CAMIO

New-Vehicle Average Transaction Price Drops Year Over Year and Incentives Increase

Wednesday March 20, 2024

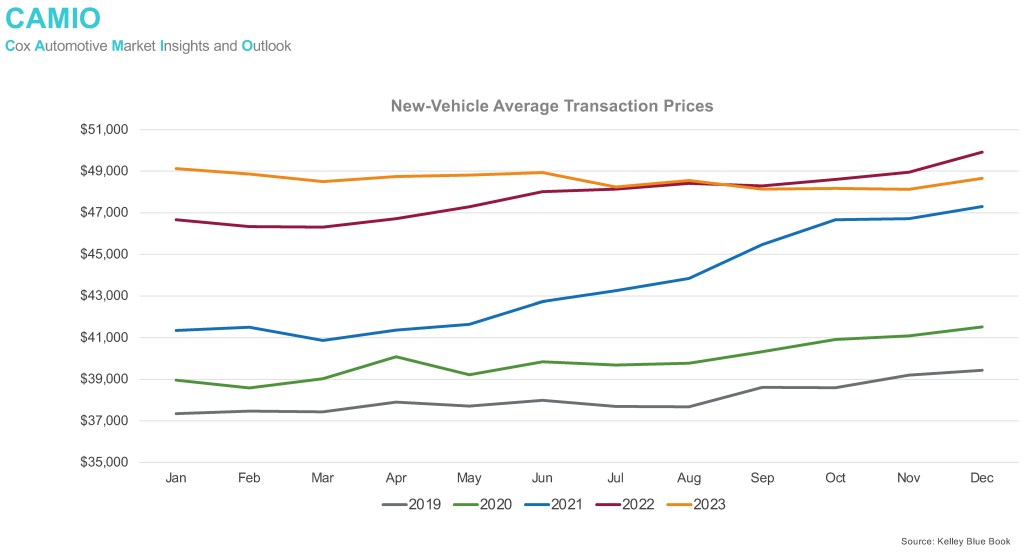

2023 ended with the new-vehicle average transaction price (ATP) at $48,974, down 5.4% year over year, according to Kelley Blue Book. The return of supply was a key contributor to 2023’s sales gains, but another key contributor was the return of incentives. As supply grew throughout 2023, so did the discounting, rising to nearly 6% of average transaction price by year’s end, up from an all-time low of 2% of ATP in the fall of 2022.

Another measurement of new-vehicle pricing is price strength, or the transaction price relative to the manufacturer’s suggested retail price (MSRP). Before the pandemic, this measure was closer to 95% (the price paid was 95% of the suggested retail price) but rose to 102% in 2022 – representing a seller’s market where demand exceeded supply and buyers had little opportunity to negotiate. However, the seller’s strength eroded as supply returned in 2023, and the transaction price share of MSRP retreated to around 98% at the end of 2023, suggesting that price negotiating had returned to the market.

What’s next: New-vehicle transaction prices are expected to hold steady in 2024 as dealer margins are squeezed. The increase in inventory is expected to lead to higher incentives and discounts; however, it is unlikely incentives will return to the record territory seen in 2019 when discounting exceeded 10% of transaction prices and the new-vehicle market was pushed above 17 million units for a fifth consecutive year, according to Kelley Blue Book counts. Market forces will likely exert downward pressure on vehicle prices, further improving consumer affordability in 2024. So far in 2024, the average transaction price for a new vehicle has dropped to the lowest level since April 2022.