Data Point

New-vehicle Inventories Under 4 million Units for Eighth Consecutive Month

Tuesday January 14, 2020

Article Highlights

- New-vehicle inventories came in under 4 million units for the eighth consecutive month to close out the year.

- Days’ supply for December was 56, down 4 days year over year and down 10 days from November.

- Inventories of both cars and light trucks fell from November as well as from year-ago levels.

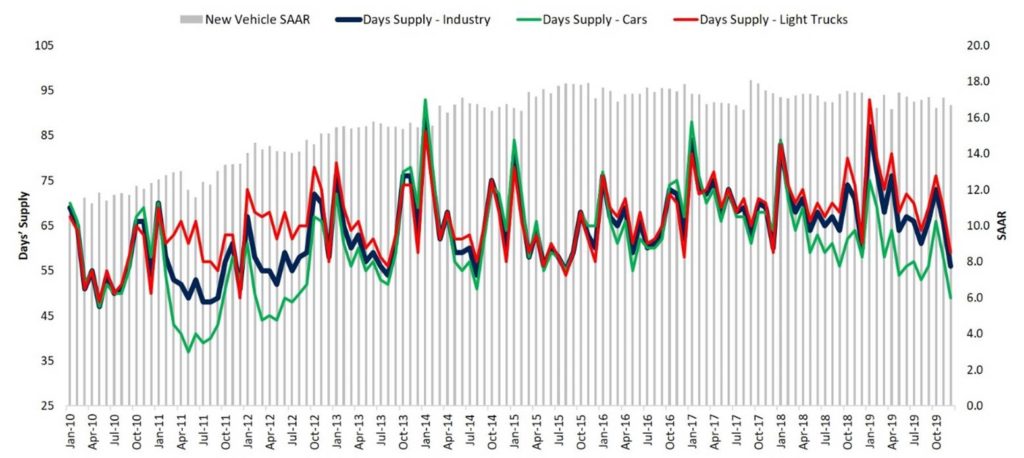

New-vehicle inventories came in under 4 million units for the eighth consecutive month, ending the year at their lowest levels since September 2015. Days’ supply for December was 56, down 4 days year over year and down 10 days from November. Average car days’ supply came in at 49, down 9 days year over year and down 9 days from November. Light truck days’ supply was 59 last month, down 2 days from last year and down 10 days from the prior month.

Inventory levels are an important indicator for the industry. High inventories mean automakers must cut production, boost incentives or do both. Tight inventories generally result in fewer incentives.

Inventories of both cars and light trucks fell from November as well as from year-ago levels. About 60 days’ supply used to be considered normal, but that was before the recent dramatic shift from cars and to trucks and SUVs. Days’ supply of trucks tends to be higher because of the large number of configurations of pickups.

The average days’ supply of cars, which represented only 26% of total inventory in December, came in at 49, down nine days from November and December 2018. The average days’ supply of light trucks – pickup trucks and SUVs combined – stood at 59 in November, down ten days from November and down two days from December 2018.

Inventory levels vary widely by brand. As has been the case, Subaru had the lowest days’ supply at 21, but Kia, which has enjoyed strong sales largely due to the addition of new models including the three-row Telluride SUV, wasn’t far behind at 33 days. Toyota had a 51 days’ supply, down eight days from November and up three days from a year ago. In contrast, Jeep had the highest days’ supply at 98.

Fiat Chrysler scheduled downtime at four plants in North America to reduce inventories. It temporarily shut its minivan plant in Windsor, Ontario that produces minivans, its Belvidere, Ill., plant that makes some Jeeps, including the Cherokee, and two plants in Mexico that make trucks, the Dodge Journey and the Jeep Compass.

With Mercedes-Benz and BMW locked in a battle for the 2019 luxury sales crown, both enter the new year with relatively low inventories. In raw numbers, BMW posted a 4% year-over-year gain in sales in December, with the lowest luxury days’ supply for December at 33 days. Mercedes-Benz trailed closely behind with 36 days’ supply for the month, one day more than November and 11 days less than a year ago.