Data Point

Inventory Build-Up Suggests Incentives May Be Coming

Thursday January 12, 2023

Article Highlights

- Total active supply climbed to 1.8 million vehicles for a 58 days’ supply.

- Despite higher inventory and sluggish sales, the average listing price rose to $47,662.

- Supply varies widely by brand, segment, price and region.

Revised, Feb. 16, 2023 – New-vehicle inventory stacked up in December, suggesting some automakers may be forced to bring back incentives to spur sluggish sales and draw down supply, according to Cox Automotive’s analysis of vAuto Available Inventory data. Despite stagnated sales and rising supply, prices still increased.

“New-vehicle inventory climbed through December, nearing what used to be considered ‘normal’ levels in the pre-pandemic era,” said Charlie Chesbrough, Cox Automotive senior economist. “Days of supply at the end of December increased due to production and supply improvements. But sales barely budged.”

1.80M

Total Inventory

as of Dec. 26, 2022

59

Days’ Supply

$47,531

Average Listing Price

The total U.S. supply of available unsold new vehicles stood at 1.80 million units at the end of December, compared with a revised 1.62 million vehicles at the end of November. Supply at the end of December was 715,000 units higher than at the end of December 2021. Supply jumped by 500,000 units just since September.

Days’ supply climbed throughout the month to an upwardly revised 59. Days’ supply was 65% higher than at the end of December 2021. The highest since March 2021, December’s days’ supply compares with a revised 52 days’ supply at the end of November. Historically, a 60 days’ supply across the industry had been considered normal and ideal.

“While new-vehicle supply rose 37% since September and is 66% above a year ago, the sales pace at the end of December had improved by a scant 2%,” said Chesbrough. “If this trend continues – and it seems likely to do so – automakers will be under heavy pressure to move the metal with higher incentives. This will be the story to watch for in the first part of 2023 – automakers returning to discounting.”

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period, which ended Dec. 26, when about 934,189 vehicles were sold. Retail demand clearly softened, with December sales buoyed by large hikes in fleet sales, including a doubling of rental car sales. For the full calendar month of December, total new light-vehicle sales were up 5% from the year earlier. December sales were up 12% from November. However, a 20% rise between November and December, as was the case in December 2021, is typical. That put the December sales pace, seasonally adjusted annual rate (SAAR), at 13.3 million, up from 12.7 million in 2021 but down from November’s 14.2 million.

While inventory is up substantially from recent levels, it remains low by historical standards. At the end of December 2020, supply stood at 2.87 million vehicles for a 68 days’ supply. For pre-pandemic November 2019, supply hit 3.50 million vehicles for an 82 days’ supply.

New-Vehicle Prices Turn Upward Hitting Records

After showing some signs of stabilizing, the average listing price – or the asking price – jumped to an upwardly revised record $47,531 at the end of December, up from a revised $46,659 at the end of November, according to Cox Automotive’s analysis of vAuto Available Inventory data. The listing price was 4% higher than in December 2021.

The average transaction price – or the price paid – also set a record of $49,507, according to Kelley Blue Book, a Cox Automotive company. The nearly 5% rise in the ATP from a year ago was partly due to a high percentage of luxury vehicle sales in December, as is typical.

Supply Shows Wide Variation by Brand, Segment, Price and Region

December continued to show wide variation in supply by brand, segment and region.

Closing December, the industry had non-luxury vehicle inventory totaling 1.53 million vehicles for a 57 days’ supply, compared with 1.40 million vehicles for a 53 days’ supply at the end of November. The inventory of luxury vehicles (excluding uber luxury ones) stood at nearly 270,000 units for a 61 days’ supply. That compares with 244,000 vehicles for a 57 days’ supply a month earlier.

Import non-luxury and luxury brands had the lowest inventories. The highest inventories are a mix of domestic brands, dominated by Stellantis’ brands, European luxury makes and Nissan’s Infiniti luxury marque.

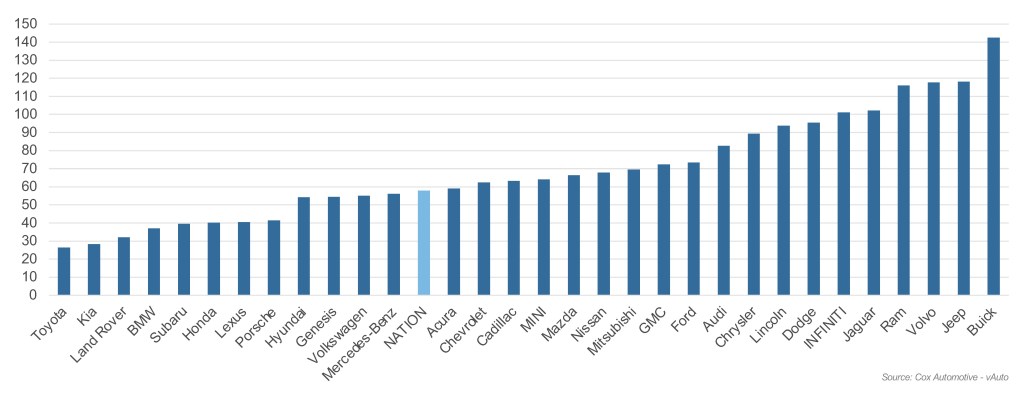

December Days’ Supply of Inventory By Brand

Non-luxury brands with below the national average inventory were, from lowest to highest, Toyota, Kia, Subaru, Honda, Hyundai and Volkswagen.Luxury brands at the low end were Land Rover, BMW, Lexus, Porsche, GenesisandMercedes-Benz.

Non-luxury brands with the highest inventory were allStellantisbrands, in descending order, Jeep, Ram, Dodge and Chrysler. Luxury brands at the high end were Buick,with the most, Volvo, Jaguar, Infiniti and Lincoln.

Affordable vehicles popular with less affluent consumers had the lowest supply. Large and/or expensive cars had the highest along with domestic SUVs and trucks.

The lower the price category, the tighter the supply. Under $20,000, a segment with low active supply, had a scant 20 days’ supply, dropping again as it has each of the previous few months. Between $20,000 and $30,000, days’ supply rose to 43. The larger segments for supply – those between $30,000 and $50,000, had between 43 and 58 days’ supply. The $60,000 to $80,000 category had a 68 days’ supply.

Except for low-volume, high-performance cars, vehicles most often purchased by middle-income Americans were in the lowest supply – subcompact and compact cars, minivans and midsize cars. Also below the national average were full-size, non-luxury SUVsandcompact SUVs.The remaining segments were roughly in line with the national average. Hybrids, which had been extremely low in supply, moved to just above the national average. That could change with gas prices on the rise.

Larger and/or expensive cars had the highest inventories, along with full-size pickup trucks. Full-size cars and uber luxury vehicles had the most, followed by full-size pickup trucks, high-end luxury cars, sports cars, and luxury cars.

Of the 30 best-sellers for the 30-day period that ended Dec. 26, Toyota, Kia and Honda had the most models at the low end of supply. Starting at the very bottom were Toyota Corolla, Kia Sportage, Toyota Highlander, Kia Telluride, Toyota RAV4, Honda CR-V and Toyota Camry.

Of the 30 best-sellers for the 30-day period that ended Dec. 26, large trucks and SUVs from domestic manufacturers had the biggest supply. Starting with the most were Ram 1500, Chevrolet Silverado, Ford Explorer, GMC Sierra and Ford F-150.

Supply showed wide variation by DMA, in contrast to the past when there was less variation. Northern DMAs, led by Minneapolis-St. Paul and followed by Detroit and Denver, had the highest supply, likely because they are heavier on domestic brands, which have more abundant inventory. Southern DMAs, specifically Miami-Ft. Lauderdale and Orlando-Daytona Beach-Melbourne in Florida, had extremely low supplies. Atlanta and Tampa-St. Petersburg were also at the low end.

More insights are available from Cox Automotive on new-vehicle inventory, using a 30-day rolling sales methodology to calculate days’ supply.

Michelle Krebs is executive analyst at Cox Automotive.