Data Point

New-Vehicle Inventory and Prices Climb in February

Thursday March 11, 2021

Article Highlights

- The total U.S. supply of available unsold new vehicles stood at 2.82 million as February closed.

- The days’ supply near the end of February stood at 78, compared with 66 at the end of January and 101 a year ago.

- Inventory of new luxury vehicles had a 79 days’ supply; non-luxury was at 78.

New-vehicle inventory climbed through February due to slower sales caused by winter storms, but it remains lower than year-ago levels as prices keep rising, according to a Cox Automotive analysis of vAuto Available Inventory data.

2.82M

Total Inventory

78

Days’ Supply

$40,178

Average List Price

The total U.S. supply of available unsold new vehicles stood at 2.82 million as February closed. It was the highest inventory so far this year and up from 2.79 million near the end of January. Still, inventory remains well below year-ago levels when 3.41 million vehicles were available in the comparable time period.

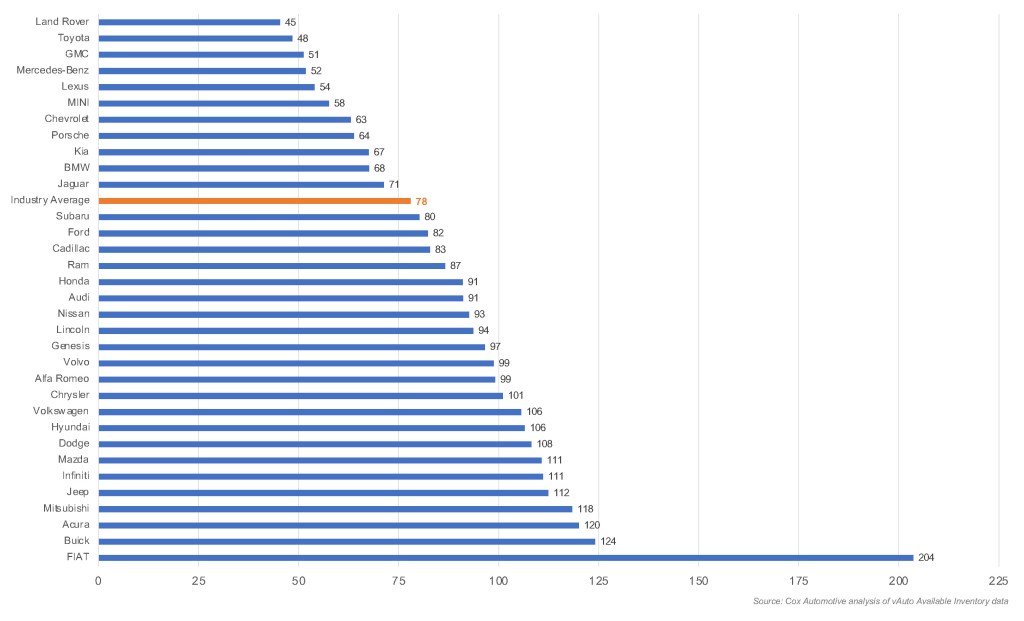

National Days’ Supply by Brand

The days’ supply near the end of February stood at 78, compared with 66 at the end of January and 101 a year ago. Inventory of new luxury vehicles had a 79 days’ supply; non-luxury was at 78.

“Despite increases, new-vehicle inventory is still 17% lower than it was a year ago,” said Charlie Chesbrough, Cox Automotive senior economist. “Days’ supply has been creeping higher since Christmas, as vehicle supply rose, and the sales pace slowed. Still, days’ supply is 22% lower than the same time a year ago.”

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period. February sales were weak due to severe winter storms across a wide swathe of the country, hitting Texas particularly hard. Texas typically accounts for 9% of all February sales.

“With inventory still relatively low, prices remained high in February, running about 6% above year-ago levels,” Chesbrough said. As February closed, the average list price was $40,178, compared with $40,474 at the end of January. The average list price hit bottom last year in March at $37,211. It peaked the week of Jan. 4 at $40,994.

Luxury Brands Improve Stock Levels

For luxury vehicles, the average listing price in February edged higher to $59,469, compared with $59,336 in January. The average non-luxury listing price in February was $36,662, down a bit from January’s $36,805.

Among mainstream luxury brands, only a half-dozen had below-average days’ supply in February, and, for a change, Lexus was not rock bottom for the least amount of inventory. Land Rover was at 45 days’ supply, with every model in short supply. Mercedes-Benz was at 52. Lexus, with its SUVs in the tightest supply, at 54 days’ supply. BMW, Porsche and Jaguar had days’ supply of 68, 64 and 71, respectively.

At the other end of the spectrum, Buick, again, had one of the heftiest inventories at 124 days’ supply. Acura and Infiniti also had days’ supply in the triple digits.

Among non-luxury brands, Toyota continued to have the lowest days’ supply at 48. Subaru, typically near the bottom with Toyota, had an 80-day supply. Chevrolet and GMC along with Kia were in between with below average inventory levels.

A number of non-luxury brands had extremely high days’ supply. Once again, the highest was Fiat with 204 days’ supply. Other Stellantis (Fiat Chrysler) brands also in the triple digits for days’ supply were Chrysler, Dodge and Jeep. Mazda, Mitsubishi and Volkswagen had more than 100 days’ supply as well.

Trucks, Mid-to-Large SUVs in Tightest Supply

Trucks and big SUVs had the lowest inventories in February. Full-size pickup trucks had a days’ supply of only 61. The number was pulled down by extremely tight supplies of the Toyota Tundra, at under 30 days’ supply. Toyota has slowed production of the Tundra to move computer chips in short supply to other models. A new version of the Tundra hits the market later this year.

Chevrolet Silverado and GMC Sierra had 43 days’ supply, with their heavy-duty versions with even less. The Ford F-150 had a 73 days’ supply, and its F-Series Super Duty models were under 50 days’ supply.

Midsize trucks had only a 55 days’ supply. The Toyota Tacoma, at 35 days’ supply, along with the Chevrolet Colorado and GMC Canyon, at 43, pulled down the average.

Full-size and large luxury SUVs have light inventories. General Motors’ new large SUVs – Cadillac Escalade, Chevrolet Tahoe and Suburban, GMC Yukon and Yukon XL – had skimpy inventory levels with under 30 days’ supply.

Midsize SUVs, both luxury and non-luxury, had low inventory in February. Among them were the Subaru Ascent, Kia Telluride, Hyundai Palisade, Toyota 4Runner. The compact Toyota RAV4 had a tiny 25 days’ supply.

But the model with the lowest inventory again in February was the Chevrolet Corvette at 10 days’ supply. The Kentucky plant that produces the sports car has multiple production disruptions.

By price, the $20,000 to $30,000 segment had a high 95 days’ supply. The segments between $30,000 and $60,000 had below-average days’ supply.

More insights are available from Cox Automotive on new-vehicle inventory, using a 30-day rolling sales methodology to calculate days’ supply.