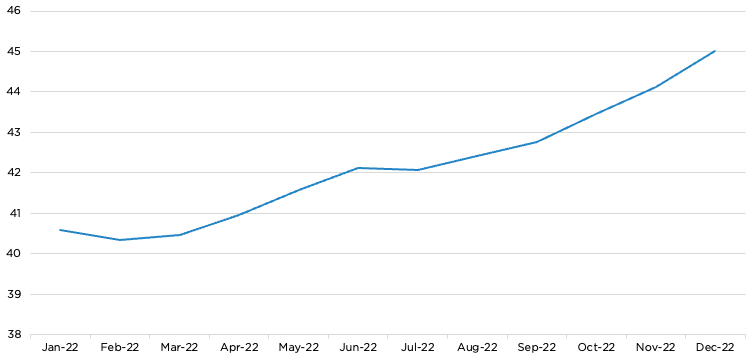

Affordability was challenging for many Americans long before the pandemic and global computer chip shortage. Those events only exacerbated the problem. The Cox Automotive team measures vehicle affordability using the Cox Automotive/Moody’s Analytics Vehicle Affordability Index, which presents a measure of the ability of a household earning the median income to afford the purchase of an average-priced new automobile. Updated monthly, using the latest data from multiple government and industry sources, this unique indicator calculates the number of weeks of median household income needed to purchase an average new vehicle.

The chip shortage caused massive global production disruptions through 2021 and 2022 against strong consumer demand, pushing prices up. Even before the pandemic and chip shortage, some automakers had largely abandoned the affordable car market to focus on more popular and highly profitable SUVs and trucks. With the chip shortage, automakers allocated their constrained chip supply to popular, pricey models laden with features that would generate maximum revenues.

To open 2022, January showed a slight improvement in new-vehicle affordability compared with December 2021, according to Cox Automotive/Moody’s Analytics Vehicle Affordability Index. But it was still far worse than the previous year when prices were lower and incentives higher.

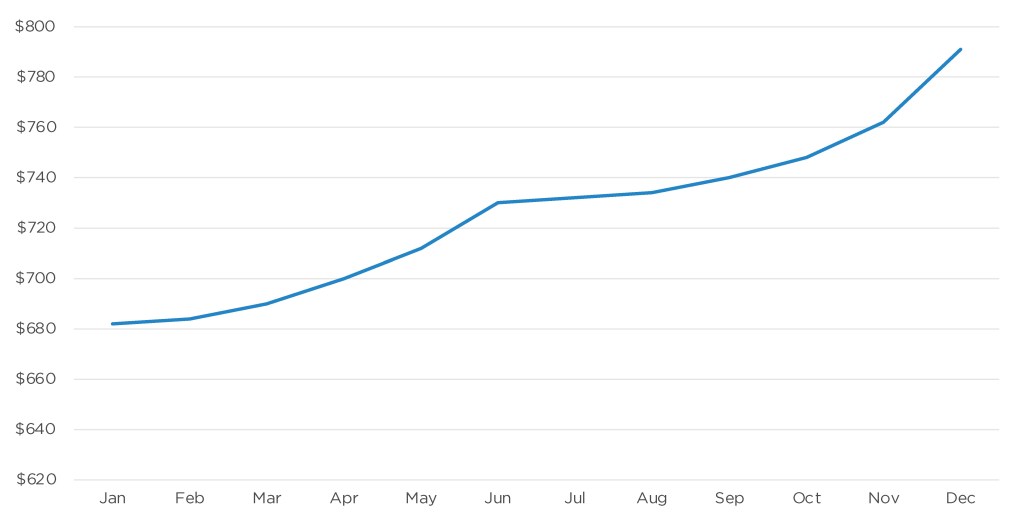

In January 2022, prices declined slightly from the then-record average of $47,243 in December 2021, according to Kelley Blue Book. At the same time, median income grew. But incentives declined, and interest rates rose. The typical monthly payment amounted to $682 in January compared with the then-record high of $687 in December. The number of median weeks of income needed to purchase the average new vehicle in January stood at 42.8 weeks, according to the Vehicle Affordability Index.

January marked the end of any improvement in affordability. Month after month throughout 2022, affordability worsened, hitting new lows as prices stayed high and interest rates climbed.

Cox Automotive/Moody’s Analytics Vehicle Affordability Index

Weeks of Income Needed to Purchase a New Light Vehicle

By December 2022, new-vehicle affordability declined to a new low, according to the index, closing the year far worse than the year earlier when prices were lower, incentives higher and interest rates lower. By year-end 2022, auto loan rates reached a 20-year high. The average new-vehicle price increased to a record-setting $49,507, according to Kelley Blue Book. The typical monthly payment soared to a new record of $791. The number of median weeks of income required to purchase the average new vehicle in December climbed to 44 weeks.

Typical Monthly Payment for New Vehicle

Outlook: In the first quarter of 2023, new-vehicle affordability improved slightly. Supply grew, consumer demand softened a bit and prices, while still historically high, came off their records and big over-list markups. Still, vehicle affordability is expected to continue to be a challenge through 2023 as interest rates continue to rise.