Data Point

Days’ Supply Increases Month over Month at Start of May, as More Brands See Higher Inventory Levels

Thursday May 16, 2024

Article Highlights

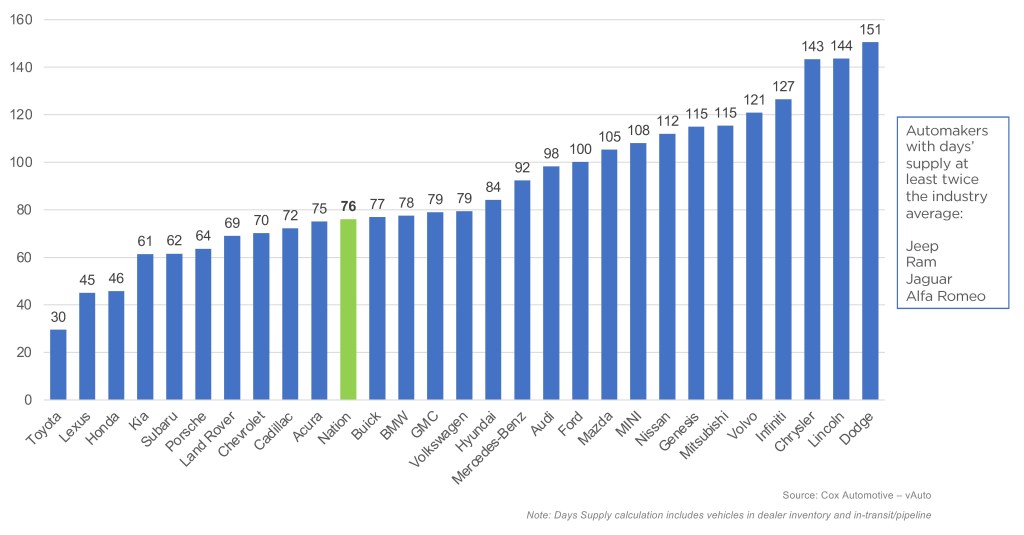

- Days’ supply increases to 76 days, up two days from the start of April and 44% year over year.

- Stellantis brands hover at roughly twice the industry average.

- Listing prices have been mostly flat in 2024, but are starting to show small gains.

Despite generally healthy sales in April, brands with 100+ average days’ supply pulled the average days’ supply up two days at the start of May to 76 days, according to Cox Automotive’s analysis of vAuto Live Market View data. One month ago, at the start of April, days’ supply stood at 74.

2.84M

Total Inventory

as of May 2, 2024

76

Days’ Supply

$47,433

Average Listing Price

At the start of May, the top end of the trending days’ supply jumped collectively, with Stellantis brands Jeep and Ram weighing on the average. Days’ supply at Jeep increased by 21%, while Ram jumped up by 14%. Both brands have days’ supply at more than twice the industry average.

MINI and Mitsubishi both joined the 100+ club at the start of May, with MINI new-vehicle inventory jumping to 108 days’ supply, a 56% increase month over month, and Mitsubishi climbed to 115 days’ supply, representing a 26% increase month over month. Those increases were offset by a continuing trend of tight supply at Toyota, Lexus and Honda, as well as outliers such as Porsche, where inventory tightened by 10 days from last month, landing at 64 days’ supply at the beginning of May.

The total U.S. supply of available unsold new vehicles opened May at 2.84 million units. That is 961,000 units – or 51% – above a year ago. It was up from a revised 2.77 million at the start of April when days’ supply was 74. Compared to 2019, new-vehicle inventory volume at the start of May is down 26%; days’ supply is tighter by 19%.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period, which ended May 2. Sales during that period ran 5% ahead of a year ago. According to Kelley Blue Book estimates, the seasonally adjusted annual rate (SAAR) of sales in April was 15.5 million, keeping 2024 generally on track to be the best new-vehicle sales year since 2019.

APRIL DAYS’ SUPPLY OF INVENTORY BY BRAND

The average listing price for a new vehicle at the start of May was $47,433, lower by $94 compared to one year ago. Listing prices remained relatively flat through the month of April. When looking at inventory by price level, we continue to see more affordable units showing less supply. The highest-priced inventory, at $50,000+, has increased to an average of 90 days’ supply, representing a 5.5% increase month over month.

The average transaction price (ATP) of a new vehicle in the U.S. last month was $48,510, up 2.2% from last month, the highest price since December 2023, according to Kelley Blue Book. Discounts and incentives in April dipped to 6.3% of ATP, the first decrease since October 2023, when incentive levels ticked lower to 4.7% from 4.8% in September.

Erin Keating

Erin Keating is an Executive Analyst and Senior Director of Economic and Industry Insights at Cox Automotive. She has 25 years of experience in marketing and communications, including 10 years with Audi of America, where she also ran Audi Motorsport North America. With a focus on the wider industry, the individual automakers, and consumer shopping and buying behavior for new vehicles, Erin provides analysis and insights leveraging the breadth and depth of data from DRiVEQ, Cox Automotive’s data intelligence engine. Upon joining Cox Automotive, Erin was responsible for Enterprise Data Strategy – Partnerships. Erin is based in Atlanta.